The general direction of gold is still bullish, waiting for adjustment to follow suit!

The expectation of global economic growth slowing down, the International Monetary Fund lowered the global economic growth rate by 0.5 and 0.3 percentage points respectively for 2025 and 2026 yesterday. This uncertainty will prompt investors to continue to pay attention to gold and provide some support for gold prices. In addition, the demand for gold purchases by central banks around the world in 2025 may still dominate, providing some support for gold prices. The demand for gold ETF investment is still strong, and some institutions such as Goldman Sachs have raised their gold target prices, which also shows the market's recognition of the value of gold investment.

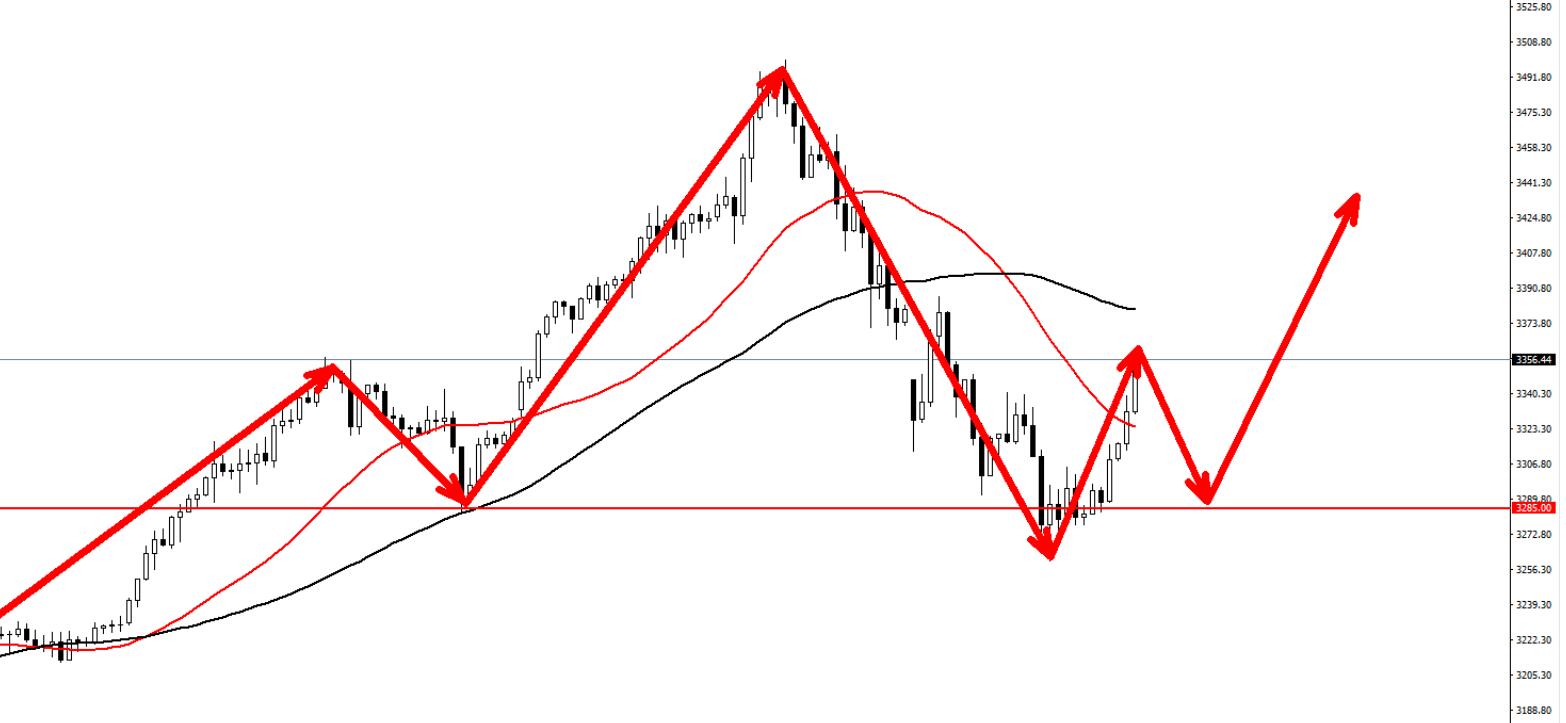

After the London spot gold price once broke through the historical high of 3500, it quickly fell below 3300 US dollars in two days. Technically, the gold price is facing strong support around 3300, and the market has entered an oversold stage. The rebound in the oversold area may push the price back to the upward trend. In the future, the gold market has certain uncertainties, and long-term factors such as global economic situation, central bank gold purchasing behavior, and investment demand will still provide strong support for the gold price. The general direction is still bullish. Currently, the market volatility is large, and the main focus below is on the 3285 line support. Follow up with the bullish trend by stepping back!

Specific strategies

Gold 3290 buy long, stop loss 3275. Target 3400

Disclaimer: The above suggestions are for reference only. Investment carries risks, and caution should be exercised when operating

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights