Analyst: Gold experiences its biggest weekly decline in three years, seeing $2400 by the end of the year

Precious metal investors watched as New York gold futures fell from a high of over $2800 per ounce two weeks ago to just over $2500 per ounce last week. Analysts and traders have been working overtime to study the magnitude of the decline in gold prices and trying to determine the possible bottom of gold prices in the near future. Although gold holders feel relieved to hear that all the medium - to long-term favorable factors supporting gold are still valid, they still feel anxious as they see the gold price continue to decline day after day.

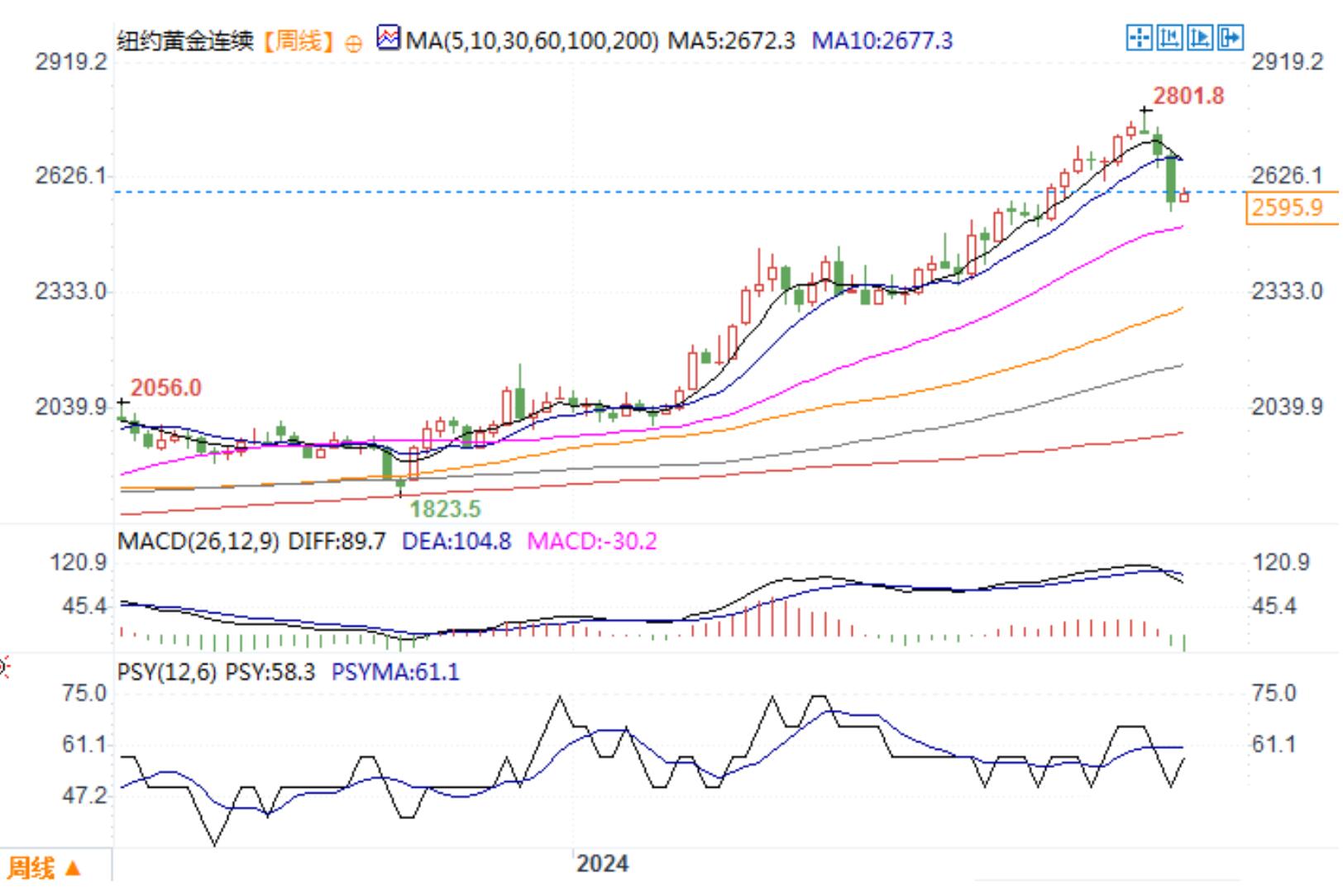

Alex Kuptsikevich, Senior Market Analyst at FxPro, pointed out, "Last week alone, gold prices fell nearly 5%, marking the largest weekly decline in nearly three years. Since its peak, gold prices have fallen by over $250, a drop of about 9%, making it the longest lasting decline since the beginning of this month

However, he pointed out that despite a significant pullback, "the recent rise in gold prices since October last year means that even if it falls to $2400, it is only a correction that brings gold prices back to the 200 day moving average. At the current rate of decline, gold prices may reach this level before the end of this year

Technically speaking, Kuptsikevich stated that there is a clear bearish signal on the weekly chart: "Gold prices have fallen sharply after exiting the overbought zone, while the RSI (Relative Strength Index) has fallen from above 80. This extreme level reversal usually indicates a shift in momentum

He said, "To understand its meaning, we can look at historical precedents. The last two sharp bearish reversals from historical highs were in 2009 and 2011

He pointed out that in 2009, "gold experienced a 15% decline from high to low, and then saw a resurgence of buying, pushing prices to historic highs. This bull market lasted for nearly two years, with only a brief pause

In 2011, gold prices initially fell by nearly 20%. He said, "Although gold prices subsequently rebounded by 17%, the pillars of the bull market have broken. Over the next four years, gold prices have fallen 45% from their peak

Kuptsikevich stated that in both cases, the 50 week moving average is the medium-term support level during the selling period. He said, "Currently, this moving average is at $2330, but it is showing an upward trend and may reach $2400 by the end of the year. A decisive drop below this level could trigger a deeper decline

Naeem Aslam, Chief Investment Officer of Zaye Capital Markets, acknowledges that gold prices have weakened recently, but he believes that there are many factors that may provide a heading correction for the gold price trend.

He said, "Due to the strengthening of the US dollar and changes in expectations for the Federal Reserve's monetary policy, gold prices have been under significant downward pressure in the past few days." He pointed out that gold prices are expected to record their largest weekly decline in months.

Aslam said, "Given the latest economic data, the Federal Reserve is not in a hurry to change its monetary policy in the near future. Therefore, traders and investors are concerned that gold may face greater challenges in the near future. But bargain hunters are looking at the situation from another perspective

He pointed out that although the strengthening of the US dollar and reduced expectations of interest rate cuts are affecting gold prices, there are several factors that may change the trend of gold prices in the coming months.

He said, "The attractiveness of gold as a safe haven asset may be boosted by global economic uncertainty, such as trade disputes and geopolitical tensions. If uncertainty intensifies, investors may seek refuge in gold

Inflation may also alter the value of precious metals. Aslam said, "If inflation continues to exceed expectations, the Federal Reserve may face greater pressure to adjust its policies. If sustained inflation exceeds interest rate hikes, gold may ultimately benefit from it

The statements of Federal Reserve members will also have an impact, just as Governor Kugler hinted on Thursday that the pace of interest rate cuts may slow down. He added, "The upcoming speeches and statements by Federal Reserve officials, including Chairman Powell, will be closely monitored, and any signs of monetary policy changes could have a significant impact on gold prices

Finally, the recent outstanding performance of the US dollar may experience a pullback. Aslam said, "If the US dollar starts to deteriorate due to domestic or international factors, demand for gold may increase

New York Gold Continuous Weekly Chart

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights