Pacific Investment Management Company: The Bank of Japan will raise interest rates as early as January next year

Pimco Japan Ltd., a subsidiary of Pacific Investment Management Company, expects the Bank of Japan to raise interest rates again as early as January and is preparing to actively invest in ultra long term government bonds. From a value proposition perspective, the levels of these bonds have been revised.

Tadashi Kakuchi, the Japanese bond portfolio manager of Pacific Investment Management Company's Japan branch, stated in an interview that despite the geopolitical uncertainty and financial market instability in August, the Bank of Japan's monetary policy normalization policy has not changed, and "the next interest rate hike will be as early as January next year".

Since the Bank of Japan launched its aggressive quantitative easing policy in 2013, the forward interest rate of ultra long term bonds has exceeded 3% for the first time.

Kakuchi stated that the yield curve is still steep, and purchasing longer-term government bonds "does not require maturity, it is an opportunity to take on some risk".

The balance between supply and demand of ultra long term bonds is deteriorating due to weak investment and the Bank of Japan's reduced purchase of Japanese treasury bond.

The Ministry of Finance of Japan has also begun to consider shortening the issuance period of Japanese treasury bond bonds, but Kakuchi said that the situation will improve in about six months, and the increase in demand may bring stability to the entire bond market.

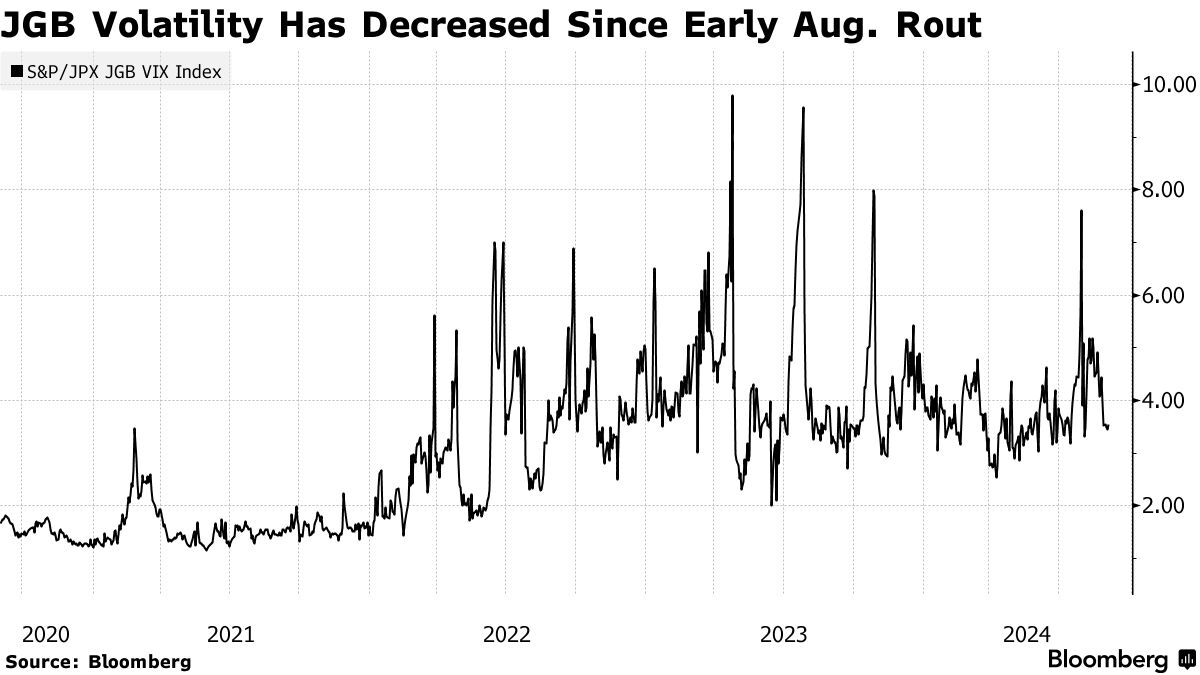

He said that although volatility has recently eased, it will still be higher than before the Bank of Japan began policy normalization.

For us active managers, volatility is always better than no volatility at all, "he said.

This week may be a crucial week for the USD/JPY exchange rate, as important data released by Japan may affect the interest rate trend of the Bank of Japan. Taro Kimura, an economist at Bloomberg Institute for Economic Research, responded to the inflation data released in Tokyo last Friday: "The unexpected significant increase in Tokyo's inflation rate in August will undoubtedly attract the attention of the Bank of Japan. We believe that this will make it possible for the Bank of Japan to raise interest rates at its October meeting. The report provides clear evidence that steady wage increases are driving up consumer prices

The better than expected economic data in Japan, coupled with rising expectations for the Bank of Japan to raise interest rates in the fourth quarter of 2024, may lead to a drop in USD/JPY to 145.

In the future, investors will shift their focus to the US manufacturing industry. Economists predict that the ISM manufacturing PMI for August will rise from 46.8 in July to 47.8.

Although accounting for less than 30% of the US economy, better than expected data may support the expectation of a soft landing for the US economy. However, investors should consider sub factors such as employment growth trends, especially as the US labor market is increasingly under scrutiny.

Positive data may further reduce investors' bets on a 50 basis point rate cut by the Federal Reserve in September. The expectation of a 25 basis point interest rate cut by the Federal Reserve may indicate that the US dollar/Japanese yen will fall towards 147.500. On the contrary, weaker data may exacerbate speculation about a 50 basis point interest rate cut, potentially leading to a decline in the USD/JPY ratio towards 145.

Technical Analysis of USD/JPY

FXEmpire analyst Bob Mason stated that the USD/JPY exchange rate remains below the 50 day and 200 day EMAs, confirming a bearish price trend.

The return of USD/JPY to 147 may drive bulls to move at the 147.500 level. In addition, breaking through 147.500 may indicate a move towards the resistance level of 148.529.

On the contrary, a drop below the support level of 145.891 may activate the level of 144.500. A drop below 144.500 may indicate a decline towards the support level of 143.495.

The 14 day RSI is 45.41, indicating that the USD/JPY has fallen below the support level of 143.495 and entered oversold territory.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights