Gold: The dawn of the new year is just beginning to bloom, seize the opportunity to move forward

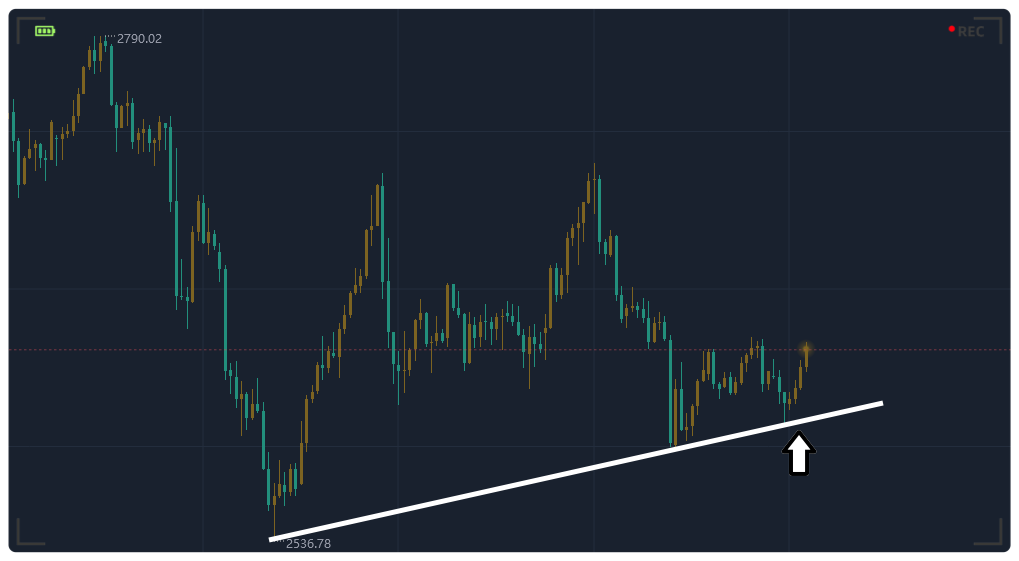

At the beginning of the new chapter in 2025, the gold market continues its past heat! Looking back at 2024, the annual increase in gold prices reached as high as 27%, writing the most magnificent chapter since 2010. Its price successfully reached a peak of $2790.15 on October 31st, and the feat of breaking the high point more than 40 times throughout the year has witnessed its strong resilience in the market.

Although the November US presidential election caused a stir and led to a brief drop in gold prices, it was just a ripple in its glorious journey and did not change its status as a king throughout the year.

Entering 2025, many favorable factors are intertwined, providing a solid foundation for its continuation of the legend. The ever-changing global economic landscape and the surging geopolitical undercurrents continue to empower the safe haven value of gold like a driving force behind the scenes. The lingering echoes of loose monetary policies by central banks around the world have further solidified the foundation for their price increases.

From a technical perspective, examine the current gold market. The previously formed key points of 2537, 2583, and 2602 have successfully established a stable upward support line, becoming an important cornerstone for the steady rise of gold prices. Every brief price correction can quickly bottom out and rebound.

Last week's market performance was another manifestation of this pattern, with gold prices rising in a continuous bullish trend after touching the key support of 2602.

On Monday evening, when interpreting the market situation, we provided a late review analysis of "Gold: bottoming out and rebounding, with rebound signals emerging", and gave a bullish idea based on the opportunity of the 2606 retracement. The lowest retracement in consolidation is better to reach the 2606 line and stabilize and pull up.

On the opening of this trading day, it successfully broke through the suppression level of 2628 and demonstrated its upward momentum in a large volume rally.

Looking ahead to this trading day, the strong performance during the Asian session has further laid the foundation for the upcoming upward trend. Currently, the bottom of the bullish entity on the 4-hour chart is around 2624, serving as a key support point for the bulls. During the day, when the price retraces to this critical area, follow up with a buy long strategy.

Of course, if the market sentiment is high and there is a strong situation of directly increasing volume and breaking through 2639 in the Asian market, according to the usual rhythm of the market, after the Asian market rises, the European market will experience a brief correction or sideways consolidation. Of course, this is just the market accumulating strength and laying the groundwork for further upward movement in the US market. At that time, investors should closely monitor the dynamics of the European market and rely on the correction situation of the European market to make a second buy long follow-up!

The above views are for reference only. Investment carries risks, and caution should be exercised when entering the market

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights