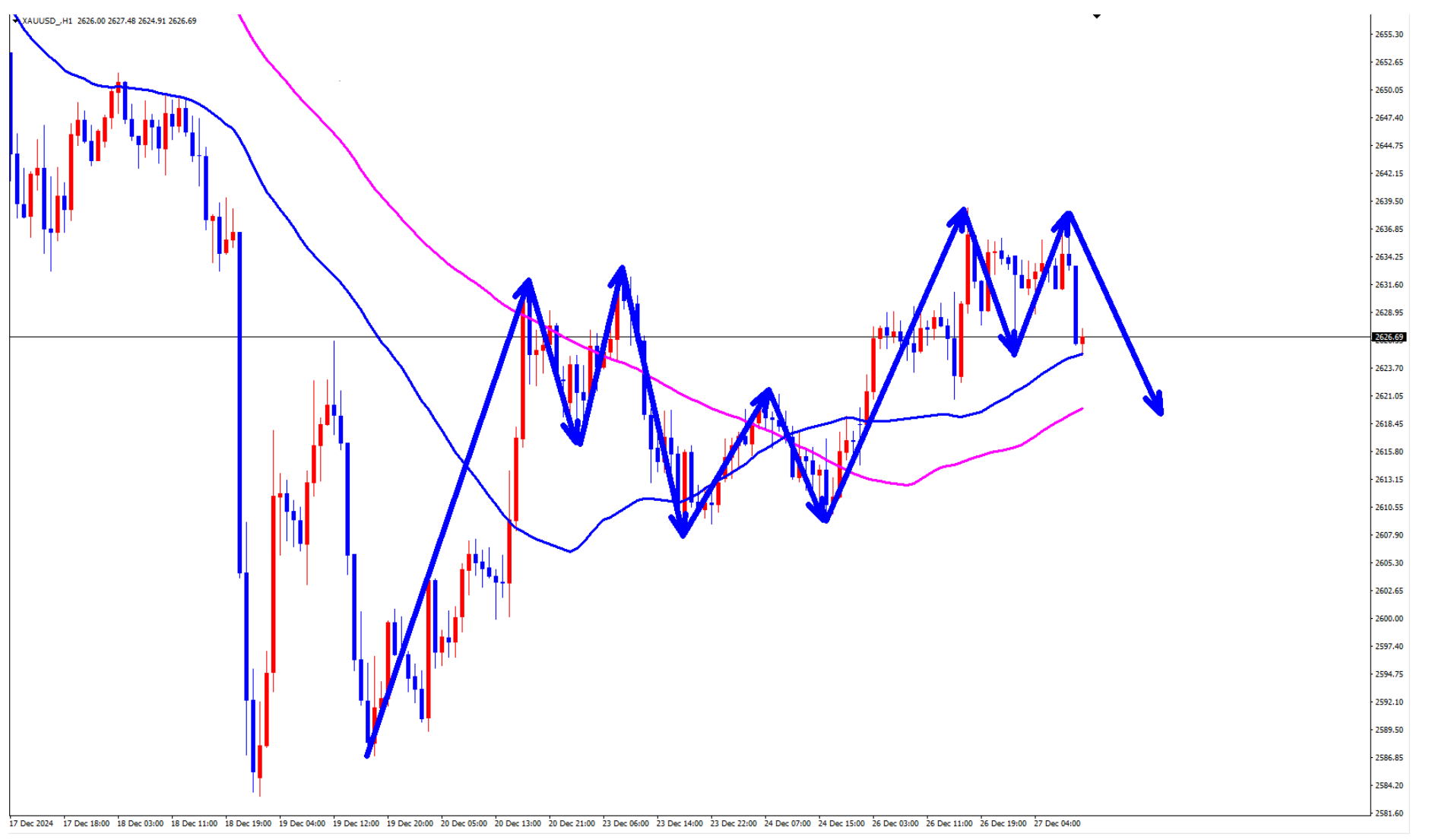

Gold 2635 short selling fell and harvested as scheduled, while the rebound in the US market continues to be bearish!

After the rise and fall of gold yesterday, gold continued to sell short at 2635. The article also directly suggested selling short at 2635. In the morning session, it was still suggested to sell short at 2635. Gold fell and harvested as scheduled, and the gold market did not reverse. The rebound in the US market still led to continued short selling.

If there is no substantial breakthrough in one hour of gold and it stabilizes at the previous high of 2633, and the gold surge falls below 2633 again, then the gold surge breakthrough is invalid. The gold bulls still do not have the strength to directly drive the gold bulls to reverse. If the gold is under pressure at 2640, it is better to continue short selling at high prices. If the gold rebound is around 2635, it is still possible to continue short selling first.

This is the market trend, it's not necessarily about continuing to be bullish once it rises. If gold bulls are unable to keep up, it means they lack confidence in further upward movement. In this case, gold bears have the opportunity to continue their efforts, and if gold rebounds, they should continue to sell short.

Operation strategy for the US market:

Short selling gold 2635, stop loss 2645, target 2615-2610;

Disclaimer: The above is purely a personal opinion sharing and does not constitute operational advice. Investment carries risks, and profits and losses are borne by oneself.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights