Morgan Stanley warns: Japanese yen may further strengthen, global markets may experience catastrophic turbulence again

Tomoko Amaya, Executive Advisor of Norinchukin Research Institute and former senior official of the Japan Financial Services Agency, believes that the Bank of Japan may still raise interest rates this year, which means that the market cannot ignore the possibility of the "black swan" flying out again. Morgan Stanley strategists warn that if the Federal Reserve cuts interest rates by more than 25 basis points, it could lead to further strengthening of the yen, prompting traders to withdraw from US assets and potentially causing catastrophic turbulence in global markets.

On Tuesday (September 10th), the US stock market closed with all three major indexes rising except for the Dow Jones Industrial Average, which fell slightly. The Dow Jones Industrial Average fell 92.63 points, or 0.23%, to close at 40736.96 points; The S&P 500 index rose 24.47 points, or 0.45%, to close at 5495.52 points; The Nasdaq index rose 141.28 points, or 0.84%, to close at 17025.88 points; The Philadelphia Semiconductor Index rose 54.89 points, or 1.19%, to close at 4680.67 points.

Although the stock market gradually stabilized after the August crash and is expected to see an increase in October after the September volatility, the nightmare of yen arbitrage trading has not yet ended.

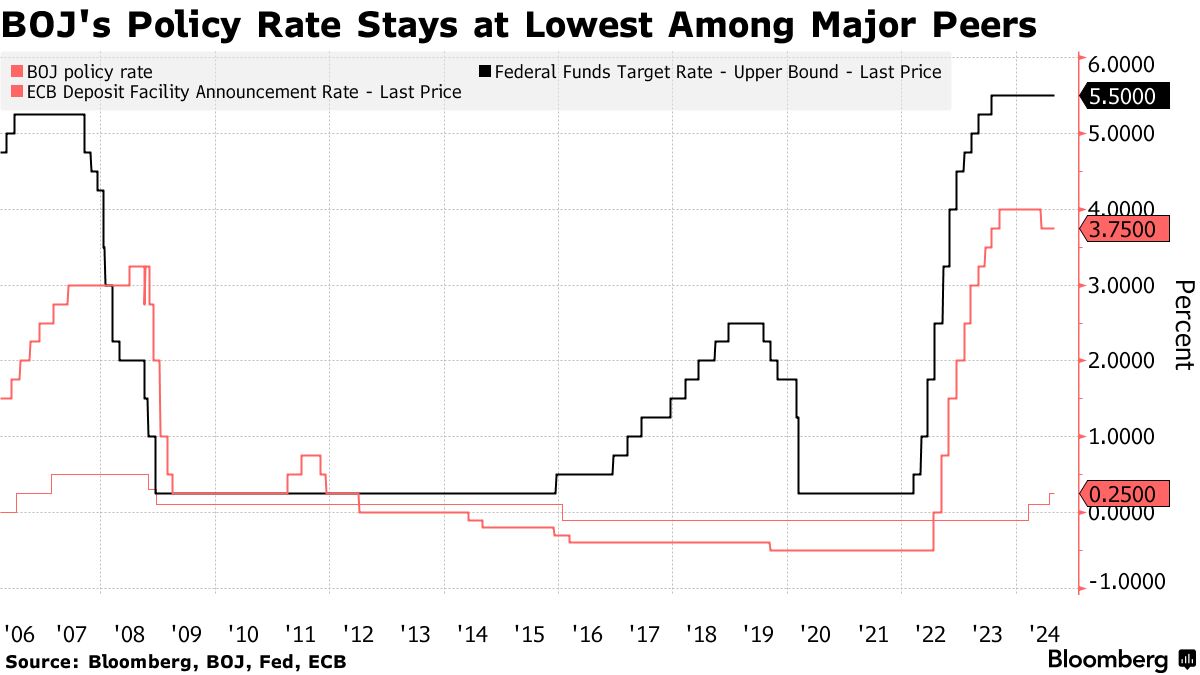

The "Japanese Yen Arbitrage Trading" refers to investors borrowing cheap, low interest yen in recent years to invest in high interest assets, especially US technology stocks. However, Japan raised interest rates by 15 basis points in July, prompting traders to sell assets and becoming a major reason for the collapse of the US stock market on August 5th.

In the past two weeks, various economic data in Japan have exceeded expectations, with real household income returning to positive after a 27 month hiatus in June, and domestic demand recovering in the second quarter, providing the Bank of Japan with confidence to continue raising interest rates.

Tomoko said, "Although the market has experienced some turbulence in the past one or two months, I don't think the market has lost confidence. Currently, the market has regained enough stability, so the Bank of Japan may still raise interest rates this year, which will benefit banks

Observers of the Bank of Japan also generally believe that if the market is not as unstable as in early August, the Bank of Japan will raise interest rates again in January.

At present, it seems certain that the Federal Reserve will initiate a rate cut cycle in September, and the market is more focused on whether to cut by 25 basis points or 50 basis points.

Morgan Stanley strategist Michael Wilson said that if the Federal Reserve cuts interest rates significantly from the beginning of September, it may once again trigger the disaster of yen arbitrage liquidation.

If the Federal Reserve cuts interest rates significantly in September, the US stock market may face the risk of further liquidation of yen arbitrage trading. If the initial rate cut exceeds 25 basis points, it may stimulate further strengthening of the yen, which will prompt yen traders to withdraw from US assets after domestic interest rates rise, and the global market will repeat a turbulent pattern

Kathy Lien, Managing Director of Foreign Exchange Strategy at BK Asset Management, also stated that it is expected that the closing of yen arbitrage trading will continue in September, which will bring the risk of another large-scale sell-off.

Bloomberg reported that officials from the Bank of Japan believe that it is almost unnecessary to raise the benchmark interest rate during next week's interest rate meeting, as they are still concerned about the lingering volatility in financial markets and the impact of the July rate hike.

The report quoted insiders as saying that at the end of the two-day policy meeting on September 20th, the Bank of Japan may keep interest rates in the 0.25% range unchanged, as the recent market turmoil, including the Nikkei 225 index hitting its largest historical decline on August 5th, requires the central bank to carefully monitor financial markets.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights