01.03 Analysis of the Trend of Foreign Exchange Gold and Crude Oil

EURUSD: The euro rebounded to near the first resistance yesterday and continued to decline, expanding its decline during the New York session. The daily chart closed at the upper and lower shadow lines with a bearish candlestick. From the close, the upper resistance still exists, and bears continue to dominate. Combined with the 4H chart, the Bollinger Bands turned downwards, and the MACD zero axis ran below. The main resistance above the day was 1.0310, the second resistance was 1.0360, and the support below was 1.0210, 1.0155. It is expected that the short-term support below the first resistance will test the first support.

GBPUSD: The pound hit a downward pressure below the first resistance yesterday and continued to hit a new low for the day until the close. The daily chart closed with a large bearish candlestick above and below the upper and lower shadow lines, and the closing position touched the front support area. Only after breaking below can the downward space be opened. From a 4H perspective, the Bollinger Bands are below the middle limit, running near the MACD zero axis. The top resistance is 1.2430, the second resistance is 1.2480, and the bottom support is 1.2335, 1.2270-80. The first resistance is expected to test the first support in the short term before it recovers.

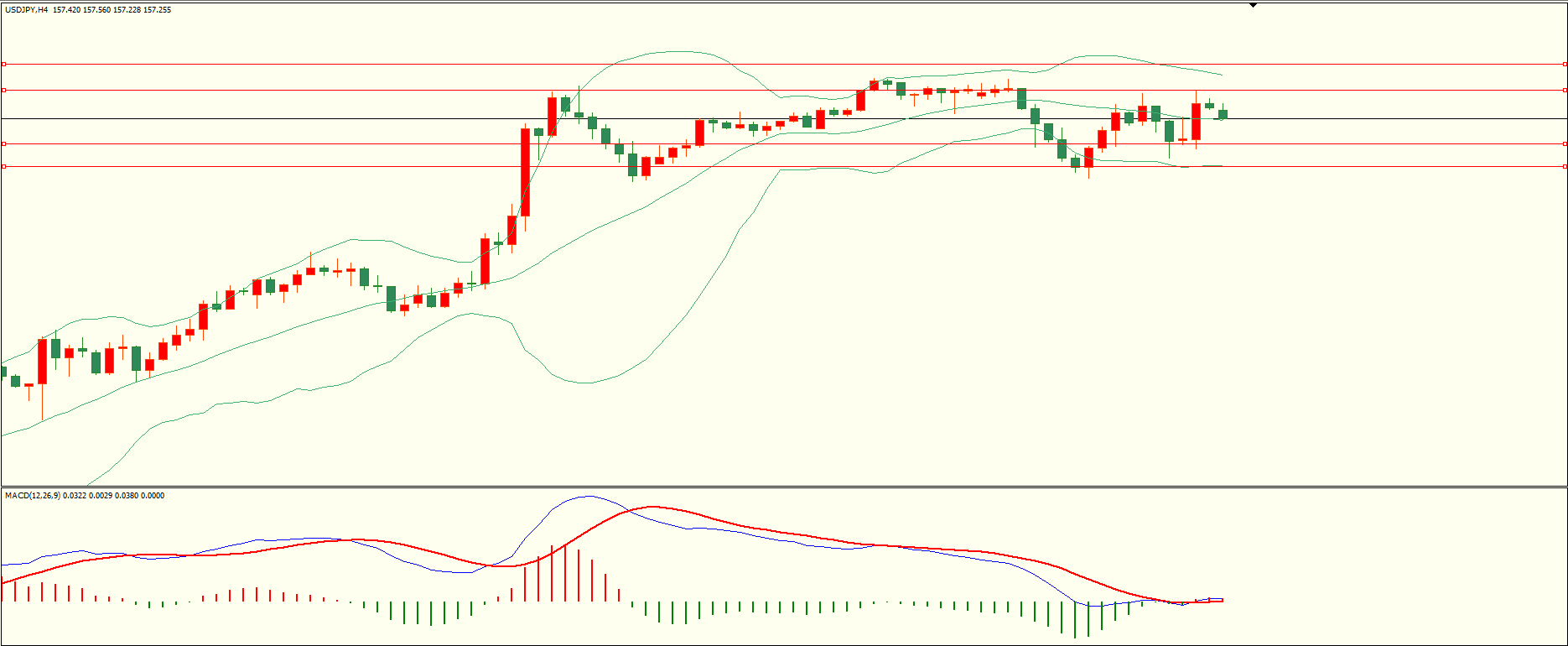

USDJPY: Yesterday, it rebounded to the second support and hit the bottom of the first resistance in the late trading session, rising and falling. The daily closing line showed a small bullish line with upper and lower shadows, and short-term bulls had a slight advantage. At the same time, it is necessary to pay attention to the high resistance area in the front and recover before continuing. From the perspective of 4H, the upper and lower tracks of Bollinger have slightly narrowed, running near the MACD zero axis. The main support for the day was 156.70, the second support was 156.25, and the upper resistance was 157.80158.35. It is expected that the short-term resistance will retest the first resistance above the first support.

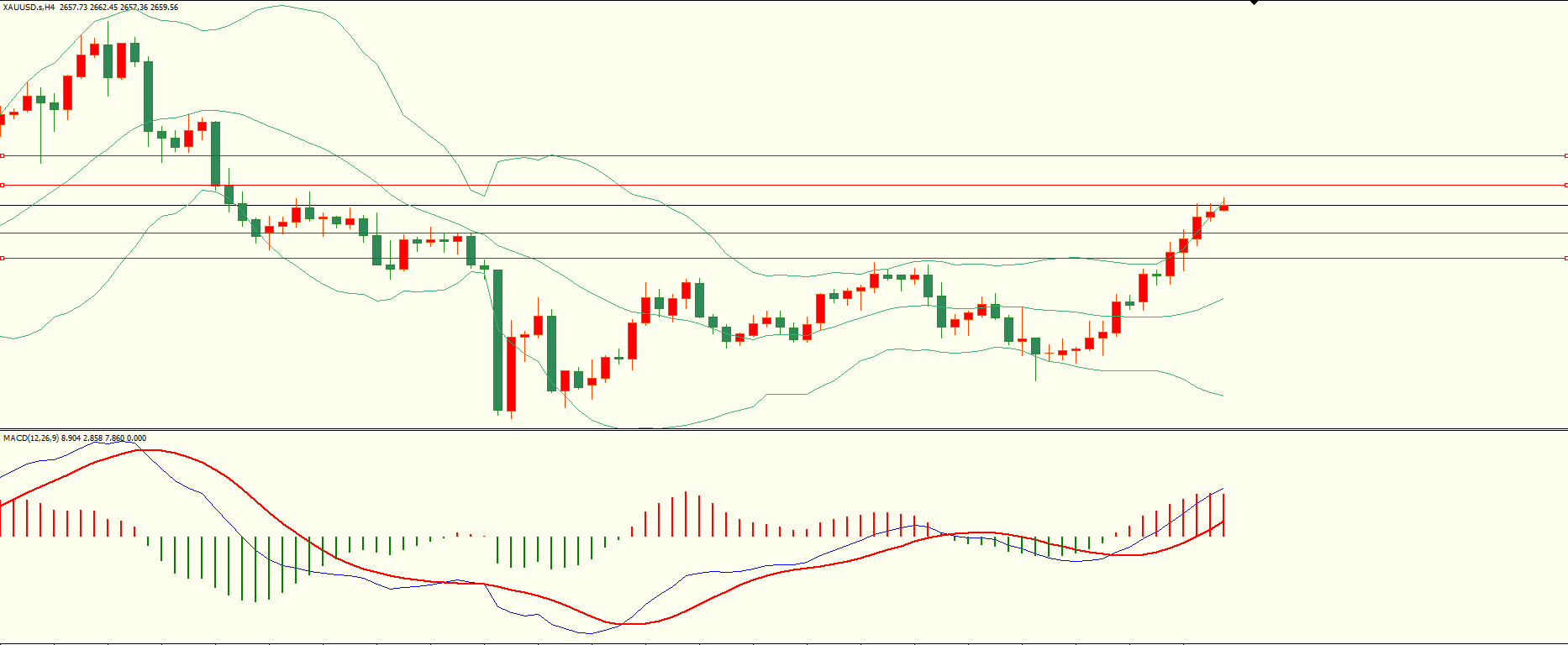

XAUUSD: Gold continued to rise after the Asian market opened yesterday, recovering its second resistance and expanding its gains. The daily chart closed at a medium positive line. From the close, it is currently close to the previous high-density pressure zone above. After breaking through, this round of rebound can continue. Combined with the 4H chart, the Bollinger Bands are above the middle limit, and MACD is running near the zero axis. The main support for the day is 2649-50, the second support is 2640, and the upper resistance is 2666-682677.79. The first support is expected to test the first resistance in the short term before it falls.

Crude oil: Yesterday's bulls remained strong, and the daily chart closed at the bullish line again. Short term bulls continue to dominate. From a 4H perspective, the Bollinger Bands are above the middle limit, and the MACD zero axis is running above it. The primary support for the day is 72.20, the second support is 71.50, and the upper resistance is 73.80-90, 74.60. Keeping above the first support, short-term resistance is expected to test the first resistance.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights