Under the US tariff policy, the pound may become a winner!

This week, global markets experienced new volatility as US President Trump confirmed plans to impose tariffs on imported goods from major trading partners. However, Trump announced on Monday (February 3) that he has decided to suspend the 25% tariffs on Mexico and Canada for 30 days.

Trump also mentioned that the possibility of imposing tariffs on European economies is increasing. Trump said last Sunday that tariffs on the European Union "will definitely happen," but he also mentioned that trade issues with the UK "can be resolved through negotiations. Trump pointed out that although he believes the UK is somewhat off track on trade issues, he has a good relationship with UK Prime Minister Kiel Stamer and is confident in reaching an agreement.

According to The Guardian, Stamer stated this week that he has discussed trade issues with Trump and made it clear that he will not take sides between the US and Europe. And UK Chancellor of the Exchequer Rachel Reeves stated last month that the UK is not the problem with the trade deficit issue that Trump is seeking to correct.

According to official data, in the fiscal year ending in September 2024, the United States is the UK's largest trading partner, accounting for over 17% of the UK's total trade volume. Although there may be a slight surplus or deficit in the trade balance between the two countries, Trump's focus is on the relative balance of their trade relationship. Trump is very sensitive to the trade deficit between the United States and other countries, especially when the US exports more than it imports.

Faced with the challenges facing the UK economy, Reeves stated last month that she is "fighting every day to promote economic growth," and some analysts believe that the UK economy may receive some boost from Trump's trade policies. Although Trump's tariff policy may have some impact on the UK economy, the impact may be milder than expected.

Analyst interpretation:

The UK economy is dominated by the service sector, especially the financial services and insurance industries, which limits its potential direct impact compared to other countries that are heavily affected by tariffs. Professor Irina Surdu Nardra from Warwick Business School pointed out that although the UK may be affected by tariffs, the overall impact will be relatively small due to its service economy characteristics.

She said, "In fact, the impact of tariffs on the UK market may mainly be concentrated in industries such as fisheries and mining. Tariffs are particularly detrimental to industries with complex supply chains, which often involve multiple cross-border flows of goods to convert raw materials into final goods. However, the main economic sectors in the UK, such as finance and consulting services, are precisely the industries with less of this situation

The UK's five major commodity exports to the United States include automobiles, pharmaceuticals and pharmaceutical products, mechanical power generators, scientific instruments, and aircraft, with a total value of £ 25.6 billion ($31.8 billion). However, compared to the export of these goods, the largest service exports in the UK, such as financial services and insurance, are more important, with a total value of 109.6 billion pounds.

Professor Neri Kara Hiraman from Oxford University said that if the UK could avoid tariffs, it could become an ideal target for attracting investment, talent, and new trading partners. She said, "If the UK maintains a zero tariff status, it may have a unique advantage in attracting foreign investment and business opportunities. Tariffs encourage businesses to seek lower cost trade centers, and the UK can be their first choice to attract investment and business opportunities by bypassing tariff restrictions

Hiraman also mentioned that in areas such as luxury goods, fashion, pharmaceuticals, and advanced manufacturing, the UK already has advantages and may benefit from more investment and trade opportunities. In addition, industries such as automotive, aerospace, and finance may also gain more demand as American buyers seek to avoid the impact of tariffs.

Potential safe haven

Former forex trader Alex King said that Trump's trade policies may provide some economic relief for the UK. The pound may become a potential winner: after Trump first confirmed tariffs last week, the pound showed an upward trend against the euro, Canadian dollar, Australian dollar, and New Zealand dollar. He believes that this indicates that the global market may see the UK as a potential safe haven.

He said, "In the end, the UK may be one of the few major economies that can enjoy relatively zero tariff treatment, which makes it and the pound both likely winners

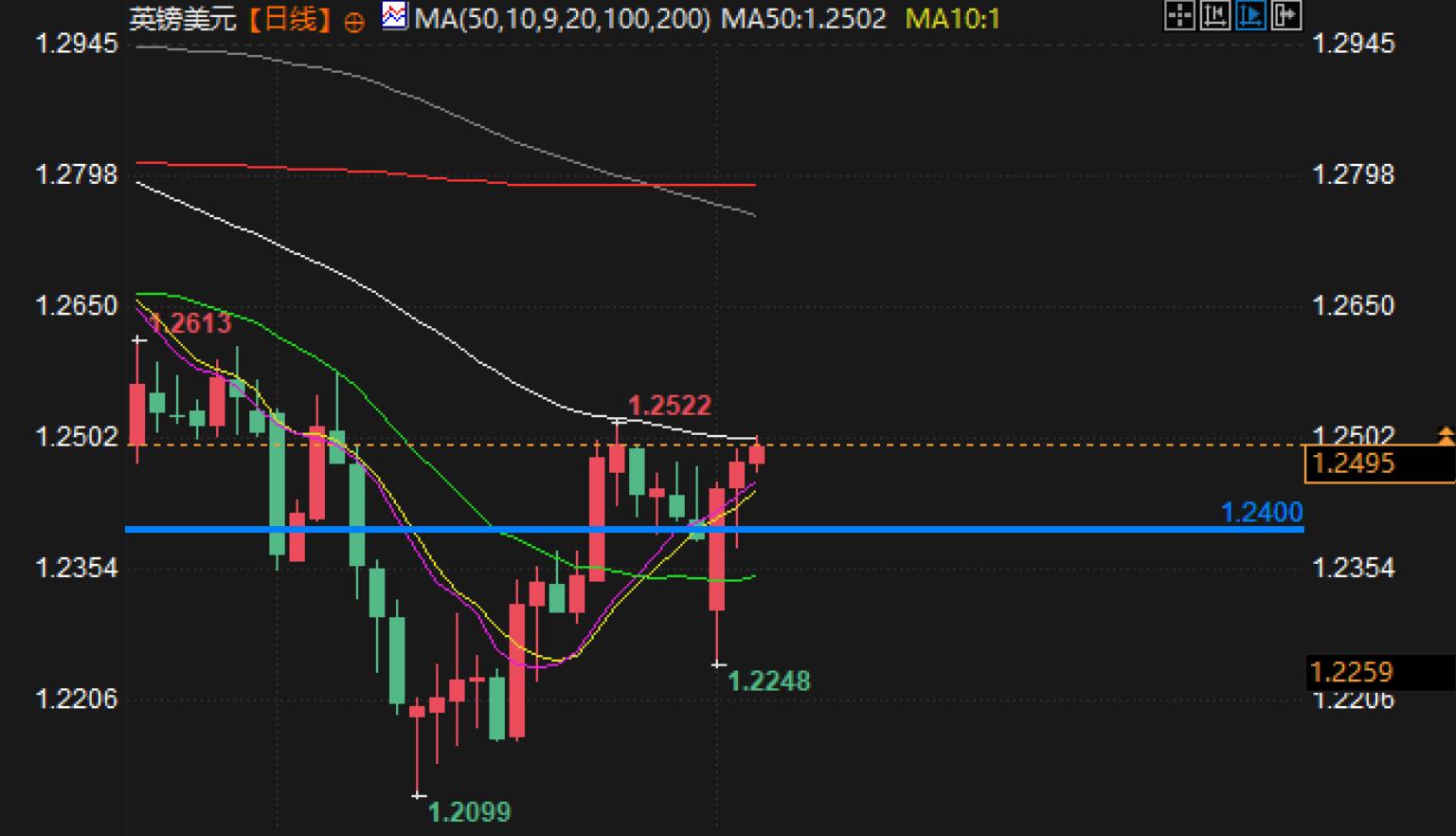

GBP/USD daily chart

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights