US index beware of retracement to daily support, EUR/USD range oscillates and awaits breakthrough

Last week, due to the Christmas holiday, the market was closed and the market was sluggish. The US dollar index rose slightly on Monday and hovered around a two-year high, but fell back before the US market on Friday, closing around 108. Spot gold trading was light, with a volatility of only $30. In the international situation, Hamas and Israel have not reached a ceasefire agreement and blame each other. The Houthi militants in Yemen attacked Israel, which was retaliated by Israel. Russia attacked energy facilities in Ukraine. Lebanon has appealed to Israel for violating the ceasefire agreement. In terms of economic data, data such as durable goods orders and new home sales in November in the United States have shown signs of improvement, and the job market has shown resilience and begun to cool down. Looking ahead to 2025, the focus of the first week will be on manufacturing PMI data and Trump policy developments. The US dollar may experience a slowdown in upward momentum due to multiple factors, the Japanese yen may face intervention risks, the market may fluctuate, and the Federal Reserve's FOMC voting committee lineup will be updated with different opinions. Many factors are intertwined, and there are many market and situational variables. It is necessary to closely monitor PMI data, policy dynamics, changes in US bond yields, and low liquidity fluctuations during holidays.

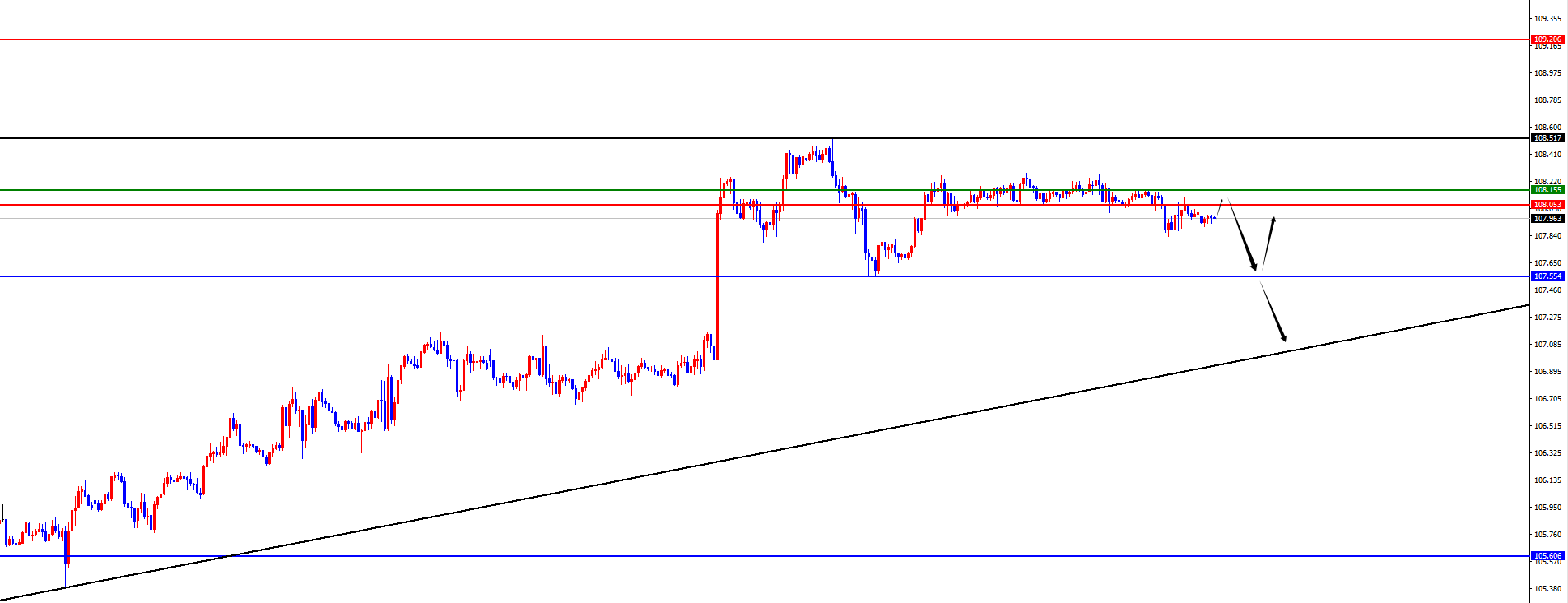

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed a downward trend last Friday. The highest price of the day rose to 108.179, the lowest was 107.838, and closed at 108.004. Looking back at the price performance of the US Composite Index last Friday, the price fluctuated upward in the short term after the morning opening, and then fell again under pressure. From a position perspective, the price continued to be under pressure from the four hour key resistance. On the daily chart, it is temporarily necessary to pay attention to the support in the 107.50-107.55 range, which is the key to the US Japan market trend. From a 4-hour perspective, the price is currently suppressed by the 4-hour resistance in the short term. Therefore, we will focus on the 4-hour resistance pressure for now, and pay attention to the daily support of the degree test for the price first, and then focus on the gains and losses of the daily support in the future.

Short selling in the 108.05-15 range of the US Composite Index, defending against $5, with a target of 107.55

In terms of EUR/USD, the overall price of EURUSD showed an upward trend last Friday. The lowest price of the day fell to 1.0404, the highest rose to 1.0443, and closed at 1.0423. Looking back at the performance of the European and American markets last Friday, during the morning session, the price was initially under pressure and corrected in the short term. Then, it gained support above the four hour support and continued to rise. However, after the US session, the price did not continue to rise, but instead fluctuated mainly. Finally, it closed with a bearish cross on the weekly line and a bullish candlestick on the daily line. Currently, 1.0445 is a key watershed in the daily line level, and the price will only continue to be under pressure after a subsequent upward break. Otherwise, it is still necessary to guard against further pressure. For the four hours, we will temporarily focus on the support in the 1.0410 range. Therefore, combined with the current price fluctuations in the 1.0405-1.0445 range, we will make a follow-up layout after a subsequent break.

EUR/USD focuses on fluctuations within the range of 1.0405-1.0445, and follows after breaking through

Today's Key Financial Data and Events: Monday, December 30, 2024

① 16:00 Swiss December KOF Economic Leading Indicators

② 22:45 Chicago PMI for December in the United States

③ 23:00 US November Signed Home Sales Index Monthly Rate

④ 23:30 Dallas Fed Business Activity Index for December in the United States

Note: The above is only a personal opinion and strategy, for reference and communication purposes only. No investment advice has been given to the client, and it is not related to the client's investment, nor is it used as a basis for placing an order.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights