High correction, gold prices are expected to fall and undergo pre adjustment!

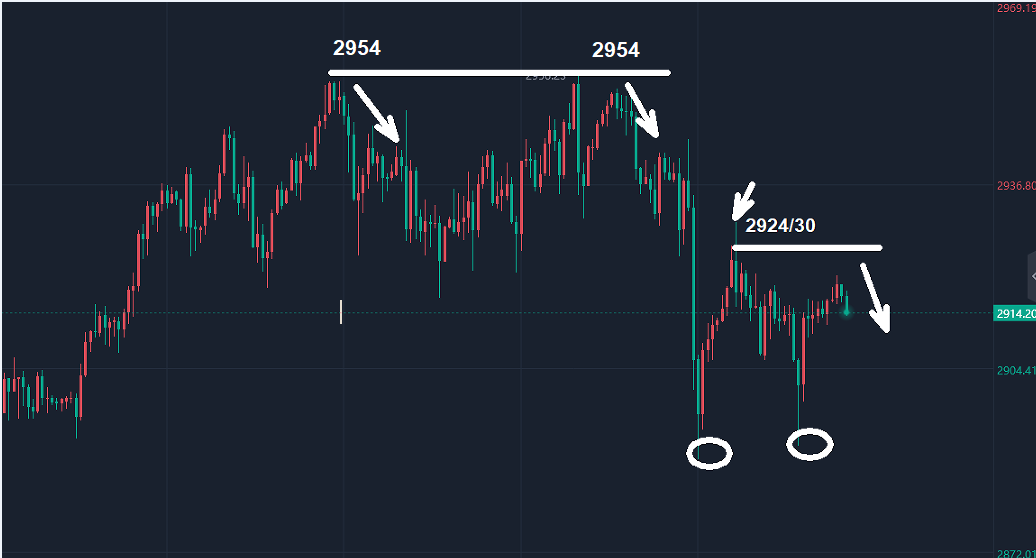

Market review: After the correction of the high level of gold this week, a bearish closing line appeared, and the strong sentiment of the daily bullish trend was broken. Under the influence of the market's fear of high prices, the short-term high level experienced stagflation, and the strength and heat of the rebound only increased without decreasing. While the trend structure has not undergone substantial changes, attention should also be paid to small short-term declines.

The intraday trend structure has not formed a strong and sustained upward trend, and the market's bullish sentiment towards gold rising to the 3000 integer level is still valid. However, a short-term pullback is bound to pour cold water on friends who are bullish on the gold trend, and friends who are bullish on bears and speculate on the top should not be blindly optimistic. A short-term pullback does not mean the end of the bulls, and it is difficult to achieve a situation without losses when blindly guessing the top and then the market rises.

So, in the current market trend, we focus on the demand for retracement at high points, followed by the continuity of the increase. It is not the fear of high prices at high points that is also a reason for short selling, and long positions will change immediately. If the retracement does not leave a large space, the directional structure of the trend increase will still dominate, and the subjective direction of the main and secondary market trends will not change. Therefore, the secondary market trends are also short-term and will not form strong continuity.

The hourly double shadow line dips downwards, while the short-term high line shows a trend with more bearish lines, forming a more obvious pullback and downward trend. The strong market did not continue, but after reaching a high point, the pullback became an important obstacle to short-term gains. In the second half of this week, the high level correction reversed back and forth. The bulls failed to continue, and the downward force of the decline was not significant enough, resulting in a short-term high-level oscillation correction.

From a short-term perspective, the continuity of the morning rebound and rise in these two trading days is not good. After each morning surge, there is pressure to fall back, and after today's surge, there may be pressure again. Let's create a time loop here. In the morning, focus on the 2920 suppression and then observe the decline. After backtesting, focus on the 2906 and 2896 support below. After stepping back, it is still more dominant, but it needs to be tested again before intervening. At the same time, it should be noted that if the backtesting range of the Asian market is limited, adjustments will be made for the temporary market at that time!

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights