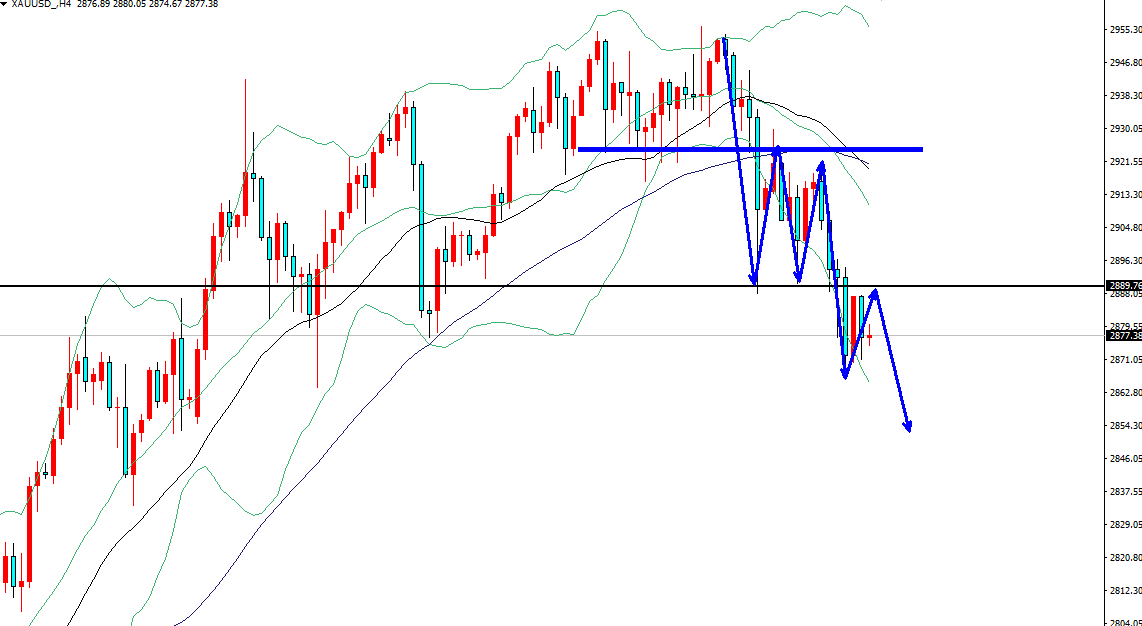

Gold falls below the top neckline, the decline has just begun

Gold has been continuously falling, with a top signal indicating a drop below the important top neck level of 2888, opening up downward space. Calculated based on the amplitude of the top oscillation, gold will fall another $70. Are all fans ready? Since everyone knows it's a bearish trend, what point is better to short?

Let me talk about the current market situation. The gold price has been running below the moving average, which is a weak market. If there is no obvious bullish trend, then we should stick to the bearish trend. Moreover, the price of gold in the 4-hour cycle is getting lower and lower with each wave, and the daily cycle has even fallen below the 5-day moving average. Isn't this a bearish signal?

The price of gold is getting lower and lower with each wave, and the K-line shows the latest pressure level at 2890. From the perspective of the top shape, the top neckline has been broken and has shifted from support to suppression, with a price range of around 2890. From the perspective of technical resonance, the best position would be to release the air under 2890 pressure.

So will you follow this order?

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights