Tokyo's core CPI accelerates in July, and the Bank of Japan still has the option to raise interest rates

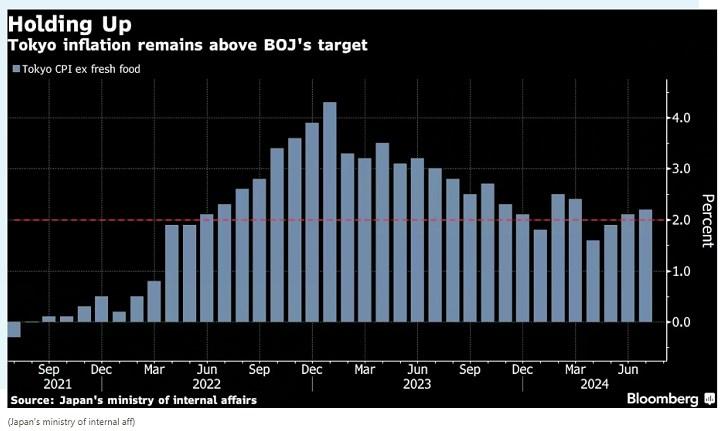

Tokyo's inflation rose for the third consecutive month in July, keeping the possibility of a rate hike open for the Bank of Japan's policy committee meeting next week.

The Japanese Ministry of Internal Affairs announced on Friday (July 26) that the core CPI for July, excluding fresh food, increased by 2.2% year-on-year, higher than June's 2.1%, which is in line with general expectations. Energy prices have driven the increase, with electricity prices rising by 19.7% year-on-year. The price increase of processed foods has slightly slowed down. Due to the gradual cancellation of accommodation subsidies a year ago, the growth rate of hotel prices has also slowed down.

The data from Tokyo is the leading indicator for the national data to be released in August.

Bank of Japan officials will carefully analyze these data as they continue to seek opportunities to normalize policy after years of aggressive easing. The day before, data showed that Japanese enterprise service prices surged in June, the largest increase in about 33 years.

Meanwhile, Yoshiki Shinke, Senior Executive Economist at Dai Ichi Institute for Life Sciences, stated that Friday's data appears to indicate that due to weak consumer spending, businesses are struggling to pass on rising costs to consumers.

Shinke said, "The policy decision of the Bank of Japan next week may or may not raise interest rates. Today's data is not disappointing, but they will not give them more confidence in the inflation trend. If I have to make a decision, I will wait for more data

The Bank of Japan will announce the details of its reduced bond buying program at the end of its two-day policy meeting on July 31st. A survey released by Bloomberg earlier this week showed that although only about 30% of Bank of Japan observers believe that the authorities will raise interest rates at this meeting, over 90% believe there is a risk of a rate hike.

Figure: Tokyo inflation (excluding fresh food) remains above the Bank of Japan's 2% target (source: Ministry of the Interior)

Bank of Japan Governor Kazuo Ueda has repeatedly stated that the central bank is looking for signs that wage increases will stimulate consumption and drive demand driven price growth, which will fix inflation above the 2% target.

The core inflation reading was boosted by the end of government subsidies for public utilities in June. Overall inflation increased by 2.2%, lower than the 2.3% in June. Excluding fresh food and energy, inflation increased by 1.5%, lower than June's 1.8%.

The service price indicator may bring some cautious sentiment to the discussion of the central bank committee next Sunday. The data slowed down from 0.9% in June to 0.5% in July.

In addition to detailing its bond operation plan, the central bank will also update its forecasts for inflation and economic growth at the meeting. At present, the central bank expects its benchmark price indicator to remain above its 2% target for the year ending in March, and then fall below 2% in the next fiscal year.

According to insiders, recent data shows weak consumption, which has complicated the decision of the Bank of Japan on whether to raise interest rates.

Bloomberg Economics said, "The accelerated rise in core inflation in Japan in July provides strong support for the Bank of Japan to raise interest rates at next week's meeting, as we have been predicting. This data is boosted by recent cuts in subsidies for utility costs.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights