Analysis of the Trend of Foreign Exchange Gold and Crude Oil on November 20th

Analysis of the Trend of Foreign Exchange Gold and Crude Oil on November 20th

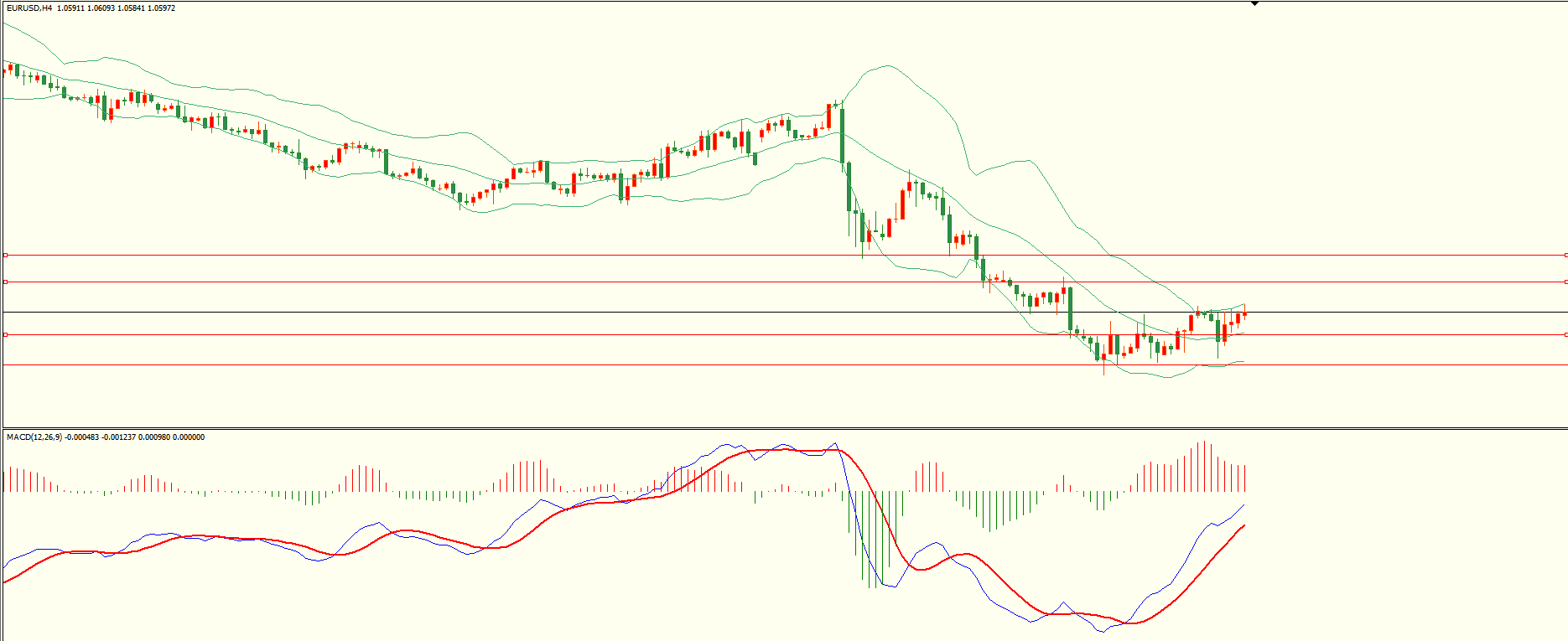

The euro rebounded below the first support yesterday and closed at a small bearish candlestick at the lower shadow of the daily chart. From the close, the lower support continues to be maintained, and attention should be paid to the high resistance zone before breaking through. Combined with the 4H trend, the Bollinger Bands turned upwards, running near the MACD zero axis. The main support for the day is 1.0560, the second support is 1.0510, and the upper resistance is 1.0645, 1.0685. It is expected to test the first resistance in the short term above the first support.

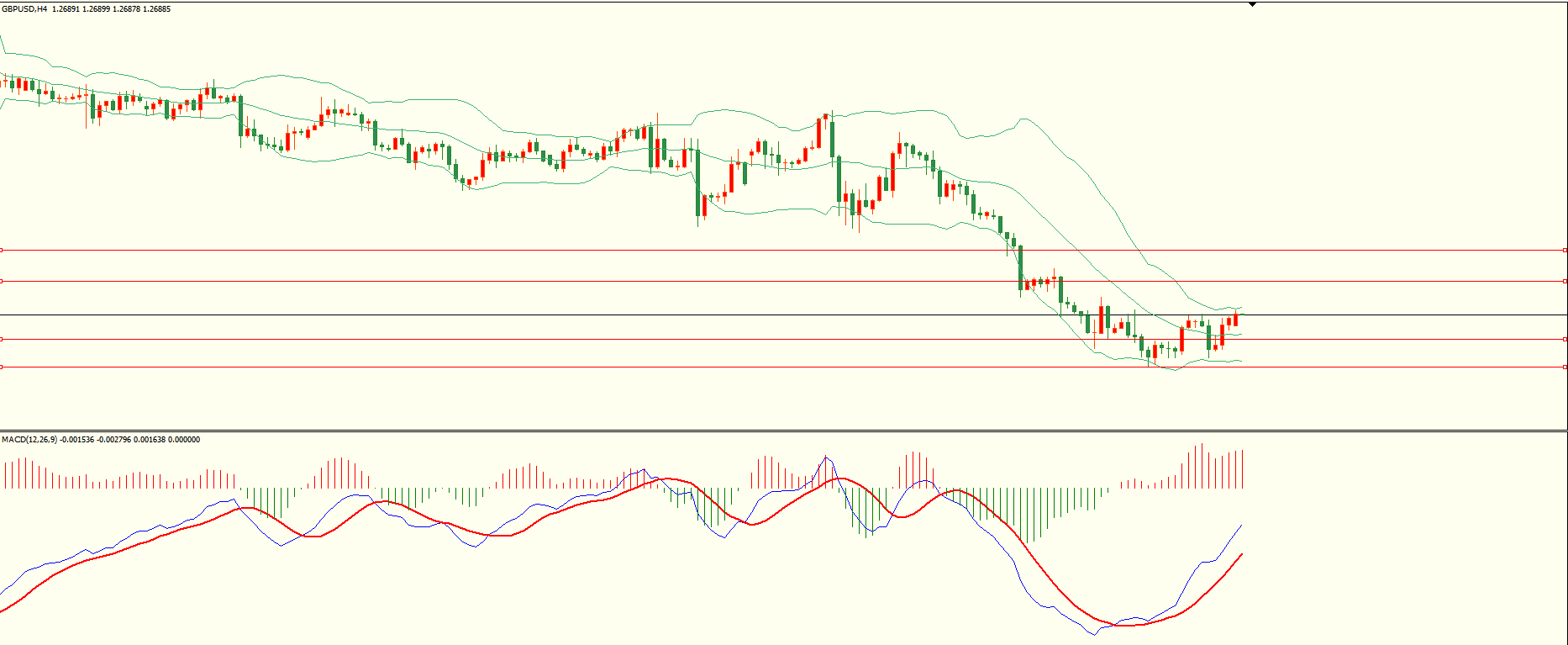

The pound hit the first support yesterday and fluctuated upwards. The daily chart closed at a small bullish line with upper and lower shadows. Currently, it is close to the front high resistance zone above. After recovering, it can continue to rebound in this round. From the 4H perspective, the Bollinger Bands have slightly turned around, and the MACD zero axis is running below. The main support for the day is 1.2645, the second support is 1.2595, and the upper resistance is 1.2745, 1.2800. The first support is expected to test the first resistance in the short term before it falls.

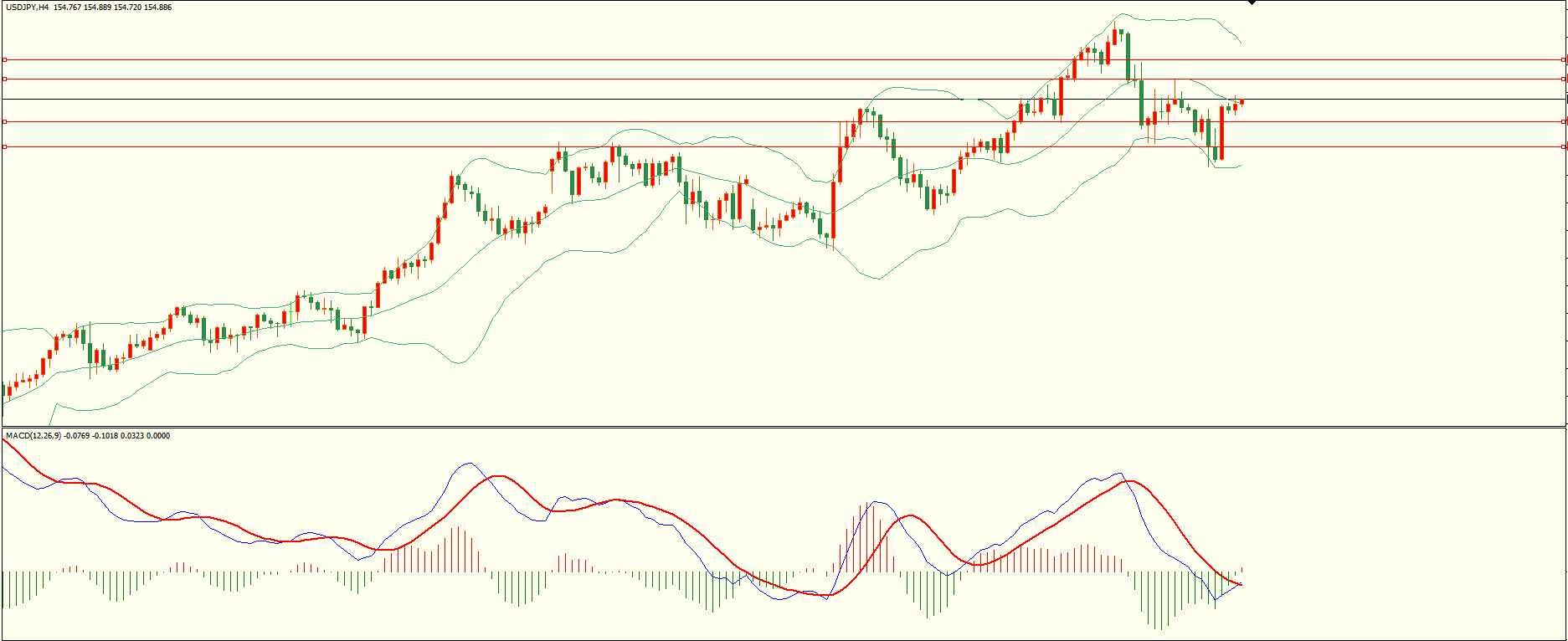

After the opening of the Asian market yesterday, the US and Japan encountered resistance and fell back. They hit the bottom of the first support during the trading session and rebounded. The daily chart closed at a cross star line, and the long short competition was relatively balanced. Overall, the short-term long short oscillation has not ended. From the 4H perspective, the upper and lower tracks of Bollinger have slightly narrowed, and the MACD zero axis is moving downwards. The main support for the day is 154.35, the second support is 153.75, and the upper resistance is 155.30-40155.80-90. Keeping above the first support, the short-term is expected to test the first resistance and be cautious of rising and falling back.

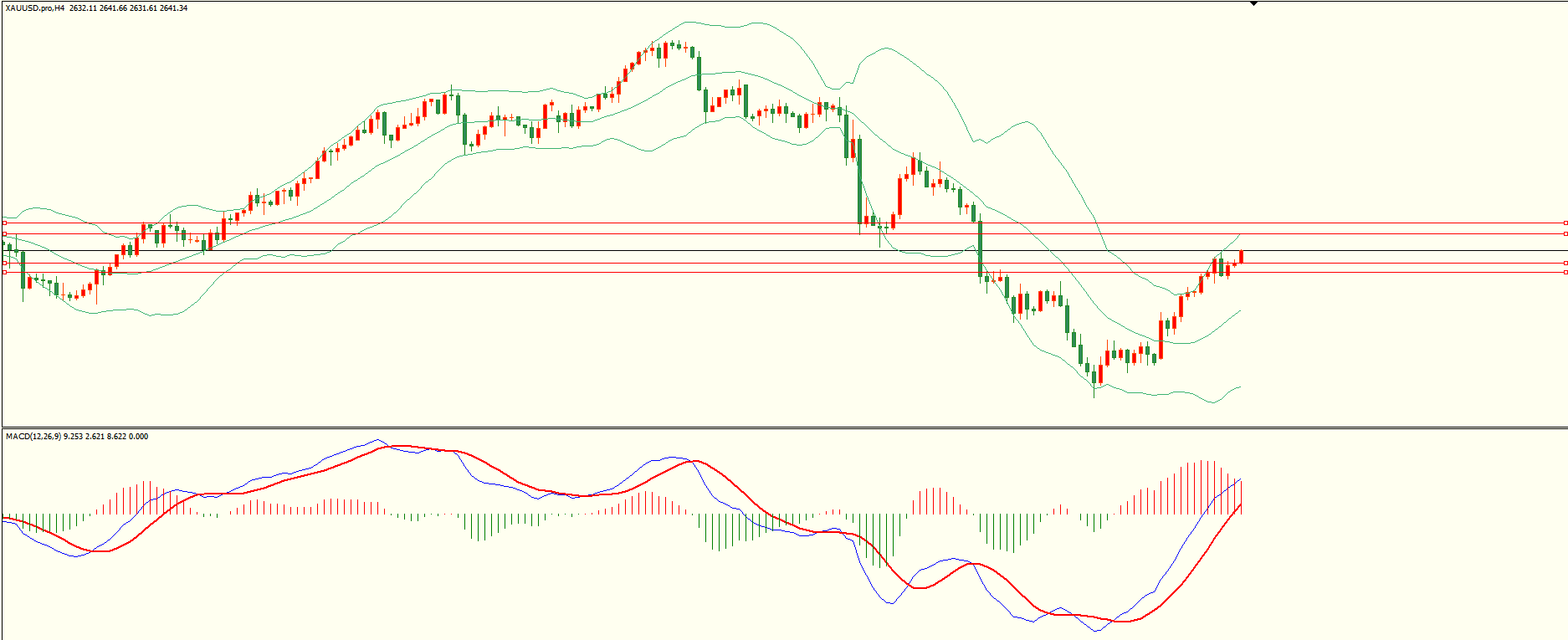

XAUUSD

After a slight adjustment yesterday, gold continued to rise, expanding its gains during the New York session. The daily chart closed at the upper shadow of the bullish line. From the close, there is still support at the bottom, while the upper side is close to the front resistance zone. Short term prevention of volatility, combined with the 4H trend, the Bollinger Bands are above the middle limit, running near the MACD zero axis. The main support at the bottom of the day is 2632-33, the second support is 2625-26, and the upper resistance is 26522660-62. The first support is expected to test the first resistance in the short term before it falls.

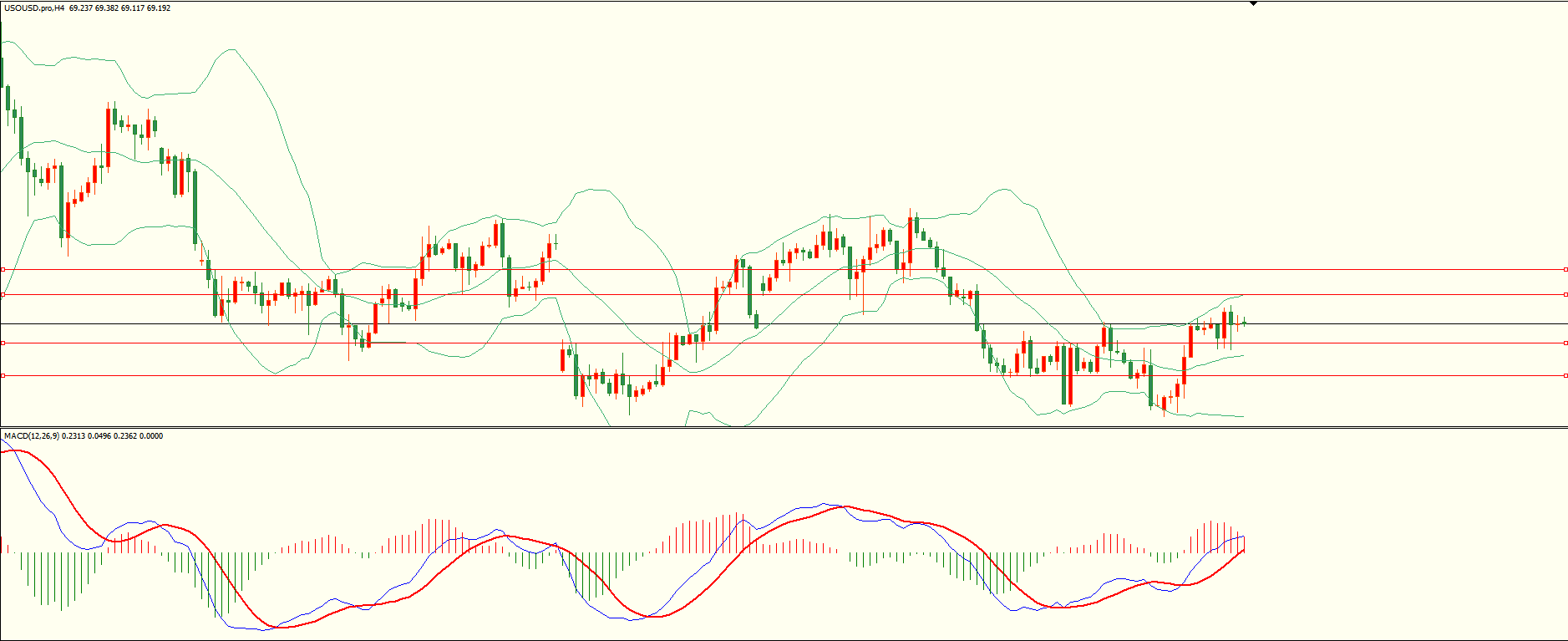

Crude oil rebounded and fluctuated above the first support yesterday, hitting the first resistance and falling under pressure during trading. The daily closing line closed with a small bullish candlestick above and below the upper and lower shadow lines, and the closing position once again touched the front resistance zone. Before recovering, cautious pursuit of gains is needed. From the 4H perspective, the Bollinger Bands are above the middle limit, and the MACD zero axis is moving. The main support for the day is 68.60, the second support is 67.70, and the upper resistance is 70.00, 70.75. It is expected to test the first resistance in the short term above the first support.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights