Powell is the 'eagle in a pigeon coat'! Investors massively sell off risky assets

At 3:00 am Beijing time on Thursday, the Federal Reserve cut interest rates for the third consecutive time as scheduled, but this did not prevent investors from selling a large amount of risky assets. Federal Reserve Chairman Powell stated that the central bank may pause further interest rate cuts as inflation remains above expectations, followed by a sharp sell-off in the stock market at the end of trading.

The S&P 500 index rose slightly before the announcement, but then plummeted by 3%. This was the worst "Federal Reserve Day" since March 2020, when the central bank responded to the COVID-19 and cut interest rates at the weekend. Less than 20 benchmark stocks closed up. Small cap stocks have the most severe risk aversion, with the Russell 2000 index falling 4.4%, the largest decline since June 2022.

After the news, the yield of US treasury bond bonds soared, which was the biggest hawkish move since the Fed's decision day in 2013 to reduce the panic. Fear swept through the entire market, and the Chicago Board Options Exchange Volatility Index (VIX) jumped to 28, the highest level since the volatility shock in August.

Max Gokhman, Senior Vice President of Franklin Templeton Investment Solutions, referred to Powell as an "eagle in a pigeon's coat". Although he downplayed the recent slowdown in deflation and boasted about strong economic momentum, he still hinted that tariffs would not be seen as temporary and that two downward forecasts for 2025 were necessary because policies must remain restrictive.

Watson, Global Co Head of Fixed Income and Liquidity and Co Chief Investment Officer, stated that although the Federal Reserve has chosen to end this year with a third consecutive interest rate cut, its New Year's resolution seems to be taking a more gradual easing step.

IG Sydney based analyst Tony Sycamore said that the combination of rising yields and a surge in the US dollar should lead to a 1.5-2% drop in the opening of Asian markets, while the weakening of the yen provides a buffer to curb the decline of the Nikkei index.

Whitney Watson of Goldman Sachs Asset Management predicts that the Federal Reserve will skip the interest rate cut in January next year and resume loose policy in March.

Chief investment strategists such as Mark Luscini and Janney Montgomery Scott stated that the Fed's interest rate cuts were not surprising. Almost 100% probability has been priced. But I think people are somewhat concerned about the wording in the news. Not only does it involve data, but it also involves the policy measures of the incoming government. The market expects two to three interest rate cuts next year, with a preference for three. Now it seems that we should stand on the easier side of the two. The market is considering some factors that should have been known but have not yet been fully integrated. I think this is a bit overreacting, subconsciously giving up what should have been known. The market was not shocked by the expectation of a rate cut next year. So it seems a bit excessive.

Jamie Cox, the managing partner of Harris Financial Group, stated that prior to this meeting, the stock market had already risen sharply, which was a good way to help some people get out of trouble before the holiday. Stock prices are expensive, especially technology stocks, so people quickly sell and lock in profits before holidays. The interest rate decision is just a catalyst for people to do what they were supposed to do - sell early and complete it after a glorious year in the stock market.

Michael O'Rourke, Chief Market Strategist at Jonestrading, stated that the entire federal funds curve has shifted upwards. This is reflected in the two-year and ten-year returns. The soaring yield will only bring greater pressure to risky assets. Of course, we did not take into account any concerns about the more hawkish interest rate outlook, as the market has been rising. This indicates that it is a good reason to give up some chips before the end of the year. This is one reason for profit taking. The thing with the largest increase will feel the greatest pain in the short term.

Jim Awad, Senior Managing Director of Clearstead Advisors, stated that expectations for a rate cut next year are rapidly weakening. The market seems to believe that there will only be one interest rate cut next year, which means inflation will continue for a long time and interest rates will remain at a high level, all of which will damage stock valuations. As financing costs rise, the deficit problem becomes even more severe. Overall, this is a negative impact on risk assets, causing panic in the market.

Chris Zaccarelli, Chief Investment Officer of an asset management company, Northlight, said that the Federal Reserve tried to give the market what it wanted, but the gift was not welcomed. The market is forward-looking, ignoring today's 25 basis point rate cut and focusing on whether there will be a rate cut next year. Only two interest rate cuts are expected, far below market expectations, indicating that investors are not satisfied with the expected future trend of interest rates.

Steve Sosnick, Chief Strategist of Interactive Brokers, said, 'What interests me the most is the response to bonds.'. I don't know why fixed income traders would be surprised by a 9-12 basis point adjustment, unless they are very discouraged by the possibility of further rate cuts. Then, the rise in interest rates strengthened the US dollar, which in turn hit multinational corporations. Take a look at VIX. That jump screamed, 'I need protection now!'

According to the median of 81 responses surveyed by Markets Live Pulse, when the Federal Reserve meets in March next year, the yield of benchmark 10-year treasury bond bonds will fall from about 4.51% at present to 4.4%. After the news of the Federal Reserve's resolution, the bond market plummeted, and the yield of 10-year treasury bond bonds rose about 12 basis points. This is the largest increase since the Federal Reserve meeting day in June 2013, when signals that the central bank's asset purchase program would soon slow down triggered a stock market crash.

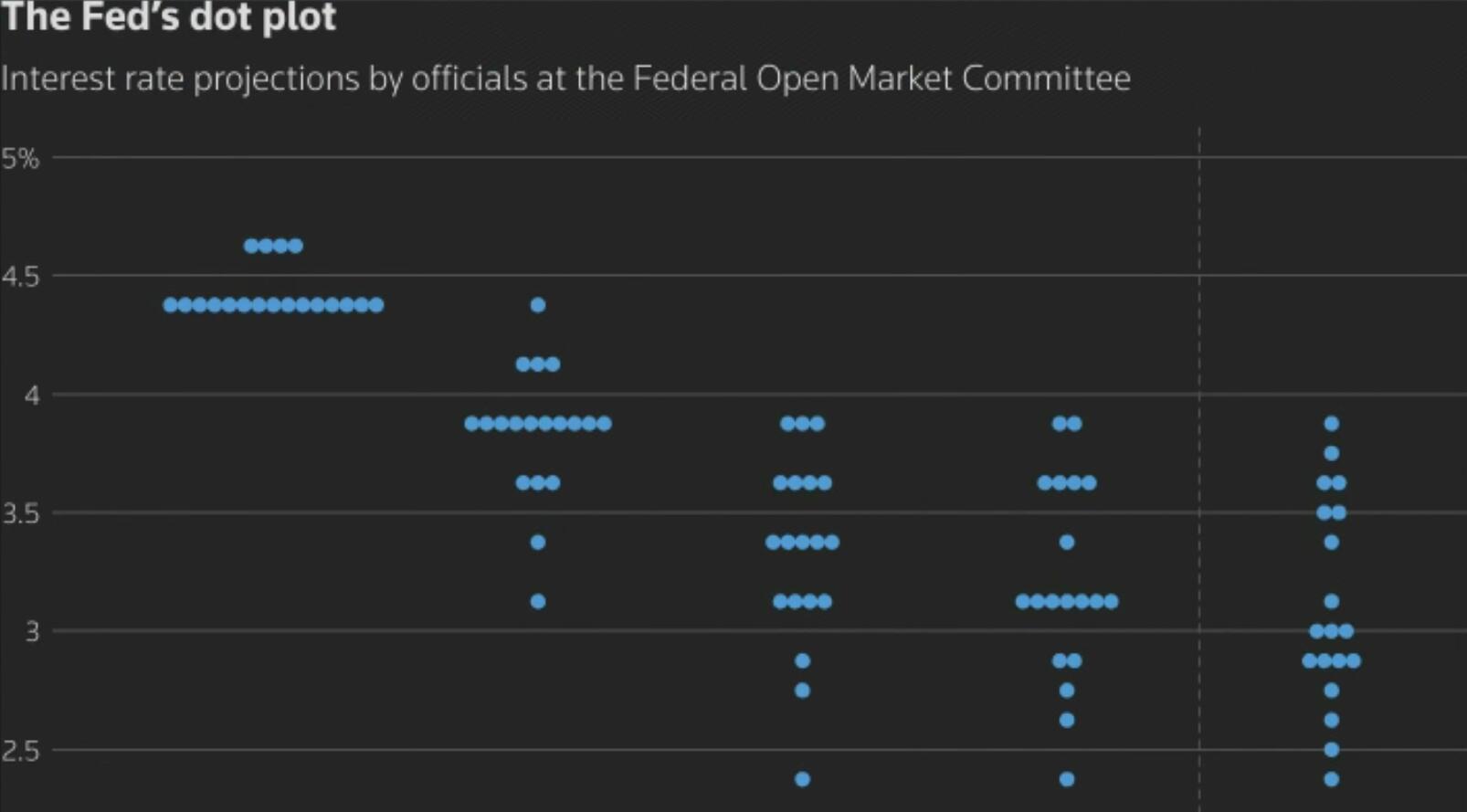

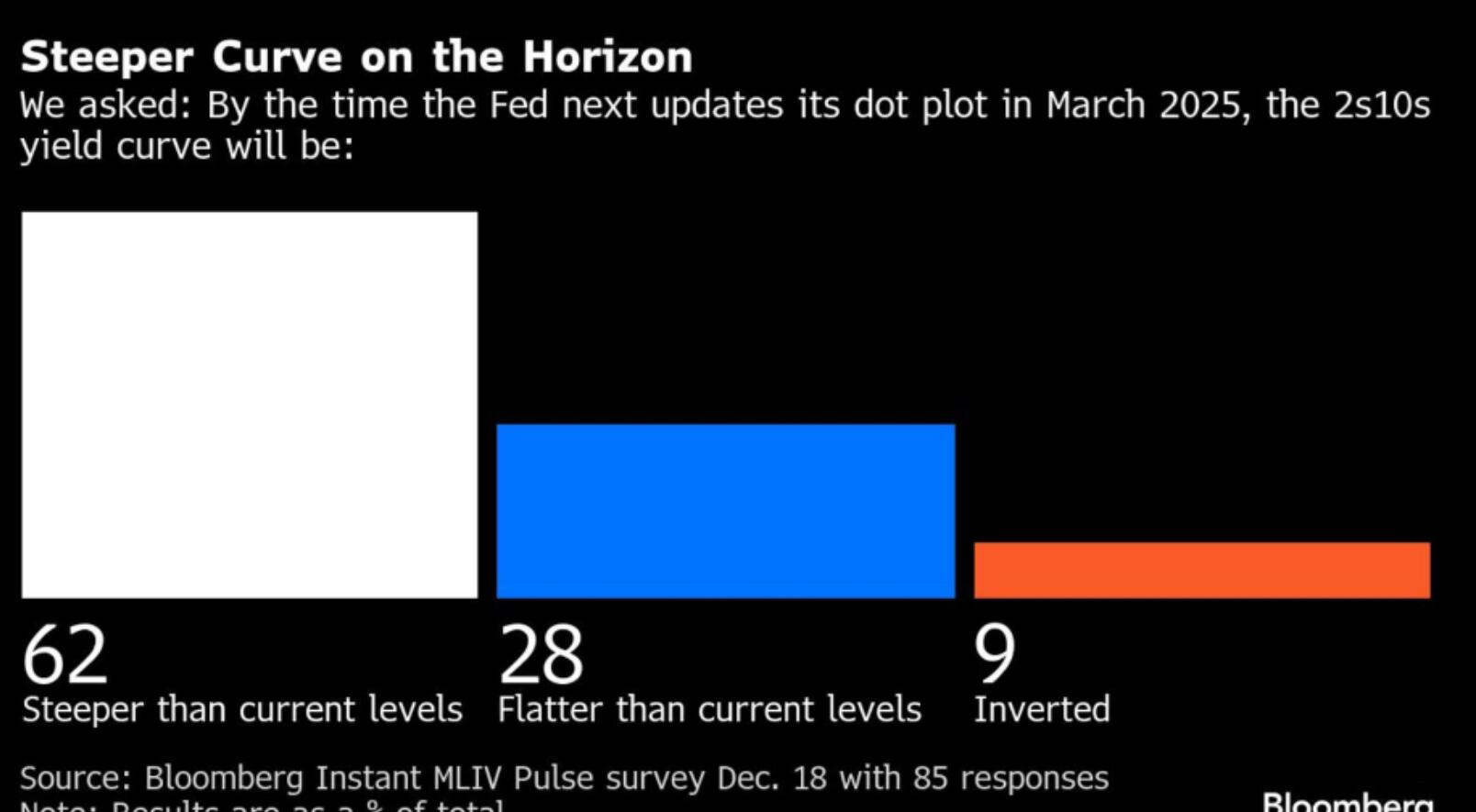

Respondents indicated that the Federal Reserve may eventually become more hawkish: 36% of respondents said that the Fed underestimated its long-term neutral interest rate, which neither promotes nor suppresses economic activity. Even if officials raise their growth rate forecast from around 2.9% in September to 3%, the situation remains the same. A quarter of people say that the Federal Reserve's estimate of neutrality is too high, while 39% of people say that this estimate is accurate. 62% of respondents said that the yield curve of US treasury bond bonds in March may be steeper.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights