Gold has hit multiple lows, with a intraday decline, continue to buy long!

Gold rose again in the second half of last night, mainly due to the continued existence of geopolitical risks and the inability of safe haven demand to completely dissipate. At the same time, the recent weakening of the US dollar index, coupled with the increasing expectation of interest rate cuts by the Federal Reserve, has reduced the cost of holding gold, further enhancing its attractiveness. In addition, the global central bank buying frenzy has provided long-term support for gold prices, making it difficult for gold prices to continue to fall below.

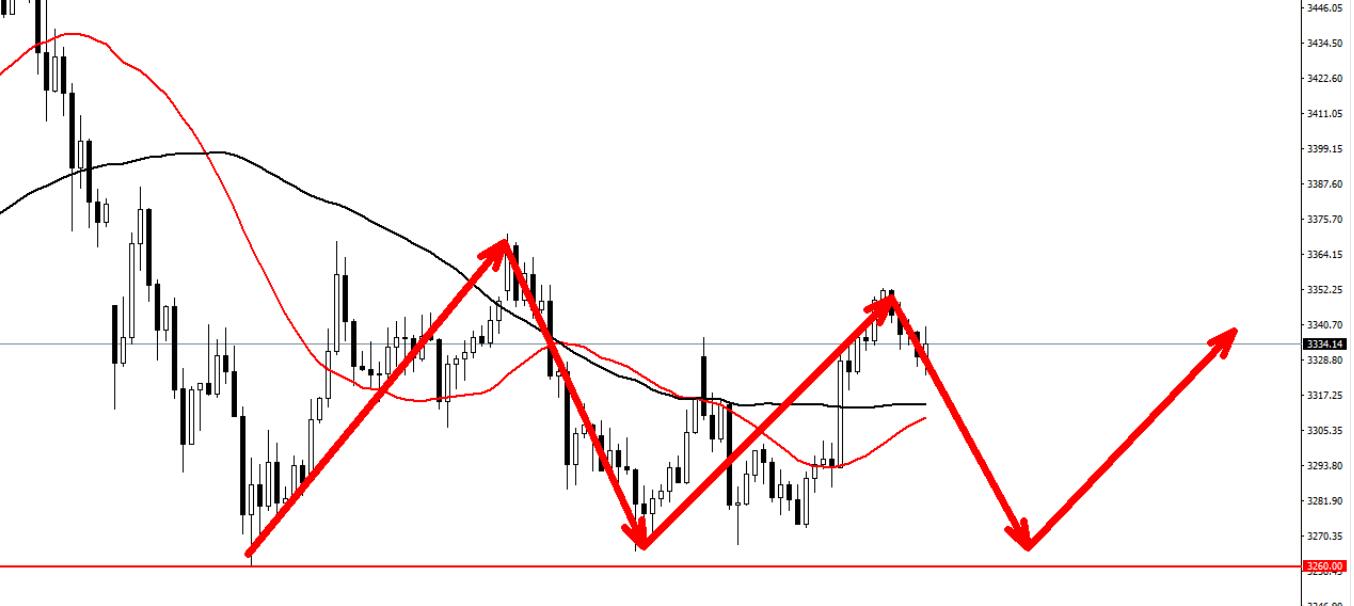

From a technical perspective, the hourly chart forms a multiple bottom structure, which also demonstrates the strong support in the 3260-3270 range. Although gold prices are difficult to fall now, it is not easy to directly rise. It is still important to pay attention to the dual pressure of the 3370 line during the day, and only after breaking through can there be a possibility of further increase. But generally speaking, the general direction of the market is still to maintain the upward trend. The direction of our intraday layout must be that the long position is greater than the short position. This morning, we focused on the starting point 3270 of the last rise last night, and the gold price adjustment was close to 3270 and began to go long!

Specific strategies

Gold 3275 buy long, stop loss 3260. Target 3330

Disclaimer: The above suggestions are for reference only. Investment carries risks, and caution should be exercised when operating

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights