The hawkish Federal Reserve cuts interest rates, causing gold prices to plummet by $60 and fall below the 2600 mark. It is feared that there will only be one interest rate cut next year

On Thursday (December 19th) morning trading in the Asian market, spot gold was hovering at a low level for nearly a month, currently trading around $2588.47 per ounce. Gold prices fell by more than 2% on Wednesday, hitting 2583.65 at the lowest level since November 18, closing at $2585.48 per ounce. The Federal Reserve had lowered interest rates as expected, but pointed out that it would slow down the pace of further decline in borrowing costs, thus boosting the yield of US dollars and treasury bond bonds.

Federal Reserve officials have released a new forecast, expecting to cut interest rates twice next year, each by 25 basis points, in the event of rising inflation rates. This forecast is consistent with the wait-and-see attitude towards Trump's inauguration in the White House in January.

The market is struggling to digest the fact that there will only be two interest rate cuts next year; gold is falling, but it is still holding on, "said independent metal trader Tai Wong." If gold can stay above $2600, bulls will be happy

The main COMEX gold futures contract hit a low of $2596.7 per ounce on Wednesday, closing at $2604.2 per ounce, a decline of about 1.9%.

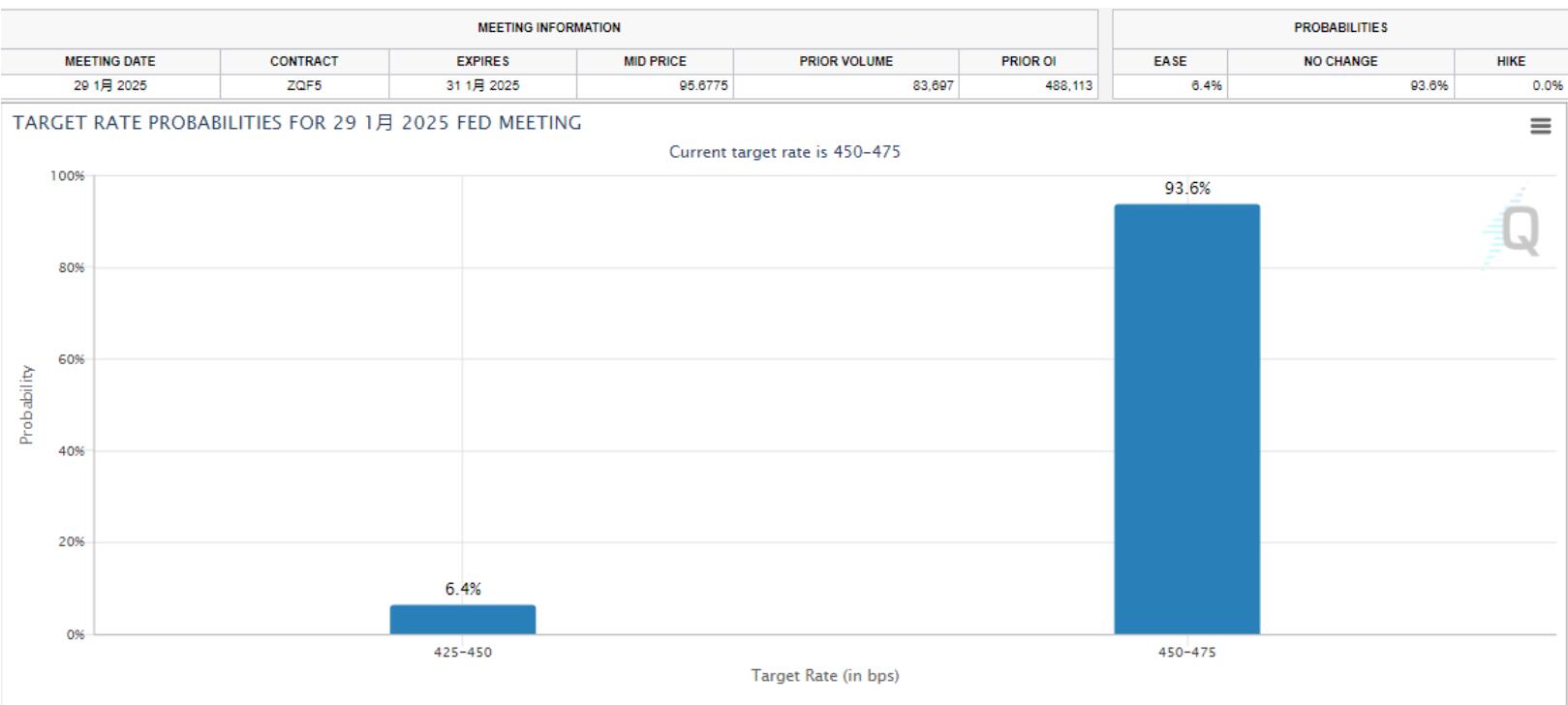

The federal funds rate futures market believes that the overnight benchmark rate will remain unchanged at the Federal Reserve's policy meeting in January, with a probability of further rate cuts in January of only 6.4%. Higher interest rate expectations have reduced the attractiveness of holding non interest bearing assets.

Chairman Powell stated that further reduction of borrowing costs depends on further progress made in reducing stubborn high inflation. This statement indicates that decision-makers are beginning to consider the prospects of comprehensive economic reform after the Trump administration takes office.

Powell's clear and repeated mention of the need for caution has made Wall Street nervous, leading to a significant drop in the stock market and prompting a market correction in estimates of the possible decrease in borrowing costs over the next year.

Powell said at a press conference after the two-day policy meeting of the Federal Reserve, "I think we are in a good position, but I believe this is a new stage from now on, and we will be cautious about further interest rate cuts

People have generally expected the Federal Reserve and Powell to cut interest rates in a hawkish manner, and it is expected that the rate cut in 2025 will be about half of the 100 basis points expected by policymakers three months ago. But at the end of Powell's speech, the market only believed that there would be a 25 basis point interest rate cut next year.

On Wednesday, as expected, the Federal Reserve lowered its policy rate range by 25 basis points to 4.25% -4.50%. Powell called this a "more difficult" decision and pointed out that the expected slowdown in interest rate cuts next year reflects higher than expected inflation readings in 2024.

Earlier this year, Cleveland Fed President Beth Hammack opposed interest rate cuts and preferred to keep the policy rate unchanged.

Federal Reserve policymakers now expect to cut interest rates only twice, each by 25 basis points, by the end of 2025. This is 50 basis points less than the rate cut they predicted as of September.

After the Federal Reserve's ruling, the US dollar continued to rise, reaching a high of 108.27, a new high since November 11, 2022, and closing around 108.26, an increase of about 1.22%, making gold more expensive for other currency holders. The US 10-year yield hit a new high since May 31, reaching 4.531%, closing at 4.522%, an increase of about 3.12%.

The Federal Reserve has raised its core inflation expectations and adjusted the dot matrix; therefore, interest rate cut bets are decreasing, and I believe there will be another rate cut next year, which is less than previously expected, "said Axel Merk, President and Chief Investment Officer of Merk Hard Currency Fund." Therefore, the initial market view is that this is hawkish and positive for the US dollar

JACK MCINTYRE, Global Fund Manager at BRANDYWIN GLOBAL, pointed out that the actual 25 basis point rate cut was the least important part of the December Federal Open Market Committee (FOMC) meeting. The market has already digested this expectation. The Federal Reserve did not disappoint either. However, if we look at the content of the forward guidance, this is a 'hawkish rate cut'. Stronger growth expectations and higher inflation expectations - no wonder the Federal Reserve has reduced its forecast for the number of interest rate cuts in 2025. The outcome of this meeting raises a question: if the market does not expect a rate cut today, will the Federal Reserve really cut interest rates? I doubt it will happen. It's not surprising that there is someone who holds opposing views. Therefore, the Federal Reserve has entered a new phase of monetary policy - the pause phase. The longer this stage lasts, the more likely the market is to believe that the probability of interest rate hikes and cuts is close. The uncertainty of policies will make the financial market more volatile in 2025. "

F. ELLEN HAZEN, Chief Market Strategist at L.PUTNAM Investment Management, believes that "this is a hawkish rate cut, and I think it's obvious. It's interesting that a new voting committee member immediately opposed it. But if you look at the changes in economic forecast statements, they really have no choice. They have raised their personal consumption expenditure (PCE) and core PCE inflation expectations for this year, next year, and the year after. They lowered their unemployment rate forecast and raised their gross domestic product (GDP) forecast. Therefore, when you see all the adjustments they have made, it is clear that the heat of economic operation is much higher than their previous predictions. This will definitely make them want to pause. "

In addition, there are reports that the ceasefire agreement between Hamas and Israel has made significant progress, which has also suppressed the safe haven demand for gold.

On the evening of December 18th local time, according to an anonymous Hamas official, significant progress has been made in negotiations between the Palestinian Islamic Resistance Movement (Hamas) and Israel regarding the phased release of detainees and a ceasefire agreement.

The official said that in the first phase of the ceasefire agreement, Israel demanded Hamas to release 34 Israeli detainees for humanitarian reasons, mainly all remaining women and children, including Israeli female soldiers, as well as patients and the elderly. In response, Israel will release an unconfirmed number of Palestinians detained by the Israeli side for security reasons, including some prisoners sentenced to life imprisonment.

The official claimed that the first phase of the ceasefire agreement will last for 42 days, during which Israel will allow a large amount of humanitarian aid, as well as equipment needed for repairing and rebuilding hospitals and public facilities in the Gaza Strip, to enter the Gaza Strip. The official stated that Israel has also agreed to withdraw from densely populated areas in the Gaza Strip in the first phase of the agreement. He also added that although all parties agreed to reopen the Rafa border crossing with Egypt in the first phase of the agreement, the issue of who will control the crossing has not yet been resolved.

It should be noted that traders are still monitoring the key US GDP and inflation data to be released later this week, which may further affect people's expectations for monetary policy. On this trading day, the Bank of Japan's interest rate decision and the Bank of England's interest rate decision will also be released, and investors need to pay attention.

In addition, as the market has anticipated that the Federal Reserve will be hawkish in cutting interest rates, investors need to be wary of the possibility of a "boot landing" market if there are more negative news. Moreover, there is also some rebound demand after the sharp decline in gold prices, so pay attention to resistance near the low point of 2613.55 on December 6th. Pay attention to the support near the lower track 2564.12 of the 26 cycle Bollinger Bands below.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights