Non farm outlook: US December employment report expected to show slower hiring and stable unemployment rate

The US non farm payroll report for December is expected to show a slowdown in hiring in the last month of 2024, while the unemployment rate remains unchanged.

The monthly employment report from the US Bureau of Labor Statistics is scheduled to be released on Friday at 8:30 AM Eastern Time (9:30 PM Beijing Time). According to consensus estimates compiled by Bloomberg, economists expect non farm employment to increase by 165000 in December, while the unemployment rate remains stable at 4.2%.

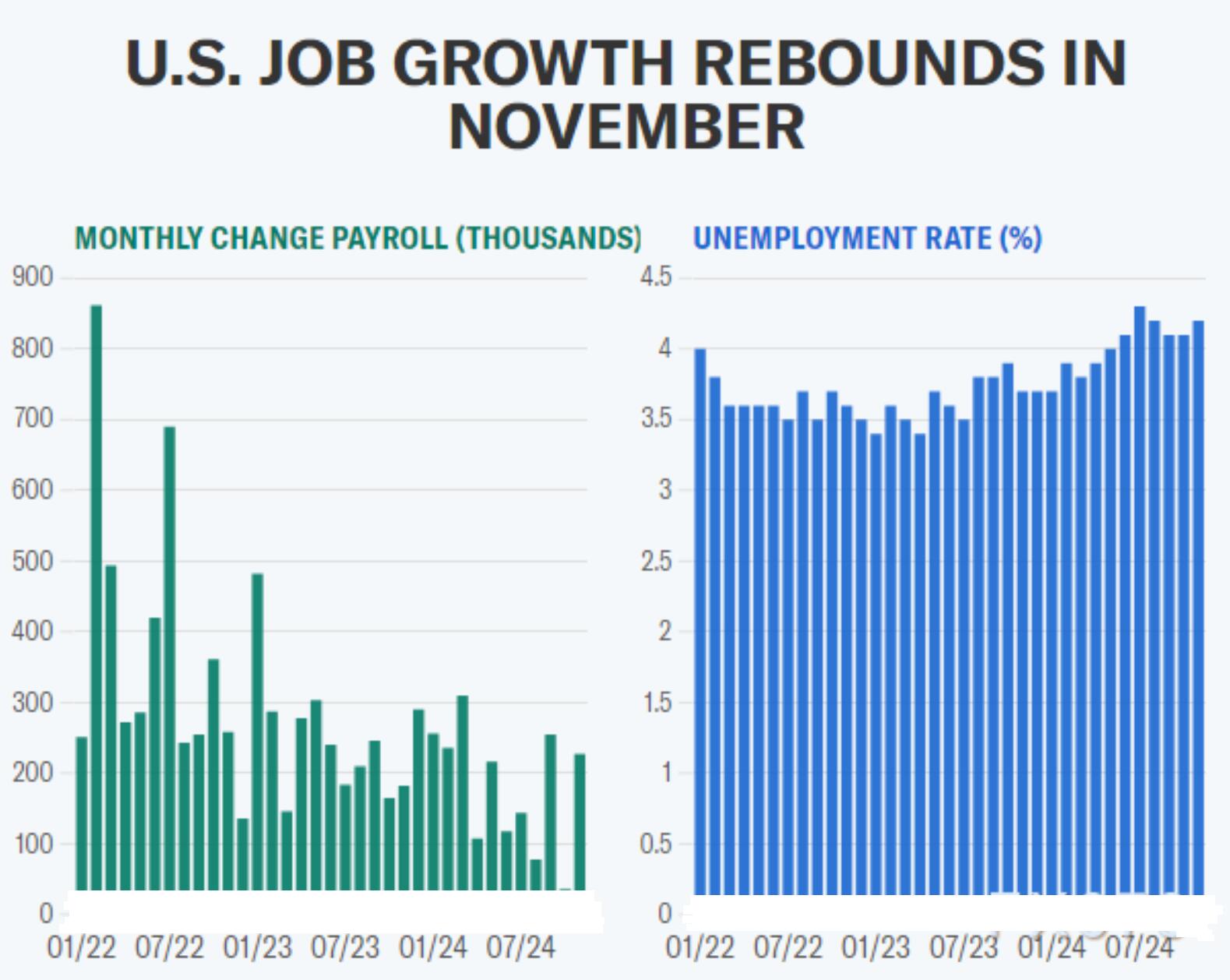

In November, the US economy only added 227000 jobs, and the labor market rebounded from several weather disturbances and worker strikes that affected previous reports. Meanwhile, the unemployment rate rose from 4.1% to 4.2% in November.

In a report to clients, Shruti Mishra, an economist at Bank of America Securities, wrote, "We believe that employment growth in December will be much slower than the 227000 jobs growth in November, as the latter includes compensation for the damage caused by the hurricane in October, particularly in the manufacturing industry. Investors should also pay attention to revisions, as the response rate has been low and revisions have been significant in recent months

Due to investors' expectation that the likelihood of the Federal Reserve cutting interest rates at its January meeting is only 5%, Mishra believes that a report consistent with consensus "will finalize" the agreement for the Fed to suspend interest rate cuts.

According to Bloomberg data, the following are the expected median and leading values of key data that Wall Street will focus on on on Friday:

Non farm employment in November: expected+165000 vs previous value+227000

Unemployment rate: expected 4.2% vs previous value of 4.2%

Average hourly income, expected month on month:+ 0.3% vs previous value+0.4%

Average hourly income, expected year-on-year:+ 4% vs previous value+4%

Average weekly working hours: expected 34.3 hours vs previous value of 34.3 hours

(Overview of Non farm Performance in the Past Three Years, Non farm Employment Rebound in November)

Recent data shows that the labor market is slowing down, but not rapidly deteriorating as layoffs remain low.

The new data released by the US Bureau of Labor Statistics on Tuesday (January 7) shows that there were 8.1 million job vacancies at the end of November, an increase from 7.84 million in October and the highest level of job vacancies since May 2023.

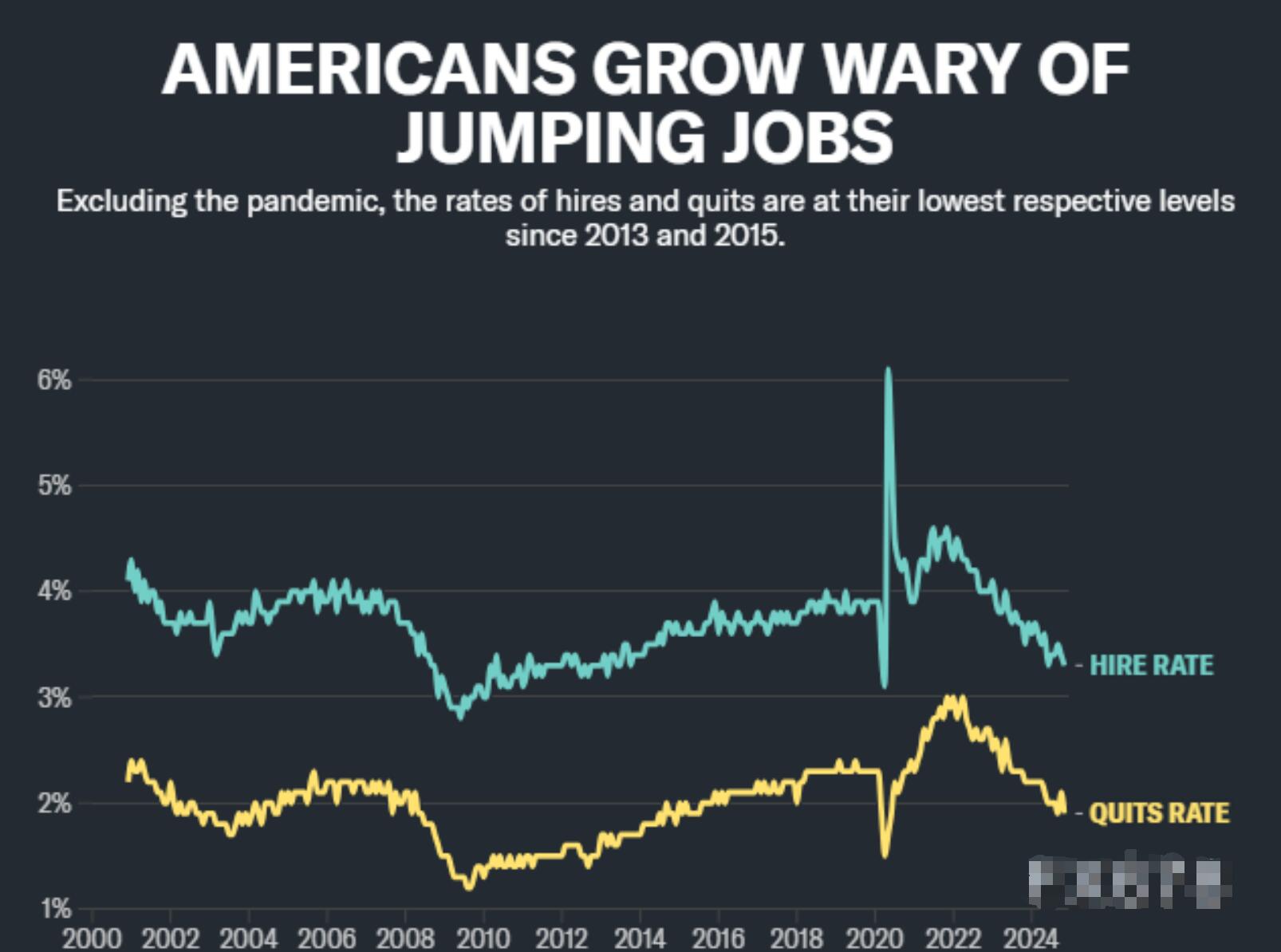

But there are also signs of cooling in the report. The Job Openness and Labor Mobility Survey (JOLTS) also showed that the recruitment rate dropped from 3.4% in October to 3.3%. The resignation rate, a sign of worker confidence, decreased from 2.1% in October to 1.9%.

(List of Historical Performance of Recruitment and Resignation Rates)

On Wednesday, January 8th, ADP released data showing that there were 122000 new private jobs added in December, lower than the 146000 in November.

ADP Chief Economist Nela Richardson said, "The job market still doesn't have much room for maneuver because it's almost in a quiet period." "Liquidity is not high. Therefore, if you're a job seeker, it's difficult to find this vacant position

Overall, the Federal Reserve reiterates that it will not seek further cooling of the labor market to achieve its goal of reducing price increases.

On December 18th, Federal Reserve Chairman Jerome Powell stated, "We believe that the labor market does not need further cooling to bring inflation down to 2%

In view of the recent surge in the yield of the US 10-year treasury bond bond to nearly 4.7%, which has put pressure on the stock market in the recent trading day, a key debate among investors is how the data will affect interest rates and whether the market will actively accept strong data on Friday.

Bank of America strategists believe that the economic data market has returned to the "good news is bad news" stage, and the strong employment report pushing up interest rates may put pressure on the stock market on Friday.

But from a longer-term perspective, Michael Aron of State Street Global Advisors believes that if Friday's employment report is strong and indicates a smaller rate cut by the Federal Reserve, investors need not worry.

As long as the economy is growing and profits are increasing, I believe we can continue to rise, "said Aron." I hope the market can accept this view. We will see if they will do so in the coming days and weeks.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights