The daily support of the US index is waiting to fall below, and the suspense of EUR/USD breaking through remains to be resolved

On Thursday, there were frequent developments in the US economy and geopolitical situation. In terms of economic data, as of the week of January 11, the number of initial claims for unemployment benefits had increased to 217000, exceeding expectations, indicating that the labor market has weakened, the yield of US treasury bond bonds has declined, and gold has become more attractive. Retail sales increased by 0.4% month on month in December, and the growth rate in November was revised up to 0.8%. Import prices slightly increased, and the inflation outlook is moderate. Influenced by this and Fed Waller's comments, the market's expectation of the Fed's interest rate cut has risen, the yield of 10-year treasury bond bonds has declined, and the dollar index has declined. However, the Philadelphia Fed's manufacturing index jumped in January, or it may be an abnormal reading. Geopolitically, with the mediation of the United States and Qatar, Israel and Hamas reached a ceasefire agreement in Gaza on Wednesday, which came into effect on Sunday. But the progress of the agreement was hindered, with Israel delaying its approval due to internal differences, and Israeli troops attacking Gaza, with each side holding their own views. Hamas stated that it is still committed to the agreement, and US officials said that all parties are coordinating to resolve the prisoner identity dispute. In addition, the market is paying attention to Trump's inauguration and policy impact, and multiple economic data should also be monitored this trading day.

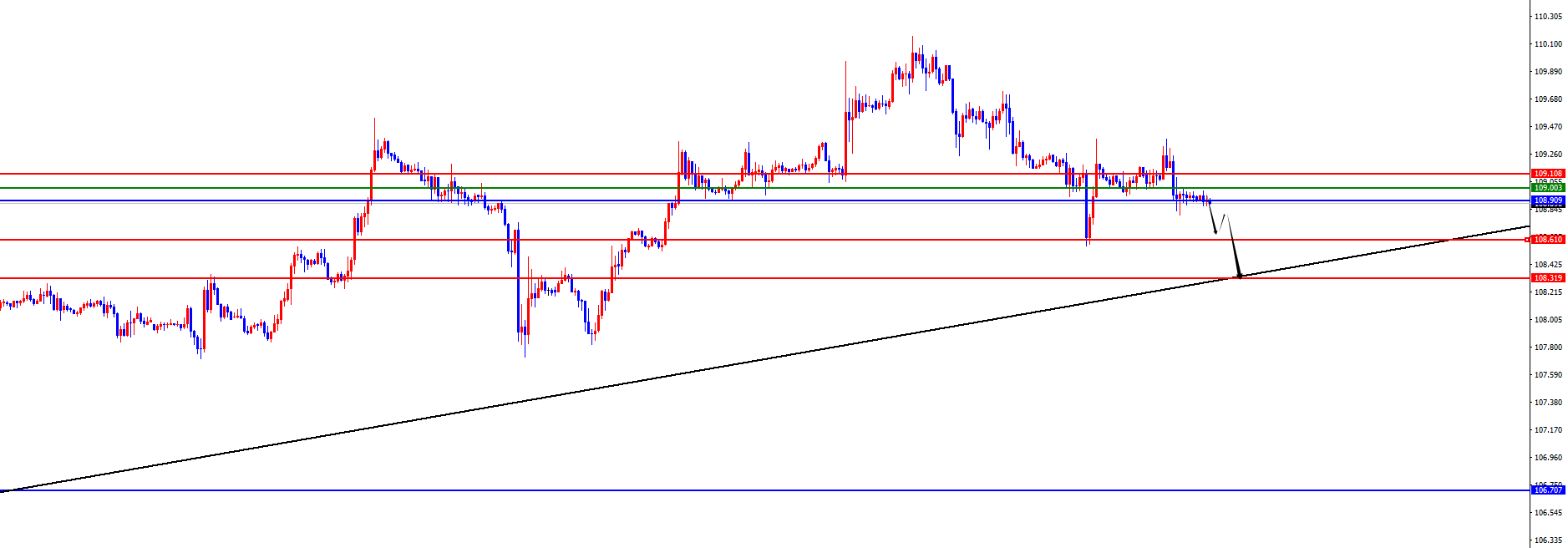

US dollar index

In terms of the US dollar index, the overall price of the US dollar index showed a downward trend on Thursday. The highest price of the day rose to 109.378, the lowest was 108.798, and closed at 108.936. Looking back at the performance of the US dollar index on Thursday, after the morning opening, the price first fluctuated upwards in the short term, and then suppressed at the high point on Wednesday. The time point was in the US market, and then the US market price fell under pressure, and finally the daily bearish trend ended. At present, the weekly support of the US Composite Index is in the 106.70 range, and the price is above this level with a bullish trend towards the center line. At the daily level, we are currently focusing on the support of the 108.90 area, as the gains and losses at this position determine the key trend of the US index band. At the same time, for the four hour level, temporarily focus on the resistance in the 109-109.10 area. If it does not break yesterday's high in the future, continue to look for pressure. Below, focus on the 108.60-108.30 area, with a particular emphasis on the gains and losses of support in the 108.30 area of the trend line.

Short selling in the 109.00-10 range of the US Composite Index, defending against $5, targeting 108.60-108.30

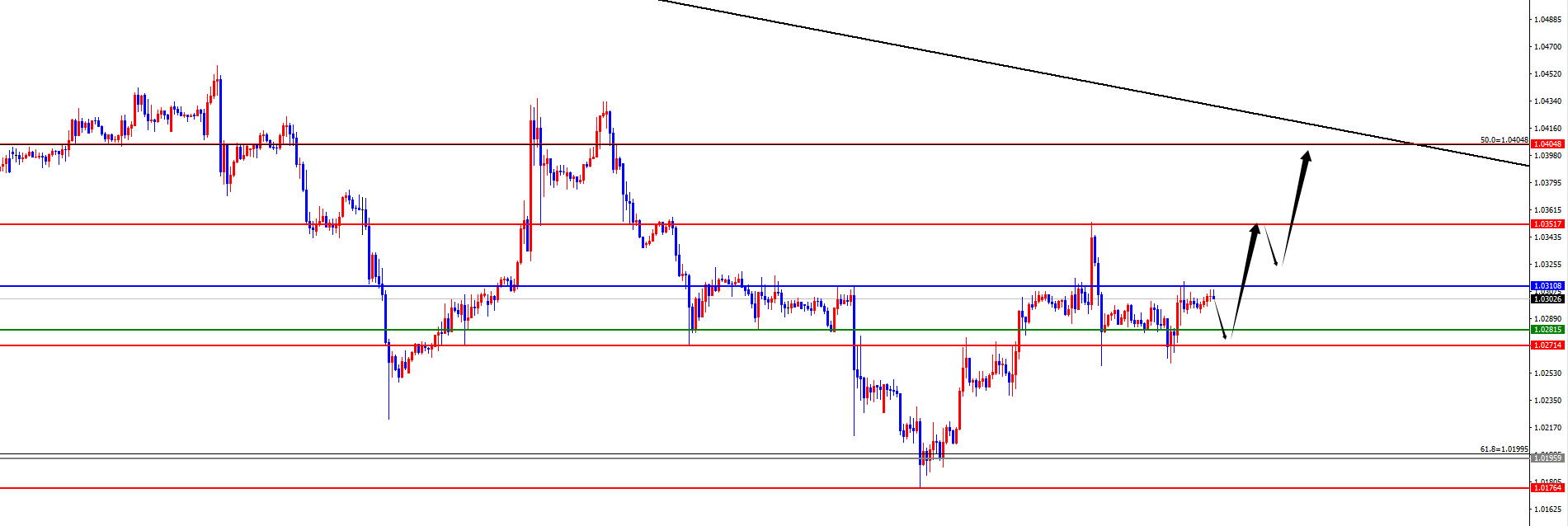

In terms of EUR/USD, European and American prices showed an overall upward trend on Thursday. The lowest price of the day fell to 1.0260, the highest rose to 1.0314, and closed at 1.0294. Looking back at the performance of the EURUSD market on Thursday, the price fluctuated in the short term during the morning session. During the European session, it broke through the four hour support but did not fall below the previous day's low point. At the same time, the price rose again after the US session, and finally ended the bullish trend. Overall, the daily resistance is at the 1.0310 area resistance, and the price will continue to rise after stabilizing. Once stabilized, there is a possibility of a band rise, so the focus will be on it in the future.

Buy long in the EUR/USD 1.0270-80 range, defend 40 points, target 1.0310-1.0350-1.0400

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights