Due to the narrowing of the US Japan interest rate differential, traders have reduced their bullish bets on the yen

After the policy meetings of the Federal Reserve and the Bank of Japan raised questions about the speed at which the US Japan interest rate differential narrowed, traders are reducing their bets on the rise of the yen.

Prior to last week's consecutive meetings, strategists were betting that 2025 would be the year of the Japanese yen. But the market is not so optimistic about the outlook for the yen now. Previously, Bank of Japan Governor Kazuo Ueda stated that he may wait a while longer to raise interest rates, while the Federal Reserve hinted that it will slow down the pace of monetary easing next year.

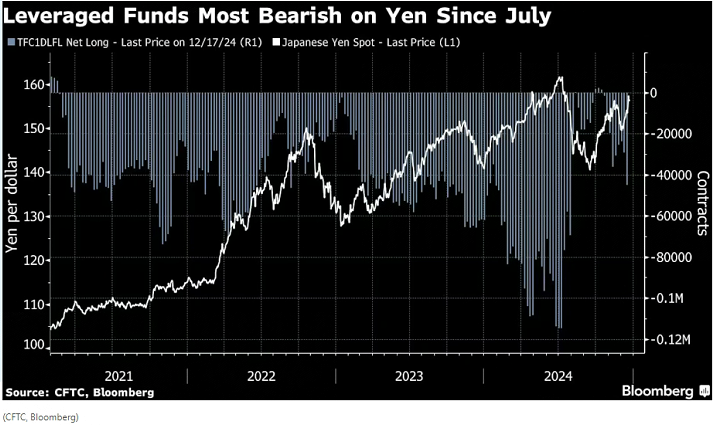

Figure: The most pessimistic view of leveraged funds on the Japanese yen since July (the left vertical axis represents the USD/JPY exchange rate, the right vertical axis represents the number of contracts, the white line represents Japanese yen spot, and the gray line represents net long positions)

Options indicators show that after the meeting, traders' bullish sentiment towards the Japanese yen dropped to its lowest level in a month. The latest data from the US Commodity Futures Trading Commission (CFTC) for the week ending December 17th shows that leveraged funds have also increased their net short positions in the yen to approximately 44926 contracts, the highest level since July.

Strategists from Mizuho Securities and Sumitomo Mitsui Insurance have recently lowered their USDJPY exchange rate forecasts. Mizuho has raised its forecast for the USDJPY exchange rate by the end of 2025 from 130 to around 145, while Sumitomo Mitsui Insurance currently expects it to be 140, compared to the initial forecast of 130.

Tsukasa Sugiura, market strategist at Sumitomo Mitsui Insurance, said, "Due to the extreme hawkishness of the Federal Reserve and the extreme dovishness of the Bank of Japan, we have changed our view on the outlook. Now it seems unlikely that the Bank of Japan will raise interest rates in January

Bank of Japan Governor Kazuo Ueda stated at a press conference after announcing the decision on Thursday that he needs more information about Japanese wages and Trump policies. On Friday thereafter, the USDJPY exchange rate fell to 157.93, the lowest level since July. Foreign exchange strategists point out that if the Bank of Japan maintains interest rates unchanged before March or later, there will be a dangerous situation of further weakening of the yen. Some people suggest that the widening interest rate spread may also lead to a resurgence of yen carry trades. Investors borrowing funds in Japan and then allocating them to higher yielding markets is a popular strategy that has exploded the global market this year.

Charu Chanana, Chief Investment Strategist of Shengbao Bank, said, "The hawkish stance of the Federal Reserve and the suspension of interest rate hikes by the Bank of Japan may provide new reasons for yen traders to 'continue' their actions." She said, "Both the Federal Reserve and the Bank of Japan are narrowing the yield gap, which has been pushed beyond the first quarter," so the appreciation of the yen may also be pushed into the second half of next year.

Mizuho previously predicted that the yen exchange rate would reach the highest level since the beginning of 2023 due to the narrowing of the policy interest rate gap between the United States and Japan and the yield gap of 10-year treasury bond bonds next year. But upon seeing the latest monetary policy expectations from the Federal Reserve, Mizuho immediately changed its forecast for the US dollar against the Japanese yen. The latest monetary policy expectations from the Federal Reserve suggest that there will only be two interest rate cuts next year, each by 25 basis points.

Masafumi Yamamoto and Masayoshi Mihara, strategists at Mizuho, wrote in a report: "Currently, against the backdrop of a relatively strong US economy and high interest rates, the US dollar is likely to remain strong, so we have raised our forecast for the US dollar

Strategists warn that the USD/JPY may reach 160 in the short term, which increases the risk of Bank of Japan intervention and may even lead to early interest rate hikes. Japanese Finance Minister Katsunobu Kato and Foreign Exchange Bureau Director Atsushi Mimura both warned on Friday that they will take appropriate measures to prevent excessive exchange rate fluctuations.

Analysts Kyohei Morita and Yujiro Goto from Nomura Securities wrote in a report, "We believe that the Bank of Japan is more likely to wait until March to raise interest rates." They revised their previous forecast for a rate hike in January. In the short term, there is a higher risk of yen depreciation overshoot, but what we are concerned about is any verbal intervention and the possibility of the Bank of Japan turning hawkish

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights