Gold, the four major events of this month remain the main theme of volatility

Gold continues to maintain its current wide range of volatility and washout. Note that it is a washout, and the purpose of washout is to wash away floating funds. Many people say that it is going to fall, it is going to fall sharply, and many people say that it is going to rise sharply and will not fall again. The market is just a vegetable market, and everyone's perspective is different. But 99% of the opinions are garbage and misleading information. The essence of washing the plate is to kill the trend plate. If you want to rise, you must kill those who follow the trend; if you want to fall, you must also kill those who follow the trend. That's the simple truth. To make a transaction, understanding and seeing clearly are the most important, guessing is worthless.

This month's four major events:

1: Non farm payroll data for this Friday

2: Trump's inaugural speech on January 21

3: January 24th Japanese Yen Interest Rate Resolution

4: January 30th Federal Reserve Rate Resolution

Gold is currently experiencing a large range of fluctuations, and in the short term, it is still difficult to break out of the range. This month, all the important data are available, but they are not enough to trigger a major one-sided market trend, whether in terms of time or space. It's still a large-scale intraday consolidation game. So, remember, in terms of operation, it is necessary to be conservative and cautious, and not to blindly carry or chase orders with heavy positions. The purpose of trading is profit, not to verify one's own strength, but the essence of trading is waiting. Space, profit, and cost-effectiveness are the only things we keep when entering the market, everything else is just floating clouds.

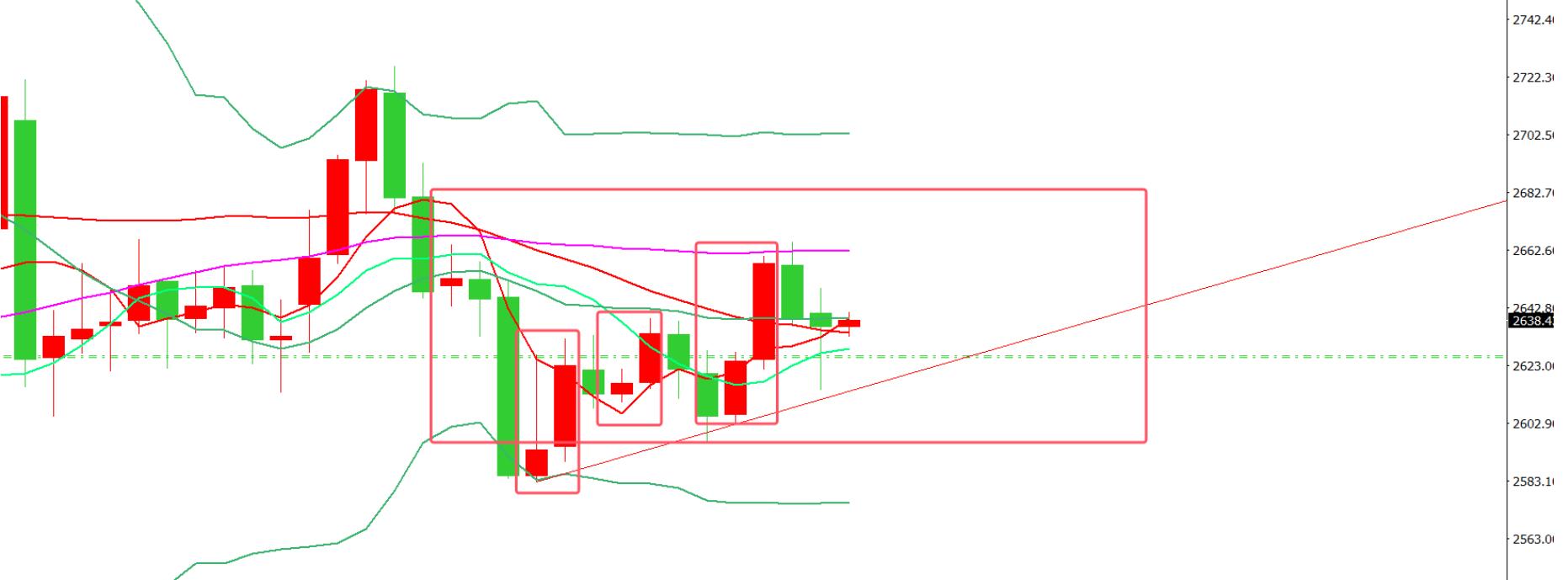

Gold was under continuous pressure from 2648-2650 yesterday before plummeting downwards, but it is difficult to generate a trend, and the essence is still a wash up. The volatility may seem significant, but in reality, it's all a situation where the knife edge licks blood, and neither dead long nor dead short positions work. After plummeting to around 2615 last night, it quickly drew back and closed above 2630. This trend is not weak, but rather a volatile pullback before reaching a high point.

At present, the daily chart level is showing a volatile upward trend, with a large amplitude of oscillation. The low point is raised and the high point is also broken, but it does not have continuity. The daily chart shows a cyclical trend of yin and yang, with a pattern of two yang and two yin, and this trend will continue. So, in terms of operation, stick to one direction instead of making one-way bets or chasing orders.

The decline last night has already completed the correction from the previous round of 2595 to 2665. The location of 2615 last night is the starting point of a new round of volatile rise, and the overnight closing was above 2630. Therefore, today's high probability is to use this as support for a volatile rise, or accelerate the rise again. This type of market cannot be defined solely by technical analysis, but by strength.

Short term intraday trading, with 2630 as the pivot point, buy low and buy long, with a focus on 2650 above. Once it breaks through 2650 again, there is a high probability that it will also break through 2665. Conversely, if 2650 is under pressure, the volatility may continue until Friday's non farm period. In recent market trends, only focus on short-term trading and avoid betting on unilateral breakthroughs.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights