Insiders: Bank of Japan may keep borrowing costs unchanged at 0.25% next week

According to insiders, officials from the Bank of Japan believe that it is almost unnecessary to raise the benchmark interest rate when the board members meet next week, as they are still concerned about the continued volatility in the financial market and the impact of the July rate hike.

Insiders say that the Bank of Japan may keep borrowing costs unchanged at 0.25% when the two-day meeting ends on September 20th.

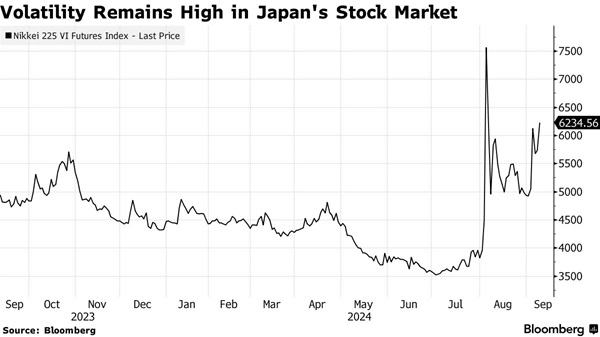

Insiders say that considering the recent market turbulence, the Bank of Japan needs to closely monitor financial markets, including the Nikkei 225 index, which experienced its largest historical decline on August 5th (just days after the Bank of Japan's interest rate hike).

After the volatile market in August, Bloomberg conducted a survey. Most economists surveyed predict that the Bank of Japan will not raise interest rates again until December or January next year.

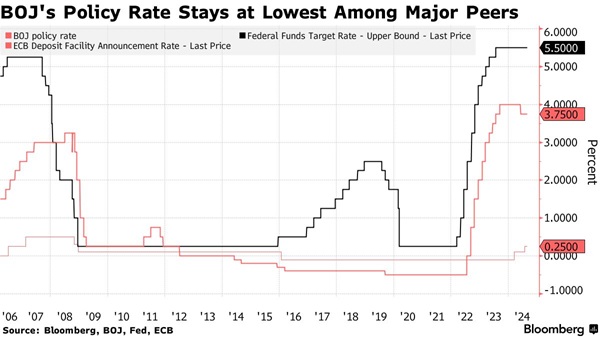

The revised data shows that the rebound speed of the Japanese economy in the second quarter was slightly slower than initially expected, but still strong enough for the Bank of Japan to adjust its monetary policy. Even after two interest rate hikes this year, the Bank of Japan's monetary policy remains ultra loose by global standards.

Insiders say that Bank of Japan officials are monitoring the market while maintaining their stance that if the economy and inflation continue to meet expectations, they should raise interest rates.

They stated that the recent market turbulence has not had a significant impact on the views presented by the bank in its July quarterly outlook report. Insiders added that depending on the conditions of the economy and financial markets, officials do not rule out the possibility of another interest rate hike later this year or early 2025.

Shinichi Uchida, Deputy Governor of the Bank of Japan, said last month that the Bank of Japan will not raise interest rates when financial markets are unstable.

Ryozo Himino, another deputy governor of the Bank of Japan, claimed that the bank's top priority at present is to closely monitor the market.

Insiders say that the possibility of a weaker than expected US economy is a factor that officials are paying attention to, suggesting that the Bank of Japan should not rush to raise interest rates next time.

The Bank of Japan's nine member policy committee will hold a meeting a few hours after the Federal Reserve's decision; It is widely expected that the Federal Reserve will cut interest rates, join the ranks of the European Central Bank, and shift towards loose policies.

If the United States cuts interest rates, it will narrow the interest rate differential between the United States and Japan and provide support for the yen. Insiders say that Bank of Japan officials will closely monitor the immediate market reaction and also observe whether the Fed's interest rate cuts will help restore market stability.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights