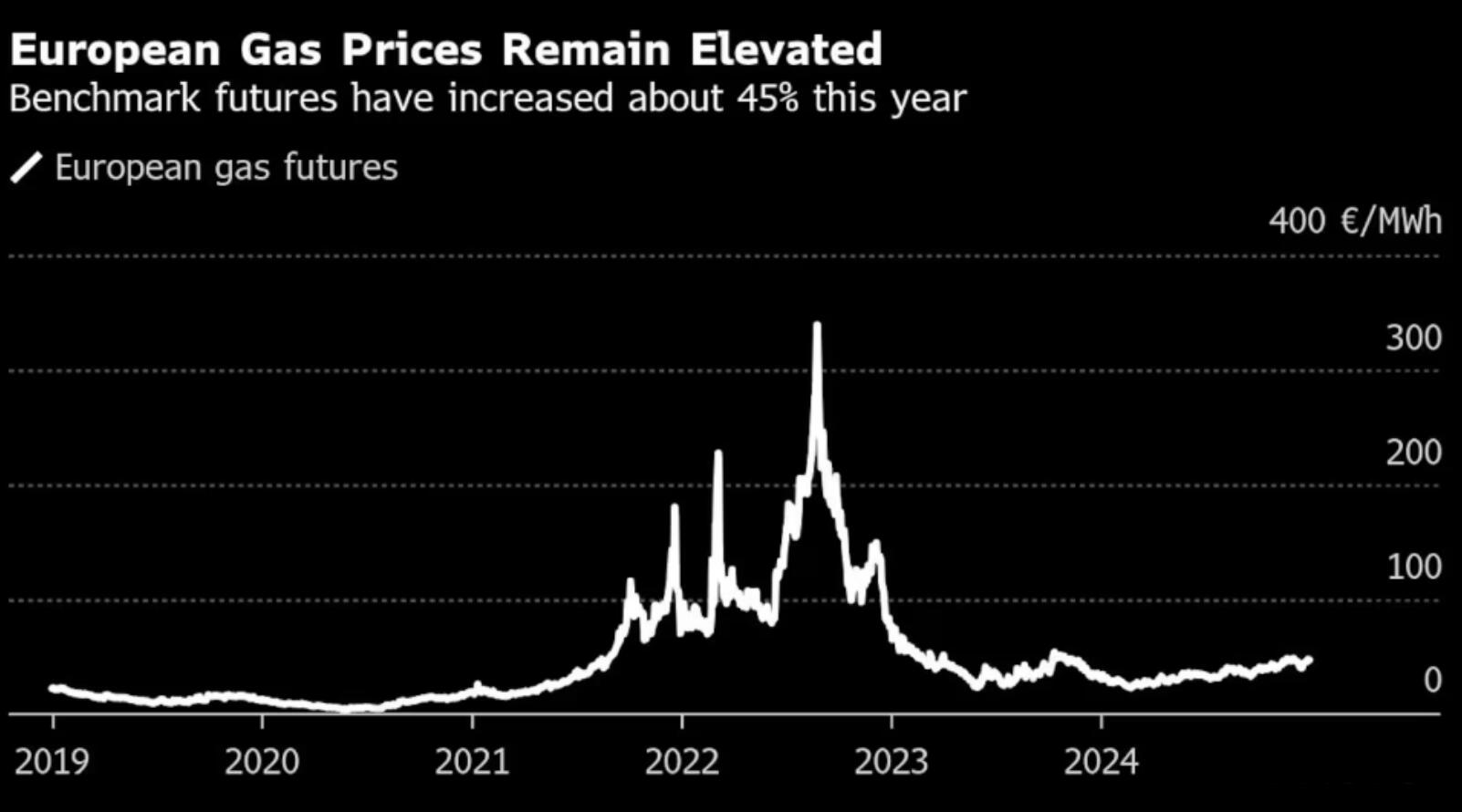

European natural gas prices have risen by about 45% throughout the year, making it difficult for European consumers to start 2025

European natural gas prices have risen by about 45% this year, adding burden to households and industries as they struggle to recover from the most severe cost of living crisis in decades. Due to the suspension of cross-border agreements on January 1st, Russia's natural gas flow may increase.

The futures contracts for next year have already generated a premium, which is a strong signal that prices will remain at a higher level for a longer period of time, ultimately resulting in larger bills for consumers. Some traders believe that the impact of no traffic is 10 euros per megawatt hour higher than if traffic continues.

The timing of the termination of the Ukraine Russia transit contract looks very dangerous. The natural gas reserves in the region serve as a buffer zone in times of tension, as they are being depleted at a faster rate than normal due to cold weather, which may make it more difficult for traders to ensure supply for next winter. The weather will become colder, which may increase the demand for natural gas for heating.

MET Group analysts stated in a report on Monday that "high prices will inevitably weaken industrial competitiveness and economic performance." Looking ahead, "delayed capacity increases or stronger than expected Asian demand driven by economic recovery or cold weather may tighten the market

Russia currently delivers less than 5% of Europe's total demand for 15 billion cubic meters of natural gas annually through Ukraine. Despite this, energy analysts from the limited company stated in a report this month that losing one of the last remaining routes for Russian pipeline natural gas will put greater pressure on the already tight natural gas market and push up global prices.

Their basic situation is that the benchmark futures of the Dutch ownership transfer facility virtual trading point will remain high. This reflects a lack of flexibility in global balance, including difficulties in refilling storage sites by the end of October next year.

The Ukrainian war has disrupted the energy market in the region, causing prices to soar, and the balance has remained very tight in the past three years. Europe has been striving to diversify its supply sources, purchase more sea freight, increase dependence on Norway, and build renewable energy. Nevertheless, prices remain extremely sensitive to any perceived production risks, especially as extreme heat waves become more frequent and Asia has been increasing its procurement of liquefied natural gas.

Over the weekend, Slovak Prime Minister Robert Fico estimated that European households and businesses could face an annual increase in natural gas prices of 40 billion to 50 billion euros (42 billion to 52 billion US dollars) and additional electricity costs of 60 billion to 70 billion euros.

Slovakia is highly dependent on Russia for natural gas. In the UK, the energy price cap represents the annual bill of a typical household, largely reflecting wholesale electricity and natural gas prices, which are expected to rise for the third consecutive time in April, posing a problem for the Bank of England's attempt to control inflation.

Due to the uncertainty of energy costs, the European economy is recovering slowly from the crisis, and more stable prices will enable businesses and households to develop spending plans. The situation in Germany is very difficult, as many factories have to stop or limit production due to high energy costs. Faster storage and withdrawal sends an ominous signal that pressure on Europe's largest economy may continue for the third consecutive year.

Last week, European Central Bank President Lagarde stated in an interview that the central bank is about to reach its 2% inflation target, but remains cautious about service sector inflation. These comments were made at the end of a year when Lagarde and her colleagues began to lift unprecedented monetary tightening policies.

Jamie Rush, Chief European Economist at Bloomberg Economics, said, "Natural gas across Europe is now a bit expensive, putting some cost pressure on Europe, but it's completely different from what we saw during the energy crisis. We still expect inflation rates to fall below the European Central Bank's 2% target by 2025.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights