The short-term pullback of the US index is weak, and EURUSD is under pressure due to volatility

As the end of the year approaches, the economic situation in the United States is complex. On the one hand, data such as new orders for key durable goods, orders for non defense durable goods, and shipments of core durable goods improved in November, and corporate investment was maintained, demonstrating a solid economic foundation. But there are also hidden concerns. The Trump administration plans to impose tariffs, causing a sharp drop in consumer confidence in December. However, the labor market situation is optimistic, with an unemployment rate of 4.2%. In terms of macroeconomic expectations, the Atlanta Fed expects GDP to grow by 3.1% in the fourth quarter. The Fed cut interest rates by 25 basis points last week and is expected to reduce the number of rate cuts and raise inflation forecasts in 2025. In the market, the dollar index rose, and the yield of 10-year treasury bond bonds rose. There have been new developments and variables in the geopolitical situation. On December 23rd, there was progress in negotiations between Israel and Hamas regarding the release of detainees. However, that evening, Israeli forces killed senior members of Hamas, and there are still key issues to be resolved in the ceasefire negotiations between the two sides. In short, the direction of the US economy is uncertain due to multiple factors and the complex geopolitical situation requires continuous attention.

In terms of the US dollar index, the overall price of the US dollar index showed an upward trend on Monday. The highest price of the day rose to 108.257, the lowest was 107.654, and closed at 108.051. Looking back at the price performance of the US dollar index on Monday, after short-term fluctuations during the morning session, it tested the resistance level for four hours upwards as scheduled. However, after the European session, it continued to exert strength and the US market did not quickly come under pressure but instead fluctuated at a high level. The price did not further explore the daily support area and ultimately closed with a strong bullish trend that day. Indicating that the market is still performing strongly. The daily support is temporarily focused on the 107.10 area, with a 4-hour support in the 107.90-108 range. Short term support is expected to further rise based on this support, with a focus on the 108.50-106.20 area above.

Buy long in the 107.90-108 range of the US Composite Index, defend for $5, target 108.50-106.20

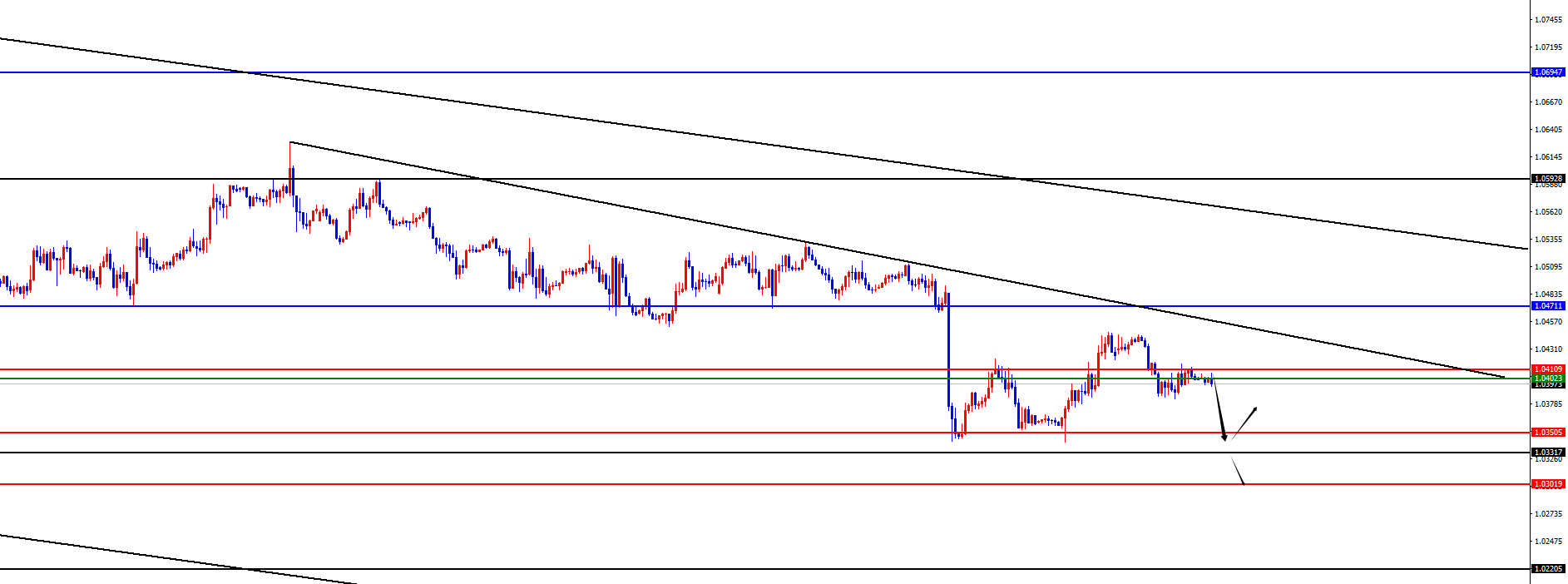

In terms of EUR/USD, the overall price of EURUSD showed a downward trend on Monday. The lowest price of the day fell to 1.0383, the highest rose to 1.0445, and closed at 1.0405. Looking back at the performance of the EURUSD market on Monday, prices fluctuated during the Asian session and were suppressed at the high point of last Friday. Subsequently, prices fell under pressure again. Prices in the US session and overnight period fluctuated and consolidated around the four hour support, eventually ending in a bearish daily trend. Currently, the market is still under weekly and daily resistance, so the medium-term and band are still bearish. The four hour 1.0400 area is a key watershed for short-term operation, so we need to continue to pay attention to the pressure under the daily resistance, and the 1.0350 area below. In the future, we need to pay attention to the gains and losses of last week's low point position. If we continue to break, there will be further pressure performance.

Short selling in the EUR/USD 1.0400-10 range, defending 50 points, targeting 1.0350-30

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights