The US dollar index is bearish below four hours, and the EURUSD exchange rate is tightly tied to the four hour support

Macroscopic perspective

The Russo Ukrainian War has entered its 1000th day. The United States approved the use of ATACMS missiles by Ukraine. Ukraine attacked Russian territory on Tuesday, and Russia shot down some missiles without causing any casualties. Lavrov called this move a signal of escalating conflict in the West, and Moscow had previously warned the US of the consequences of this move. Military experts believe that the missile has limited impact on warfare. At the same time, the United States has approved arms sales to Ukraine, and Denmark has donated to support Ukraine's arms industry. However, Trump criticized the scale of aid to Ukraine, and both sides expect him to push for peace talks after returning home. In this context, Putin approved a new version of the nuclear deterrence policy, lowering the threshold for conventional nuclear attacks. This triggered a chain reaction, with US bond yields falling on Tuesday and major European stock indices hitting their lowest levels since March, leading to increased investor anxiety and a shift towards safe haven assets. In addition, a Reuters/Ipsos poll shows that the American public hopes that Trump will first address the issue of inflation. Although he won the election, his popularity is low, reflecting the polarization of American politics. There is little economic data on this trading day, and investors need to pay attention to the situation between Russia and Ukraine, speeches by Federal Reserve officials, and updates from Trump.

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed a downward trend on Tuesday. The highest price of the day rose to 106.617, the lowest was 106.08, and closed at 106.15. Looking back at the performance of the US dollar index on Tuesday, the price fluctuated mainly in the short term after the morning opening. Subsequently, the price broke through the morning high again before the European session, and during the European session, it tested the empty area arranged yesterday as scheduled. When the price hit the spot, it fell under pressure as scheduled, and the closing of the day also ended in a big bearish state. At present, the overall daily support is in the 105.40 area. For the four hours, we will temporarily focus on the resistance in the 106.30-40 range. Once the price is in place, we will first look at the pressure. Below, we will focus on the 105.90-105.40 area.

The US Composite Index is empty in the 106.30-40 range, with a defense of $5 and a target of 105.90-105.40

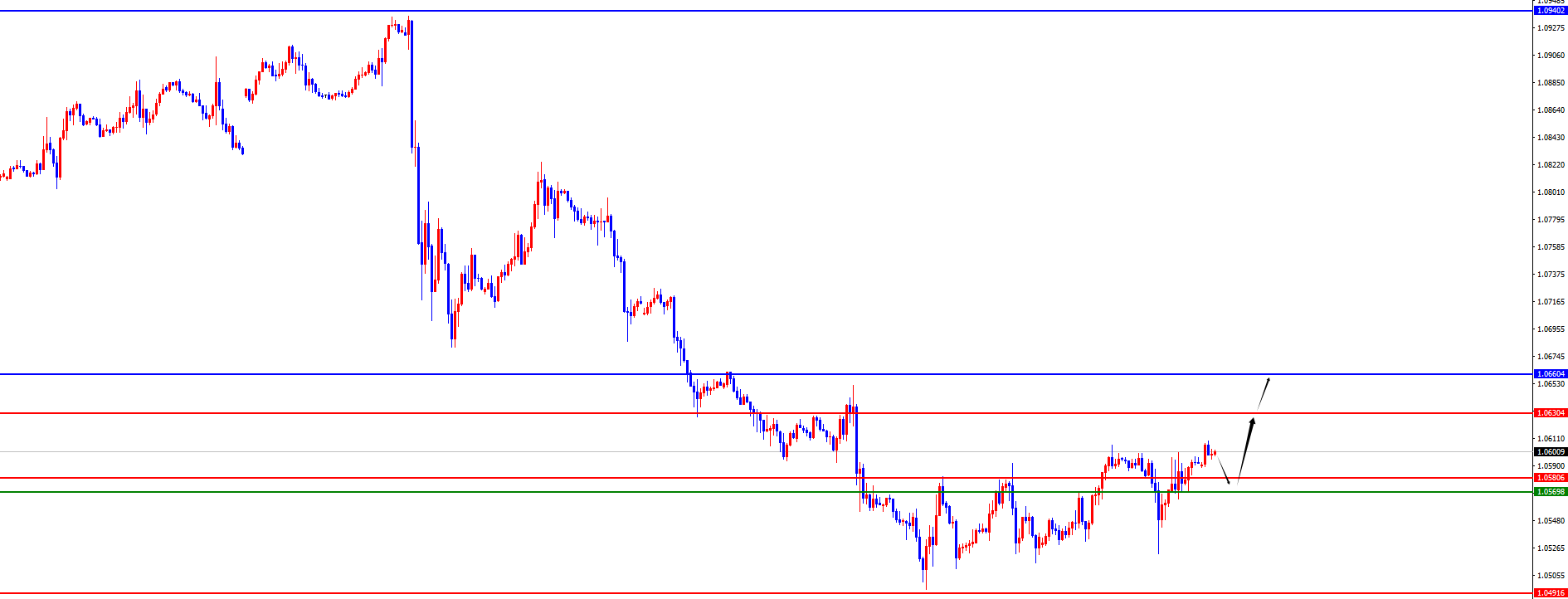

In terms of EUR/USD, European and American prices showed an overall upward trend as scheduled on Tuesday. The lowest price of the day fell to 1.0522, the highest rose to 1.0600, and closed at 1.0595. Looking back at the performance of the European and American markets on Tuesday, the price fluctuated and fell in the short term during the morning session, followed by a rapid decline before the European session. The price rebounded above the low point of the day before the test, and the price fluctuated and rose during the US session, finally ending with a strong daily bullish trend. At present, the four hour support is in the range of 1.0570-80. After the price is in place, we will first look up and pay attention to the 1.0630-1.0660 area above.

EURUSD 1.0570-80 range, defend 40 points, target 1.0630-1.0660

Today's Key Financial Data and Events: Wednesday, November 20, 2024

① Pending domestic refined oil opens a new round of price adjustment window

② 02:10 Federal Reserve Speaks on Economy and Monetary Policy

③ 05:30 US to November 15th week API crude oil inventory

④ 09:00 China to November 20th one-year loan market quoted interest rate

⑤ 15:00 Germany October PPI Monthly Rate

⑥ 15:00 UK October CPI Monthly Rate

⑦ 15:00 Monthly retail price index rate for October in the UK

⑧ 23:30 US EIA Crude Oil Inventory for the Week of November 11th

⑨ 23:30 US to November 11th week EIA Cushing crude oil inventory

⑩ 23:30 US EIA Strategic Petroleum Reserve Inventory for the Week of November 11th

⑪ At 00:00 the next day, Federal Reserve Governor Cook delivered a speech

⑫ At 01:15 the next day, Federal Reserve Governor Bauman delivered a speech

⑬ At 03:30 the next day, the December crude oil futures in New York completed the final trading on the exchange

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights