A large amount of gold suddenly poured into the US market! Rare shortage of London gold bars

Due to concerns about tariffs imposed by President Donald Trump's administration, traders hoarded $82 billion worth of gold in New York, leading to a surge in gold shipments to the United States and a shortage of gold bars in London. According to informed sources, the waiting time for extracting gold bars stored in the Bank of England vault has increased from a few days to 4 to 8 weeks due to the Bank of England's difficulty in meeting demand.

The Financial Times quoted an industry executive as saying, "People cannot buy gold because too much gold is being shipped to New York and the rest is being queued up. Liquidity in the London market has weakened

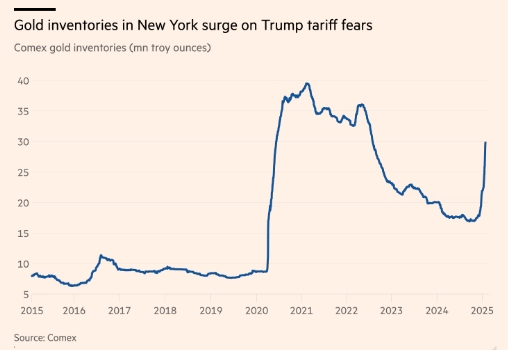

Since the November US election, gold traders and financial institutions have transferred 393 tons of gold to the vaults of the COMEX Commodity Exchange in New York, causing inventory levels to rise nearly 75% to 926 tons, the highest level since August 2022.

Market participants indicate that the total amount of gold flowing into the United States may be much higher than the data from the New York Mercantile Exchange, as there may be additional gold being shipped to HSBC and JPMorgan's private vaults in New York.

Traders say that this batch of goods is intended to avoid the possibility of US President Donald Trump imposing tariffs on gold. Some people are concerned that US President Trump may impose tariffs on gold.

Michael Haig, head of commodity research at Societe Generale, said, "People feel that Trump may impose new tariffs on raw materials imported into the United States, including gold. Participants in the gold market are a bit eager to protect themselves

This shipment is also due to the fact that the gold price on the New York Futures Exchange is higher than that on the London spot market, which is an unusual arbitrage opportunity that prompted traders to transport gold across the Atlantic.

Trump has not yet clarified his trade policy and has not specifically mentioned imposing tariffs on gold bars, although he has threatened to impose widespread tariffs on American imports.

London and New York are the two major trading markets in the world, with the majority of physical trading taking place in the UK and futures markets in the US.

Many market participants compared the current gold rush in the United States with the situation during the COVID-19. At that time, the uncertainty of blockade and gold transportation triggered a surge in gold stocks in the New York Mercantile Exchange.

The Bank of England stores gold with third parties such as financial institutions, other central banks, and the UK Treasury. The bank's president Andrew Bailey downplayed the importance of extending the waiting time for withdrawing gold from the vault.

London remains the world's major gold market, and if you participate in this market and wish to trade or use gold, you really need to own it in London, "he said on Wednesday (January 29) in response to questions from the parliamentary finance committee.

This month, gold inventory on the New York Mercantile Exchange surged by 36%, with an inflow of 244 tons, the highest monthly inflow since the peak of the pandemic in May 2020. Traders say they need gold to fulfill certain futures contracts that allow buyers to physically deliver gold.

Joe Cavatoni, market strategist at the World Gold Council, said, "Gold needs to be shipped to New York, which is basically the factor driving 'hoarding'. This has led many people to say 'we want to seize the opportunity', causing a premium in the futures market

However, Cavattoni expressed cautious optimism that the upcoming tariffs are unlikely to apply to gold. We don't feel from the government's statements that it intends to target currency metals, "he said.

Last week, the premium of the June physical gold contract on the New York Mercantile Exchange was $60 per ounce higher than the London price. As traders transferred gold to New York, the price difference has fallen back to $10 per ounce.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights