The Silver Super Cycle is Coming, Revealing the Reasons Behind It!

The Silver Institute recently released a report stating that multiple factors contribute to the silver super cycle. These factors include the escalation of the conflict between Russia-Ukraine conflict, the risk aversion of the market, the growing industrial demand, the de dollarization, and the start of the interest rate reduction cycle by the Federal Reserve.

Factors contributing to the silver super cycle

① The Russia-Ukraine conflict has led to geopolitical tensions, and the demand for silver industry has increased

Recently, the Russia-Ukraine conflict has escalated, and investors have sought more ways to preserve their wealth. According to a report commissioned by the Silver Research Institute, silver is an ideal investment tool during the current turbulent times, serving as a reliable hedge against inflation, currency depreciation, and systemic financial instability.

The report points out that "silver, as a tangible asset with both stability and growth potential, is not only a safe haven asset, but also highly valued due to its increasing industrial applications. Silver has a low correlation with traditional assets such as stocks and bonds, making it an excellent diversification and safe haven tool

The report points out that institutional investors who hope to enhance their investment portfolios through diversification should consider the advantages of investing in silver. The increasing vulnerability of the geopolitical environment and the deterioration of government fiscal conditions make silver more attractive as a tool to combat inflation and currency depreciation. These potential long-term factors have slowly accumulated for decades

However, potential structural pressures are beginning to shift, which is favorable for silver in the current environment. In addition, the increasing demand for silver from the electronics, renewable energy, and automotive industries has made it a beneficiary of long-term industrial trends

The report states that global demand for silver is expected to reach over 1.2 billion ounces by 2024, highlighting the enduring appeal and strategic importance of silver for institutional investment portfolios

The surge in silver demand is also due to the sustained strong growth of industrial consumption, which is expected to set a new record in 2024, while jewelry and silverware demand is also recovering. It is expected that the increase in silver demand will be accompanied by supply constraints, with supply expected to decline by 1% to 1 billion ounces, resulting in a deficit of 26.53 million ounces in 2024

The author points out that incorporating silver into investment strategies not only allows investors to utilize its industrial utility, but also its role as a safe haven asset, thereby ensuring the balance and resilience of the investment portfolio.

The author further explains that the dual demand for silver as an industrial metal and precious metal has benefited it from economic recovery, promoting industrial use, while also maintaining strong investment inflows due to financial market uncertainty

The author said, "This diversified demand characteristic makes silver perform better than other commodities that rely on a single source of demand, such as only for industrial use or as a tool to hedge against inflation

② De dollarization drives silver prices to rise recently

One important factor contributing to the recent rise in silver prices is the ongoing trend of de dollarization, which became a focal point at this year's BRICS annual summit.

The report points out that "many countries and large international investors have gradually moved away from the US dollar as the main reserve currency, and this trend has been going on for many years. Historically, silver and gold have been the main currency reserve assets. Silver, as a currency, has a history of more than two thousand years and is an important safe haven asset for investors

The report also takes into account the 2008 global financial crisis and the large-scale stimulus plans implemented during the pandemic, which injected a significant amount of liquidity into the market.

The report said: "During the global financial crisis and the COVID-19 epidemic, quantitative easing injected a lot of liquidity into the financial system. These measures led to significant long-term effects, including market distortions, increased inequality and rising debt levels. These consequences are still shaping economic policies and financial market dynamics."

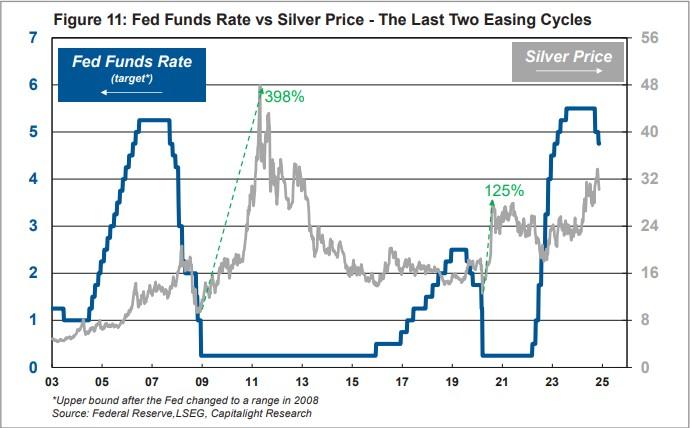

(Federal Funds Rate and Silver Price Trends: Analysis of Recent Two Loose Cycles)

③ The Federal Reserve's interest rate cuts usually lead to an increase in silver prices

Another factor driving silver prices is the cycle of interest rate cuts initiated by the Federal Reserve, which historically have typically led to an increase in silver prices.

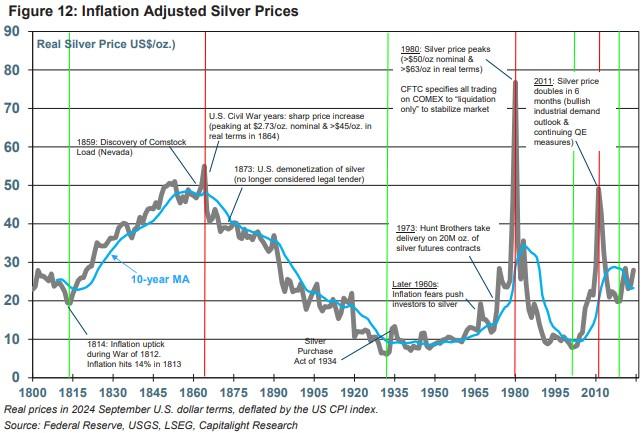

The report provides an outlook on the silver supercycle, stating: "Compared to short-term fluctuations that are more influenced by microeconomic factors, supercycles typically last much longer. Price increases in these cycles may last for 10 or even 20 years, forming a complete cycle of 20 to 40 years or more

(Inflation Adjusted Silver Price Trends: Interpretation of Key Historical Events)

The report states, "If the current bull market continues to evolve into the next metal supercycle we expect, investment demand and industrial demand will continue to grow in the coming years

The author added, "In addition, this cycle may be amplified by significant supply constraints. Stricter regulatory environments, longer licensing periods, and direct restrictions on exploration and mining development in multiple regions are hindering producers from meeting the growing demand for silver

The author reminds us, "Therefore, we can expect silver price volatility to intensify throughout the entire cycle. The slow progress of new mining projects, coupled with geopolitical risks and environmental issues, may lead to long-term supply shortages. This brings investment opportunities for projects that can successfully address regulatory challenges, especially in areas that are more friendly to exploration and mining activities

Strategic advantages of silver

The author points out that "due to its dual role as an industrial metal and a safe haven asset during market instability, silver has outstanding advantages as a strategic asset for institutional investors. Silver has a low correlation with traditional assets such as stocks and bonds, providing strong diversification benefits

The author added, "Historically, silver has proven its value during economic and geopolitical crises as a reliable hedge against inflation, currency depreciation, and systemic financial instability. Silver has existed as a form of currency reserve for over two thousand years, and in the current world where traditional reserve currencies such as the US dollar are facing challenges, it has once again become an important choice for storing value

The author concludes, "The current global environment is undergoing a structural transformation driven by multiple factors, including increasingly tense geopolitics, increasing economic fragility, and deteriorating fiscal conditions of many governments. These pressures are reshaping the global financial system, and investors are increasingly inclined to seek assets that are safe from counterparty risks and political interference, with silver being an important option in this environment

Daily chart of spot silver

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights