Powell decides not to activate the so-called 'Fed put options' for now

When the economic outlook was shrouded in unprecedented fog, Federal Reserve Chairman Powell made a rare decision: not to activate the so-called 'Fed put options' for now. Despite the stock market crash beginning to erode household wealth and threaten economic activity, Powell made it clear last Friday that it is not yet time to take action to rescue the market in the face of the chain reaction triggered by Trump's tariff policies.

1. Transformation of Decision Logic

In sharp contrast to the decisive style of fully rescuing the market during the epidemic, vigorously fighting inflation in 2022, and rescuing Silicon Valley banks in 2023, Powell chose to wait and see this time. Many people, including us, are waiting and observing, and in the face of increasing uncertainty, this seems to be the right approach, "he explained. Although the non farm payroll data for March showed strong performance, Powell emphasized that these data did not reflect the impact of tariffs.

2. Controversy over the Policy Toolbox

No Federal Reserve official would acknowledge the existence of 'Federal Reserve put options,' "former Federal Reserve Vice Chairman Alan Blinder pointed out," but Wall Street has believed in it for forty years. "Now, for the first time, this policy tool that the market sees as a lifeline is facing failure - in the current situation where inflation threats and economic recession risks coexist, interest rate cuts may backfire.

3. Challenges of the New Crisis

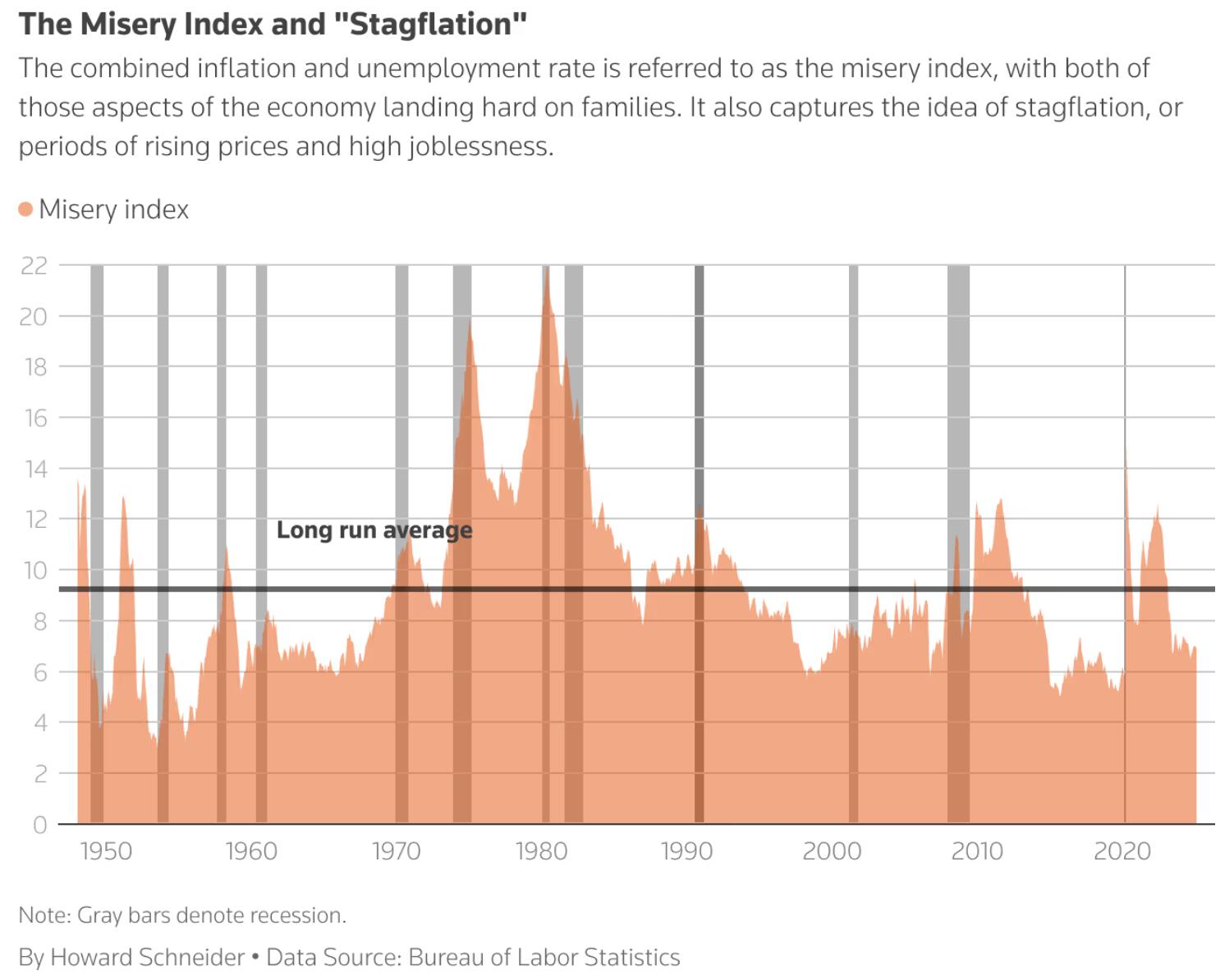

The current crisis is completely different from the historical pattern: it is not the impact of the epidemic or the disruption of the supply chain, but the tariff war initiated by the White House. JPMorgan has lowered its forecast for US GDP growth from 1.3% to -0.3%, while predicting that the unemployment rate will climb to 5.3%. Powell admitted, "The current impact may be an increase in inflation, and the unemployment rate may also rise - which is difficult for the central bank

Figure: Pain Index and Stagnation

4. The dilemma of conflicting signals

The Federal Reserve is facing a dilemma: it needs to deal with the potential inflation caused by tariffs while also being wary of the risk of economic growth stalling. Our current situation is not like the 1970s, "Powell said, but acknowledged that the current situation is equally challenging. Before the policy effect becomes clear, he tends to be patient: "I feel like we don't need to be too anxious

【 Summary 】

In this economic quagmire dominated by policy uncertainty, the Federal Reserve is rewriting its crisis response script. Powell's wait-and-see attitude marks the temporary end of the era of "Fed put options" and reflects the limitations of central banks in the face of economic shocks caused by political factors. When the White House's policy bullets hit the economic bullseye, the Federal Reserve chose to let the bullets fly for a while first - a decision that may be more indicative of the special nature of the current crisis than any interest rate cut action.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights