Why do experts say 'the central bank should not be prevented from cutting interest rates' when UK inflation rises?

An economist from the Institute for Economic Affairs (IEA) in the UK stated that despite the acceleration of inflation in October, the Bank of England should still accelerate the pace of interest rate cuts.

Julian Jessop, an economic researcher at the institution, said that UK interest rates are too high, and if the Bank of England further cuts interest rates, it may continue to suppress inflation.

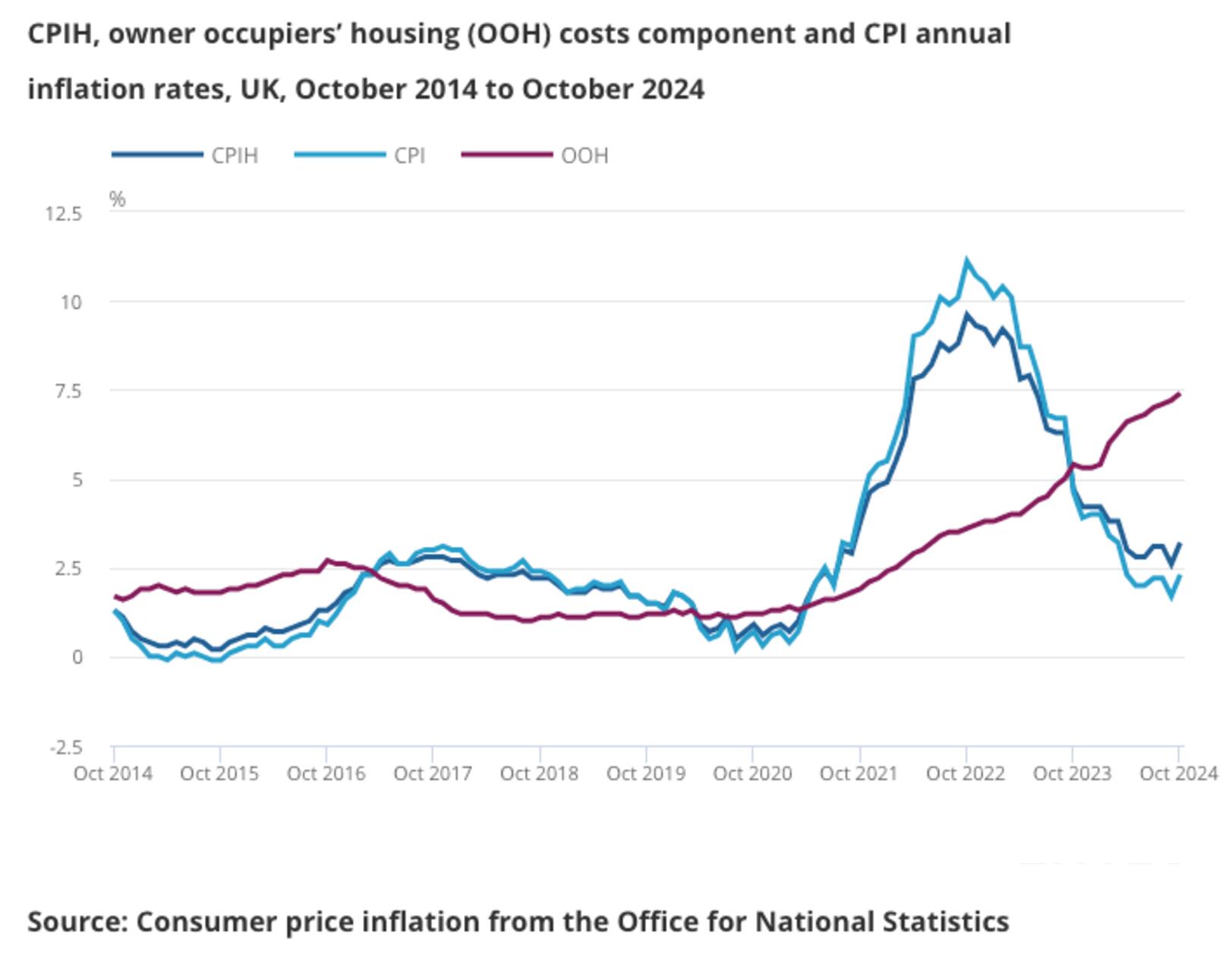

Previously, there were reports that the inflation rate in the UK rose from 1.7% to 2.3% in October, the core inflation rate increased from 3.2% to 3.3%, and the service sector inflation rate increased from 4.9% to 5.0%.

The following figure shows the call situation in the UK, where the green line represents the inflation rate and the blue line represents the core inflation rate

Jessop said, "The rise in core inflation in the UK is mainly due to the increase in airfare prices, which is an unstable factor that the Monetary Policy Committee should examine

The Bank of England's inflation target is 2.0% and has stated that it will further cut interest rates as it expects inflation to fall back to the target level in the next two years.

However, recently the inflation forecast has been raised in response to the government budget, and the significant increase in work tax in the government budget may trigger inflation.

Jessop said, "This news will intensify people's tension about the inflation outlook for the first half of next year, when the main impact of increased taxes and other business costs in the budget will begin to emerge

The central bank expects that budget measures will raise the inflation rate to over 2.5%, further away from the Monetary Policy Committee's target of 2%. The next interest rate decision of the Bank of England will be held on December 19th.

Jessop believes that this growth should only be temporary and may not be realized at all, especially if the main impact of the budget is actually to weaken confidence and growth.

He explained that the current official interest rate of 4.75% is still higher than the interest rate needed to continue suppressing inflation, especially in the absence of the full impact of past monetary tightening.

Jessop said, "If there is any, the Bank of England should accelerate the pace of easing. But at least, the Monetary Policy Committee should stick to the current path of 'gradual' interest rate cuts

Money market pricing shows that investors currently expect the Bank of England to only cut interest rates twice by 25 basis points in 2025, less than once per quarter.

After the inflation data was released, Goldman Sachs economists said that the market underestimated the speed at which the Bank of England would cut interest rates, and they still expected to cut rates every quarter next year.

Daily chart of GBP/USD

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights