The key position of EUR/USD has stopped rising as scheduled, and the breakthrough of daily resistance will accelerate in the future

Last Friday, the December non farm payroll data released by the United States showed strong performance, with 256000 new jobs added and the unemployment rate dropping to 4.1%, far exceeding expectations. This data boosted the yield of the US dollar and US treasury bond bonds. The US dollar index once rose to 110.17, the highest point since November 2022. However, it fell back to 109.59. The strong employment data weakened the market's expectation of the US Federal Reserve's interest rate cut. The interest rate futures market expects only a 27 basis points cut in interest rates this year, most likely in September or October. Next week, Trump will take office as the President of the United States, and his advocated tariff policies are expected to stimulate inflation and even trigger a trade war, increasing the attractiveness of gold as a safe haven asset. Trump's economic team is exploring a plan to slightly increase tariffs on a monthly basis to increase bargaining power and avoid a sharp rise in inflation. The yield of the US 10-year treasury bond bond rose to a 14 month high. The market questioned the interest rate level of the Federal Reserve's policy. Investors are expected to continue to sell US treasury bond bonds before Trump's policy becomes clear. In terms of geopolitics, progress has been made in the peace negotiations of the Gaza War. The mediator submitted a draft agreement on ceasefire and hostage release to Israel and Hamas, with the participation of envoys from the United States, Qatar, and Egypt. Trump's inauguration is seen as a crucial deadline for reaching an agreement. In addition, the conflict between Russia-Ukraine conflict continued, and the six EU countries called for lowering the ceiling of oil prices to Russia to reduce Russian war funds. Overall, the market is facing multiple intertwined factors, with the demand for gold as a safe haven asset supported by geopolitical risks and trade policy uncertainty, while US economic data and Federal Reserve policy direction will continue to dominate market sentiment.

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed a downward trend on Monday. The highest price of the day rose to 110.155, the lowest was 109.565, and closed at 109.579. Looking back at the performance of the US dollar index on Monday, after the morning opening, the price first fluctuated and rose in the short term, then rose and fell during the European session, and then fell all the way to the closing, finally ending with a bearish daily chart. At present, the weekly support of the US Composite Index is in the 106.70 area, the daily support is in the 108.80 area, and the 4-hour resistance is in the 109.70-80 range. Currently, the focus is on the pressure in this area, and the support in the 109.20-108.80 area is below.

The US index focuses on short selling in the 109.70-80 range, defending against $5 and targeting 109.20-108.80

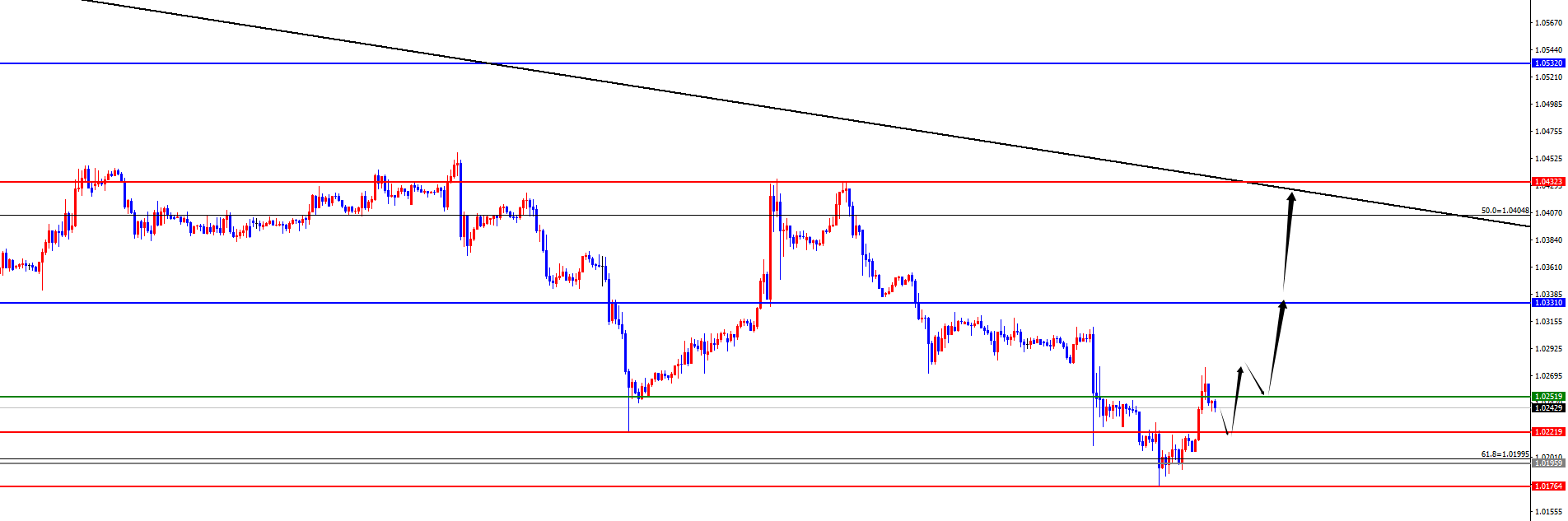

In terms of EURUSD, the overall price of EURUSD showed a fluctuating and bottoming out trend on Monday. The lowest price of the day fell to 1.0177, the highest rose to 1.0249, and closed at 1.0244. Looking back at the market performance on Monday, the price continued to fluctuate and fall in the short term during the morning session. Subsequently, we tested the European market price at the 618 level, where we emphasized a large cycle pullback yesterday. At the same time, the price broke through and rose again in the US session, indicating that this level of support is effective. We need to pay attention to further price increases in the future. However, after breaking through the resistance level of 1.0330 on the daily line above, we will exert force. Therefore, we can continue to lay low and long positions in the future and see if we break through and stabilize. Once it breaks, the band will see an increase. Follow yesterday's low support to see the band rise. If it is strong in the future, it is necessary to pay attention to whether it can operate in a long-term long position.

Buy long in the EURUSD 1.0210-20 range, defend 1.0170, target 1.0290-1.0330

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights