The gold market continues to fluctuate, and the strategy of selling high and buying low remains unchanged!

The volatility of the gold market remains unchanged, with no tendency to break through the high and low points. Even with favorable non farm payroll data and unemployment rates last Friday, gold only rebounded by a little over a dozen dollars before quickly falling to the bottom support line of 1895! In recent months, the performance of the data market has been basically the same, which also indicates that there is a serious decoupling between the current gold market and data. Only interest rate decisions can slightly change the direction of the market! Faced with the current pattern and trend of gold, we can only continue to focus on fluctuations!

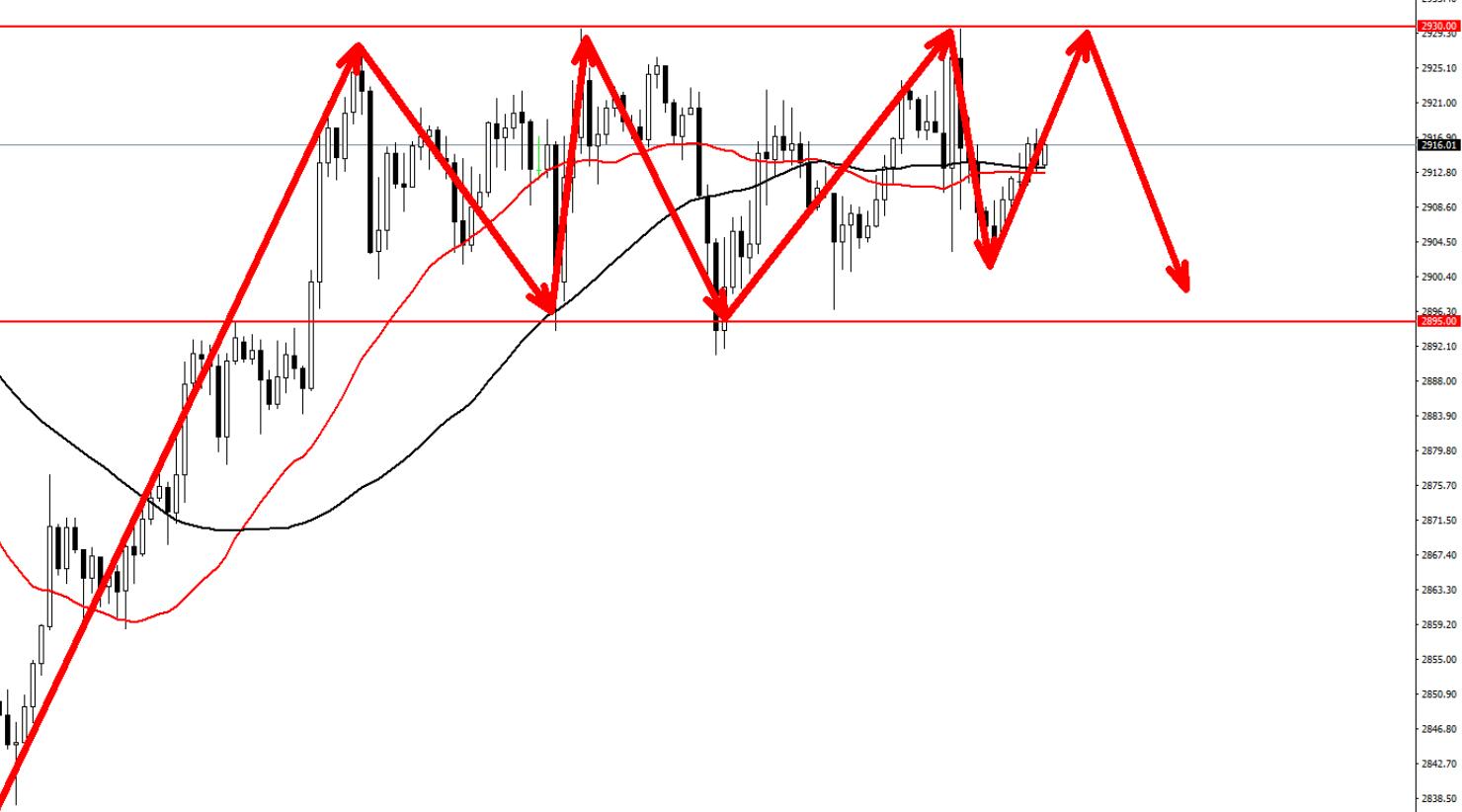

In the morning session, the gold price continued the trend of non farm market rebound. There were only two operating points in the morning session. One was to wait for the gold price to continue to rise and reach the 2930 range pressure to empty, and the other was to wait for the gold price to adjust and reach around 2900 in the morning session to go long. However, for the rebound market, it is expected to first reach the 2930 line pressure above, which gives us more opportunities to short than to go long. At present, the gold price is in the middle of the range, so we should maintain a wait-and-see attitude for now!

Specific strategies

Short selling gold 2930, stop loss 2938. Target 2900;

Disclaimer: The above suggestions are for reference only. Investment carries risks, and operations should be handled with caution

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights