The fall of the US dollar drives the rebound of gold prices. Pay attention to US inflation data

On Tuesday (June 25th) in the Asian morning trading, spot gold fluctuated slightly and is currently trading around $2330.89 per ounce. Gold prices rebounded 0.56% on Monday, closing at $2334.16 per ounce, helped by a decline in the US dollar as Federal Reserve officials reported increasing risks of rising unemployment rates. Investors are waiting for the US inflation data to be released later this week, which may affect the Federal Reserve's monetary policy path.

The US dollar fell 0.3% on Monday, making gold more attractive to investors holding other currencies. It should be noted that the US dollar index is experiencing a bearish candlestick combination similar to "swallowing" at the daily level. It is necessary to be cautious of further downside risks in the short term of the US dollar index, which may provide further opportunities for gold prices to rebound.

David Meger, Head of Alternative Investment and Trading at High Ridge Futures, stated that gold is in a consolidation mode with active low buying, and investors are looking for clues about the future trajectory of interest rates and potential timing of rate cuts.

The focus of this week will be on Friday's US Personal Consumption Expenditure (PCE) Price Index data, which is a favored inflation indicator by the Federal Reserve. Pay attention to the performance of the Conference Board's consumer confidence index in June this trading day.

"I think there will be some wait-and-see sentiment in the market. Friday's (PCE Price Index) inflation data will be the most important data of the week," said Mona Mahajan, senior investment strategist at Edward Jones. "Otherwise, this week will be relatively calm, which seems to have been reflected in the market."

In addition, at least five Federal Reserve decision-makers will speak this week, including Federal Reserve directors Cook and Bauman.

San Francisco Federal Reserve Chairman Daley said on Monday that the Federal Reserve must be "cautious" in completing its job of controlling inflation, and pointed out that rising unemployment rates are increasingly becoming a risk.

"We must continue to work hard to fully restore price stability without causing painful economic disruption," said Daley in a speech to be delivered at the Commonwealth Club in San Francisco

She said that although there is still "more work to be done" in reducing inflation, "inflation is not the only risk we face.". Daley also stated that she does not believe that interest rates should be lowered before decision-makers are confident that inflation will fall back to 2%.

She said that further reducing inflation may require suppressing demand, although the unemployment rate (currently 4%) is still below long-term sustainable levels, "a slowdown in the future labor market may translate into higher unemployment rates.". She said that in order to avoid this situation, the Federal Reserve must "remain vigilant and maintain an open attitude.".

Daley did not disclose how many times (if any) she believes the Federal Reserve needs to cut interest rates in order to balance the dual risks of still high inflation and potential rising unemployment.

"I do believe that when we see risks, we should take preemptive interest rate cuts, but what I see now is a strong labor market approaching equilibrium," Daley said. "It is very important not to take preemptive action when it is not necessary, because if you take preemptive action without it, you will keep the inflation rate at 3%."

Chicago Fed Chairman Goolsby is still waiting for inflation to further cool down as part of the process of opening the door to interest rate cuts. In an interview with CNBC, Gullsby stated that he is "privately optimistic that we will see improvements in inflation." He is full of hope that the Federal Reserve will have "slightly more confidence in inflation," believing that the pressure is decreasing after being higher than expected at the beginning of this year.

Cleveland Fed Chairman Mester still believes that as part of the Fed's ongoing efforts to reduce its balance sheet size, the Fed needs to continue actively selling mortgage bonds. These bonds were purchased after the outbreak of the COVID-19 epidemic to restore market functions and stimulate the economy.

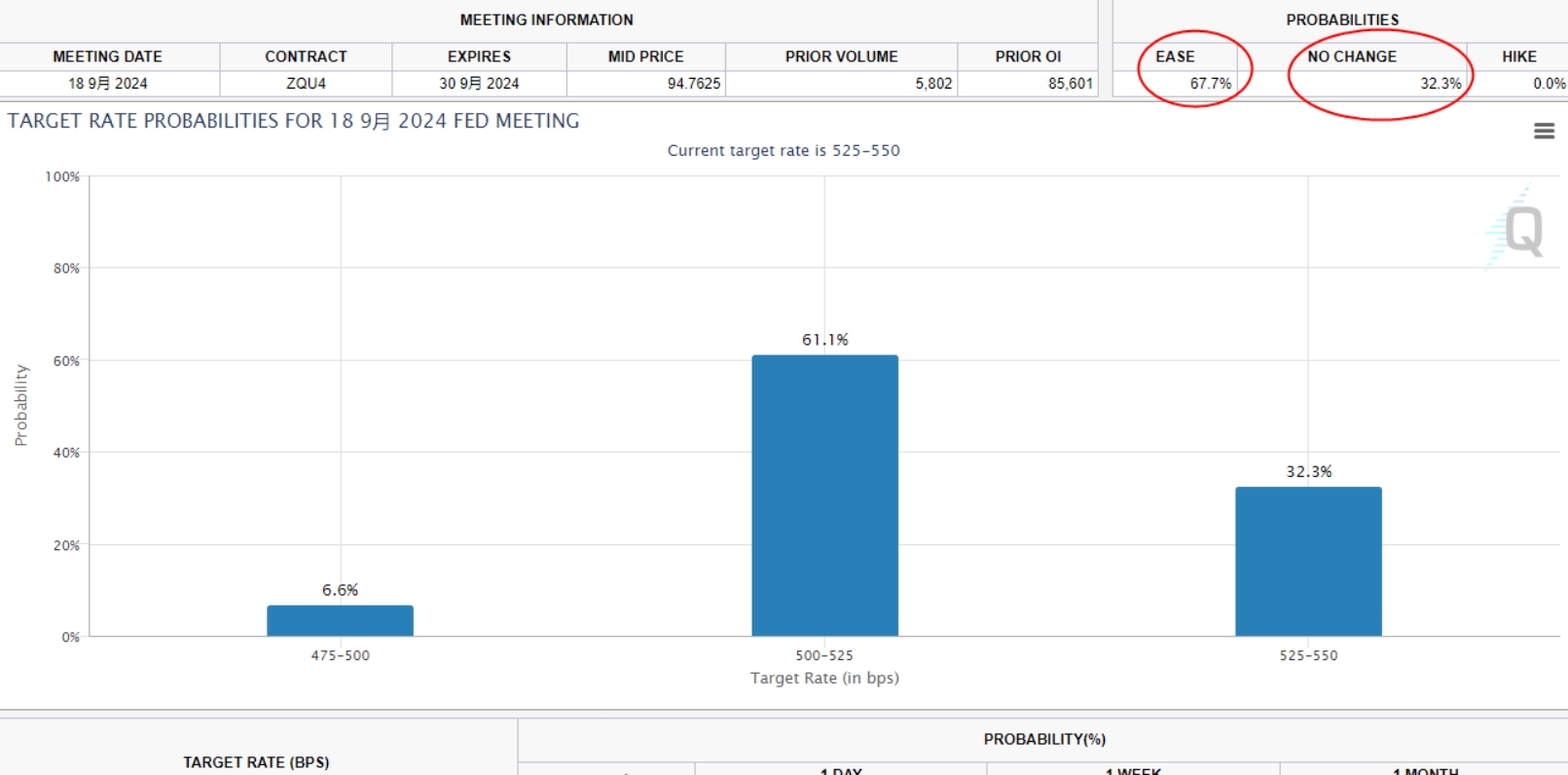

According to the FedWatch tool of the Chicago Mercantile Exchange (CME), traders currently believe that the likelihood of the Federal Reserve cutting interest rates in September is 67.3%.

"We believe that gold prices can reach $3000 per ounce in the next 12-18 months, but current liquidity does not justify this price level," Bank of America said in a research report.

The report states, "Achieving this goal requires a rebound in non commercial demand from current levels, which in turn requires the Federal Reserve to cut interest rates. The inflow of physically supported exchange traded funds (ETFs) and the recovery in clearing volume by the London Bull and Silver Market Association (LBMA) will be the first encouraging signal."

In addition, investors also need to pay attention to news related to the geopolitical situation.

According to multiple media reports, since the early morning of the 23rd local time, the Israeli military has been conducting continuous airstrikes and shelling in multiple parts of the Gaza Strip, causing multiple casualties. Palestinian armed groups announced on the 23rd that they will continue to strike Israeli targets in multiple areas of the Gaza Strip.

On the 23rd, the Israeli Defense Forces issued a report stating that they had destroyed the infrastructure of the Palestinian Islamic Resistance Movement (Hamas) in the Rafah area of the southern Gaza Strip based on intelligence. In the central Gaza Strip, the Israeli military continues to carry out operations, killing multiple members of Palestinian armed groups and seizing a batch of weapons. In addition, on the morning of the 23rd, the Israeli army launched an air raid on Gaza City located in the northern Gaza Strip.

On the 23rd, the armed faction of the Palestinian Islamic Jihad organization, the Al Quds Brigade, issued a report stating that its armed personnel used rockets and mortars to attack Israeli targets including Gaza City, central Gaza, and the surrounding areas of Rafah, resulting in the death and injury of Israeli soldiers. According to reports from Gaza media, on the morning of the 23rd, Israeli soldiers engaged in fierce gunfights with Palestinian militants at multiple locations in Rafah.

From the daily chart, it can be seen that at the daily level, the moving averages are intertwined and the MACD is intertwined. The short-term trend is highly variable and tends to fluctuate. Due to the dead cross trend of KDJ, before breaking the 55 day moving average of 2341.03, the gold price tends to fluctuate downward in the future. Below, pay attention to the 2300 level and the June 7th low point of 2286.68, with strong support around the 100 day moving average of 2246.98.

If the gold price breaks through resistance around the 55 day moving average of 2341.04, it will increase the short-term bullish signal. Further resistance refers to the positions near 2350 and the high point of 2368.62 last week.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights