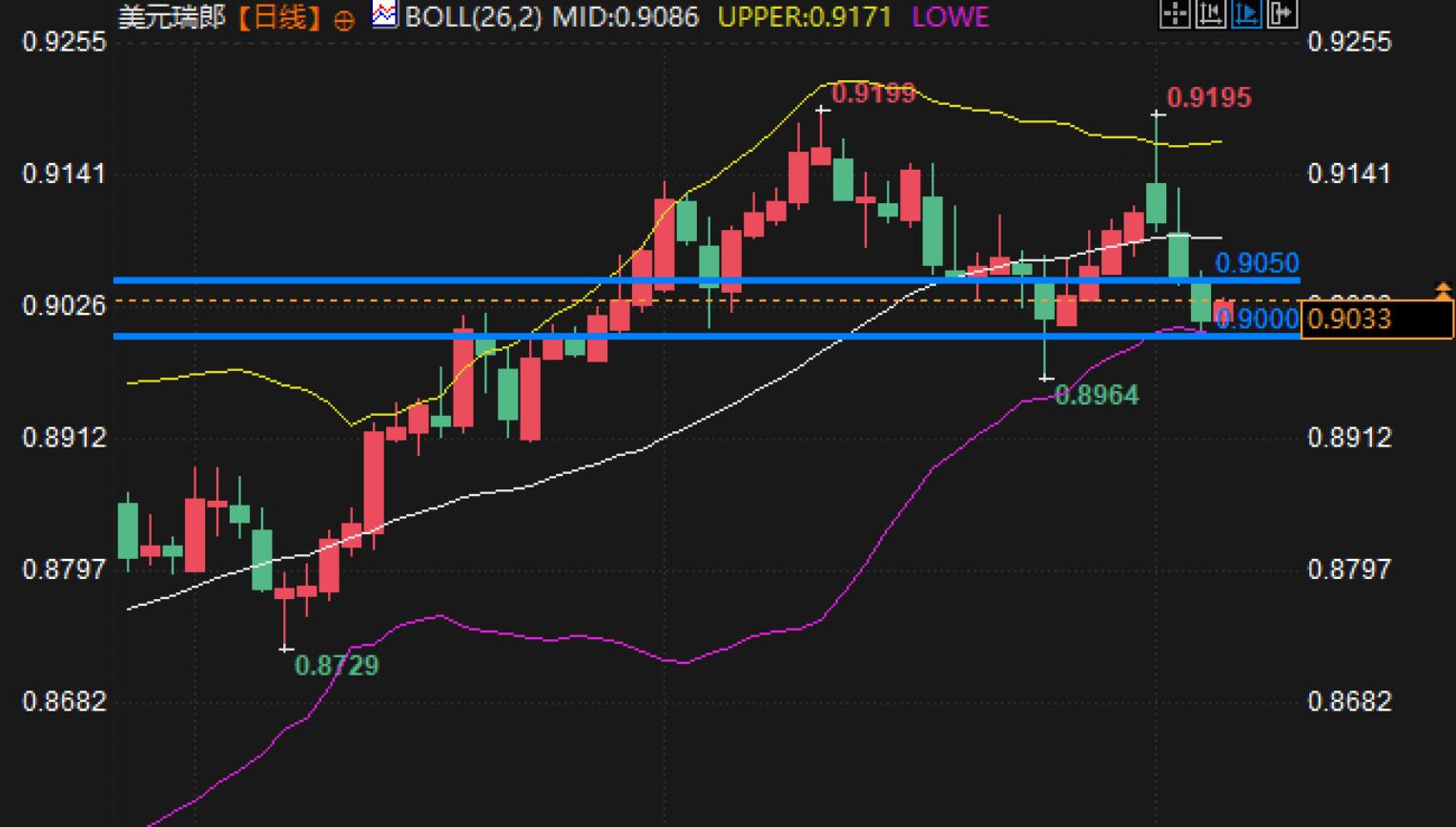

Foreign exchange trading analysis: Will USD/CHF break below 0.9?

Before the European market on Thursday (February 6th), the US dollar/Swiss franc fluctuated above the key psychological level of 0.9000, attracting some bargain hunters, ending the three-day decline and gradually recovering from a one week low. However, analysts believe that the sharp correction that began around 0.9200 this week has not yet fully ended.

The US dollar has recently experienced a slight rebound, ending its previous trend of falling to a one week low. However, analysts believe that despite the rebound of the US dollar, its overall upward momentum is still limited, mainly due to the market's expectation of further easing of monetary policy by the Federal Reserve. The market generally expects that the Federal Reserve may cut interest rates multiple times this year, which to some extent suppresses the upward potential of the US dollar.

Meanwhile, as a traditional safe haven currency, the Swiss franc's performance is influenced by global market sentiment. The safe haven buying of the Swiss franc has decreased, providing some support for the USD/CHF exchange rate. However, the cautious sentiment in the market still exists, especially concerns about US trade policies, which may limit the decline of the exchange rate.

At present, the market has very strong expectations for the Federal Reserve to cut interest rates, and it is expected that the Fed will cut interest rates at least twice this year. This expectation was further strengthened after the release of the US ISM Services PMI data in January. Data shows that the US ISM services PMI for January fell from 53.9 last month to 52.8, lower than market expectations, reflecting a slowdown in service industry activity. Despite the strong performance of ADP private employment data in the same month, which added 183000 jobs, higher than the revised 176000 last month, this positive news has not completely offset the negative impact of ISM service PMI data, and market concerns about the US economic outlook have not completely dissipated.

Technical analyst interpretation:

From a technical perspective, the USD/CHF is currently fluctuating around the psychological level of 0.9000, which is both a support level and a focus of market attention. Recently, the exchange rate has stabilized around this level, attracting some buying interest and ending the previous three-day decline.

1. Price trend

Currently, the US dollar/Swiss franc is fluctuating around 0.9030, and at the daily level, the exchange rate has formed a strong support around 0.9000. However, whether this support level can be sustained still depends on the subsequent price trend. If the exchange rate can successfully reach 0.9050, it may further challenge the 0.9100 region; On the contrary, if the price falls below 0.9000 again, it may trigger another market sell-off and push the exchange rate back to a lower level.

2. Technical indicator analysis

From a technical perspective, the RSI (Relative Strength Index) is currently in the neutral zone, at around 48, indicating a lack of clear direction in the market in the short term. The MACD indicator shows that the distance between the fast and slow lines is relatively small, indicating weak market momentum. In addition, the Bollinger Bands indicator shows that prices have recently fluctuated around the middle band of the Bollinger Bands, with a decrease in volatility, indicating that the market is currently in a relatively calm state.

3. Key support and resistance levels

For USD/CHF, 0.9000 is an important psychological barrier and also a strong support. If the exchange rate can successfully stabilize above 0.9000, it may attract more buying interest and drive the exchange rate further upward; On the contrary, if the price falls below 0.9000, it may trigger further market selling and push the exchange rate back to a lower level.

In addition, 0.9050 is also an important resistance level, and if the exchange rate can break through this level, it may further challenge 0.9100. On the other hand, 0.8950 is also a key support level, and if the exchange rate falls below this level, it may trigger panic selling in the market, pushing the exchange rate further down.

summary

In summary, the current trend of USD/CHF is influenced by both fundamental and technical factors. Although the exchange rate has stabilized around 0.9000, attracting some buying interest, market expectations of the Federal Reserve's interest rate cuts and concerns about the global economic outlook have to some extent suppressed its upward potential. From a technical perspective, 0.9000 is an important support level, and if the exchange rate can remain above this level, it may push it further upward; On the contrary, it may trigger further market selling.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights