Analysis of Gold and Crude Oil Trends: Focus on Further Development of Geopolitical Situation after Christmas

Due to the Christmas holiday in Europe and America, market trading is light and trading volume is relatively low, so price fluctuations may be relatively limited. Investors generally adopt a wait-and-see attitude, waiting for the end of the holiday before making direction choices. However, geopolitical risks and macroeconomic data will still have an impact on market sentiment.

① The geopolitical risks in the Middle East continue to rise, providing support for the gold market.

② The escalating conflict between Russia and Ukraine poses a threat to global economic and geopolitical stability, providing a safe haven for gold.

③ The upcoming data on initial jobless claims in the United States will be an important factor affecting gold prices. Although data from the previous weeks showed a decrease in the number of initial jobless claims, the data fluctuated greatly and there were differences in market expectations.

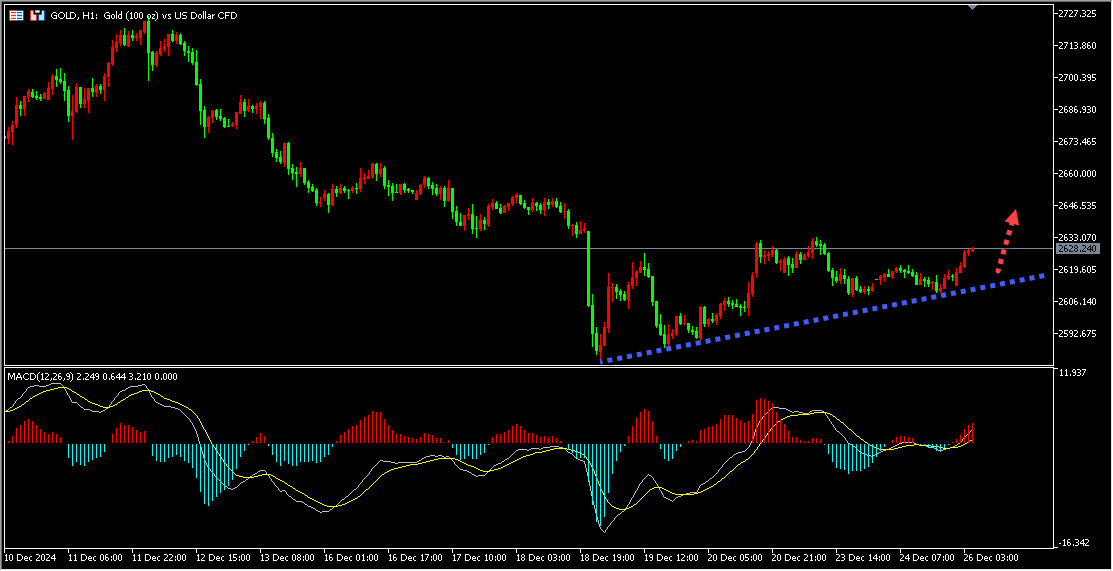

④ The current 1-hour upward trend of gold is good.

In summary, the short-term bullish trend of gold is currently good. Investors within the day are paying attention to the support area of the 1-hour uptrend line below, and will go long after the stabilization of the gold correction.

At present, trading in the crude oil market is light, and investors generally adopt a cautious and wait-and-see attitude, waiting for more information guidance. The delayed release of EIA inventory reports and the lack of clear direction in the market have led to price volatility. Investors need to closely monitor geopolitical risks, macroeconomic data, and changes in supply and demand dynamics in order to adjust their investment strategies in a timely manner.

① OPEC+has postponed its plan to reduce production by 2.2 million barrels per day until April 2025, which has to some extent suppressed supply growth and provided potential support for oil prices.

② Asian powers have recently launched a series of measures to stimulate their economies, aimed at boosting economic growth and potentially indirectly driving an increase in demand for crude oil.

③ The geopolitical tensions in the Middle East continue to escalate, posing potential risks to the crude oil market.

④ The current 4-hour trend of crude oil is relatively strong.

In summary, the current bullish trend of crude oil is clear. Today, investors are paying attention to the 4-hour support area below crude oil, and will continue to buy more crude oil after the pullback stabilizes.

The above analysis is for reference only and does not constitute investment advice. Investors should make independent investment decisions based on their own risk tolerance and investment goals.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights