Bank of America strategist: The bull market in commodities has just begun, and investors' demand for gold and oil will increase

Bank of America stated that commodities are the investment target for investors from now until the end of this century.

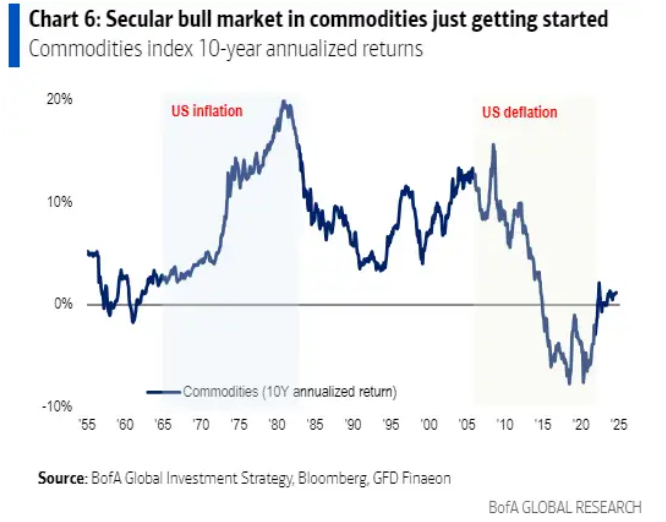

Bank of America strategists led by Jared Woodard stated in a report that the structural rise in inflation indicates that the 'commodity bull market is just beginning'.

Commodities such as oil and gold have long been seen as reliable inflation hedging tools, and if Woodward's prediction of a significant rise in inflation comes true, investors' demand for them will increase.

Woodward emphasized that due to the impact of globalization and technological trends, the inflation rate has remained at a low level of around 2% over the past 20 years, and stated that the inflation rate may soon return to pre-21st century levels, when the average annual price increase was about 5%.

Woodward stated, "The reversal of these forces means a structural shift back to 5%." The Consumer Price Index rose 3.4% in 2023, with July data showing an annualized growth rate of 2.9%.

Although it may be difficult to imagine that the sustained trend of price decline caused by technological disruption will slow down, the globalization process has grown in recent years.

From the imposition of tariffs on certain products by the United States to the recovery efforts of the US semiconductor industry, these policies are headwinds for price declines, especially as recovery efforts rely on much higher labor costs compared to emerging market countries.

Bank of America stated that commodities may generate an annualized return of 11% "due to inflation caused by debt, deficits, population structure, anti globalization, artificial intelligence, and net zero policies.

(Source: Bank of America)

These potential returns mean that commodities represent a better asset class, accounting for 40% of investors' 60/40 investment portfolios, which are typically used for bonds.

Woodward emphasized that even with declining inflation and the Fed adopting a dovish stance, commodity indices can achieve annualized returns of 10% -14%, while the popular Bloomberg Composite Bond Index only has a return of 6%.

Gold has always been a particularly strong driving force behind the steady performance of the commodity sector. So far this year, the price of gold has surged by nearly 20%, reaching a new historical high. Since inflation began to surge in early 2022, the price of gold has risen by 35%.

On the other hand, the trend of oil prices relative to gold is not good. The current WTI crude oil price is $70 per barrel, roughly the same as the price in August 2021.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights