Gold: resistant to decline!

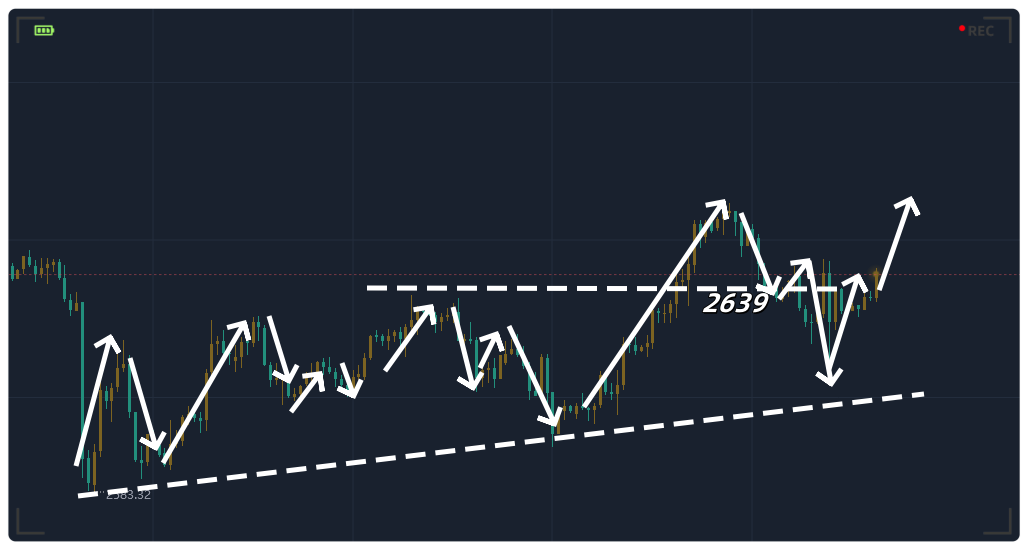

Today's morning market, the 2639 suppression level that we are focusing on has become a key factor in the market. This position serves as the top bottom transition level after yesterday's drop, and if it can be successfully held, there is a possibility of a price drop in the market; On the contrary, if the price breaks through this suppression, the downward trend will be hindered.

Yesterday evening, the price hit 2614 and then bottomed out and rebounded. It is worth noting that 2614 was supported at the bottom of the convergence triangle. Given this, if the Asian market price does not fall back, it is highly likely to directly initiate a rebound trend instead of a second dip.

Taking into account the short-term layout, there were originally two approaches: long after a retracement and long after a sideways resistance. However, the Asian market continues to show a sideways and resistance to decline, so we cannot continue to fall around the expectation of 2639. Instead, we need to adjust our operational strategy and go long and bullish in the European Review. At the current position of 2640, it is possible to consider entering the long position directly and further rebounding. Pay attention to the breaking situation of 2647. If you break through 2647, increase your position and go long. The goal is to break through the high point of 2665. However, it is necessary to closely monitor market changes, prevent potential pullback risks, set reasonable stop losses, and seize the profit opportunities brought by this rebound.

Special Reminder: The above views are for investment reference only. The risks in the investment market are unpredictable, so it is important to make cautious decisions when entering the market

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights