Gold has no upper limit, is 3100 still far away?

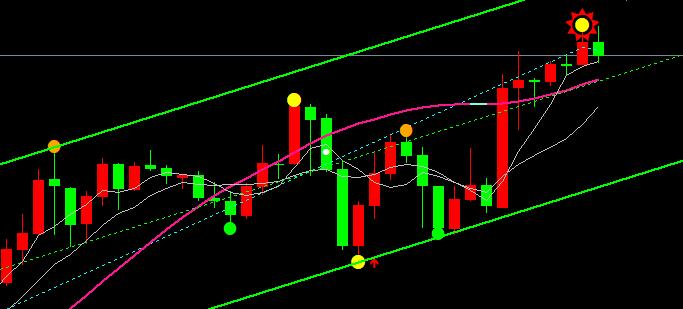

On Wednesday (March 19th), the gold market fluctuated and rose to around 3045 in the Asian session, but was blocked and fell back. In the European session, it fell below the 3023/3022 area and stabilized and rose by 3041. In the US session, it fell below the 3026 area and fluctuated and rose, reaching a high of around 3052 in the early morning. The daily chart closed with a bullish line.

From a daily perspective, as of now this week, gold has closed positive for three consecutive days, showing a strong upward trend. The moving average system continues to diverge upwards, further highlighting the strong characteristics of the current market. In terms of intraday operations, the focus below is on the support level of the 5-day moving average near 3022/3023, which happens to be yesterday's low point. As long as the gold price remains above this support level, view the market with a strong mindset first.

Pay attention to the resistance levels near 3065/3068 above, which are the current resistance areas of the short-term uptrend channel. Pay attention to the support levels near 3022 and 3026 below, which are the low points where the US and European markets fell yesterday. If the gold price can maintain these two support levels, it will continue to rise and reach new highs.

Gold rebounds 3065, short selling, defending 3072. Target 3040-3022

Gold retracement 3022, buy long, defend 3016. Target 3040-3055

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights