Analyst: If gold prices achieve their target of 2700-3000 in October "ahead of schedule", there will be a sharp correction in November

Analyst Muhammad Umair stated that driven by strong bullish momentum and technical patterns, the gold market reached record levels in 2024. He said that if the gold price achieves the target of $2700-3000 "early" in October, there may be a sharp and rapid price adjustment in November. But he emphasized that the price adjustment in the fourth quarter may provide the next buying opportunity for the continued upward trend in 2025.

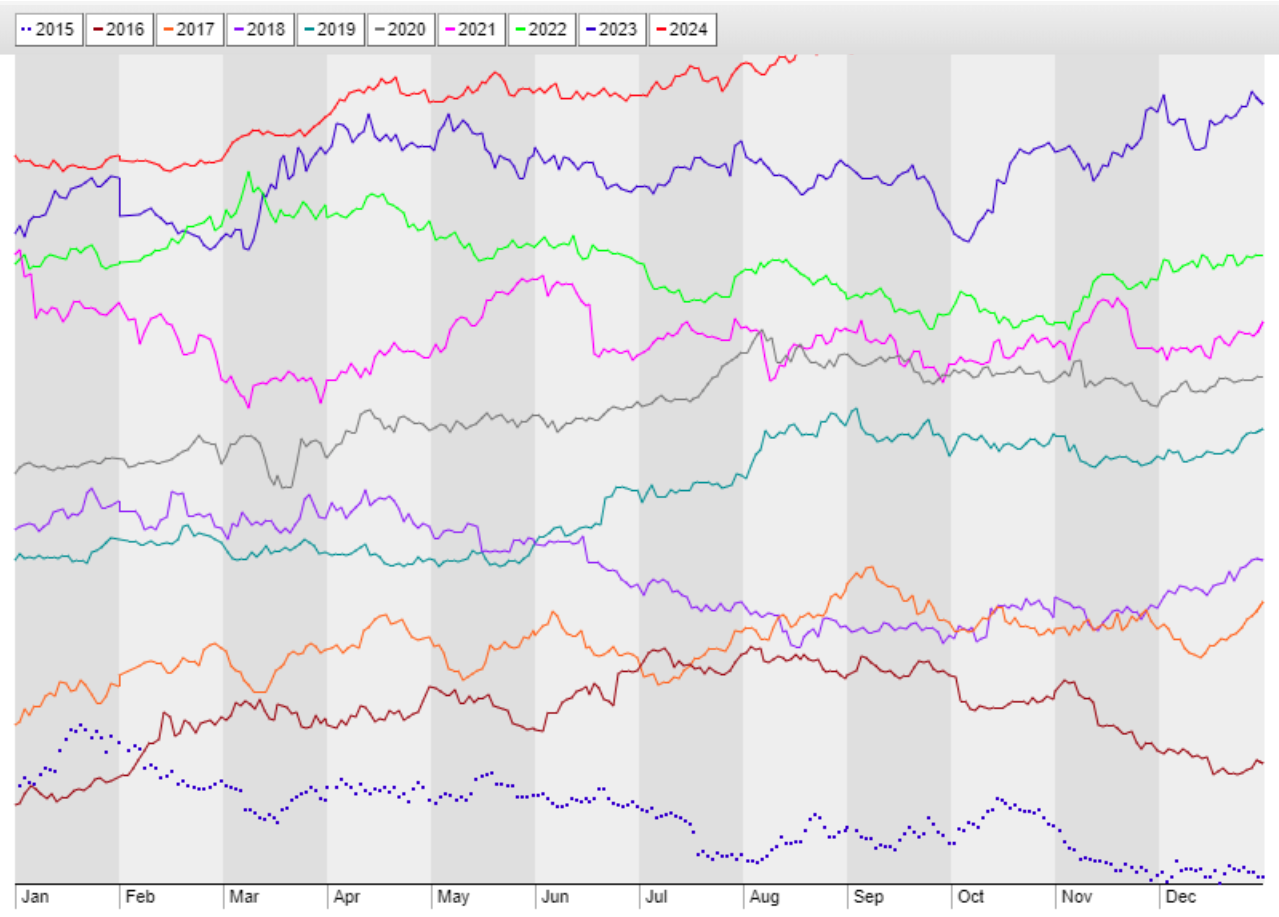

Umair mentioned that the gold market is showing an upward trend and will exhibit strong price increases in the third quarter of 2024. The seasonal chart below displays price data for the past decade. It can be observed that October is usually the peak or consolidation month for prices. The chart shows that 2023 and 2015 were the years when the gold market experienced significant price increases in October.

However, all other years in the past decade have shown price consolidation within the range. Another interesting observation is the strong performance in September 2024. Therefore, if the gold target of $2700-3000 is achieved in October, there may be a sharp and rapid price adjustment in October or November, followed by a strong December.

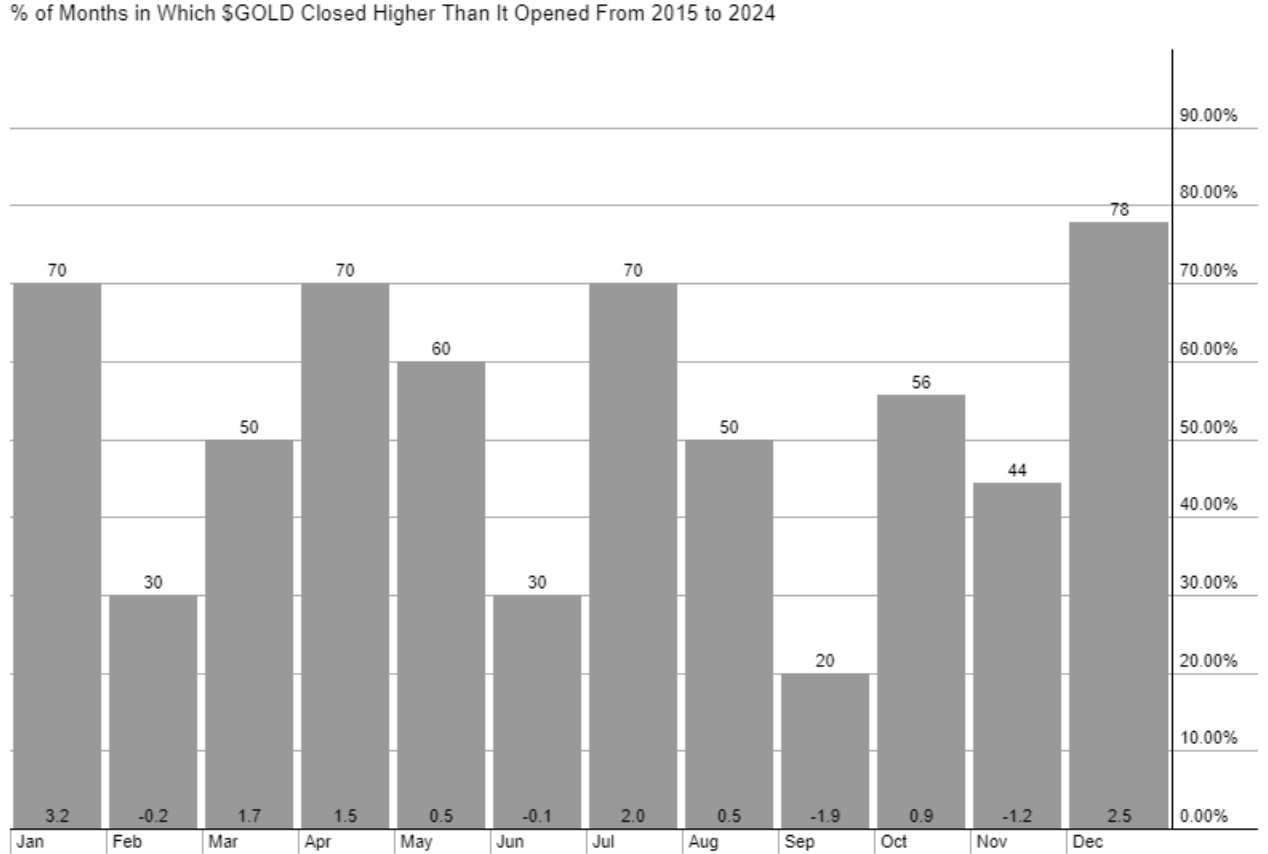

The following chart shows the percentage of months in the past decade where the closing price of gold has been higher than the opening price.

According to observations, the probability of the closing price in October being higher than the opening price is 56%. However, price charts typically display consolidation patterns. Due to strong performance in September 2024, prices rose sharply in the first half of October, followed by price adjustments, which may pose risks in the fourth quarter of 2024. Therefore, there may be adjustments in the last quarter of 2024 (October or November), but this price adjustment could lead to strong price increases in December 2024 and the following year.

The recent rise in gold prices has been driven by several key catalysts that have enhanced the attractiveness of gold to investors. Firstly, the expectation of further interest rate cuts by the Federal Reserve played an important role. The Federal Reserve has already cut interest rates by 50 basis points in September 2024, and the market expects the Fed to further cut interest rates, possibly by another 75 basis points by the end of the year. This dovish monetary policy stance weakens the yields of traditional assets such as bonds, making high-yield gold a more attractive investment. In addition, these interest rate cuts indicate a weak economic outlook, which typically stimulates demand for safe haven assets.

In addition to monetary policy, geopolitical concerns have also supported the rise in gold prices. The ongoing conflict between Russia and Ukraine, coupled with the recent escalation of tensions between Israel and Hamas in the Middle East, has exacerbated global uncertainty. These geopolitical risks have prompted investors to turn to safe haven assets, as gold has traditionally been a tool for hedging against geopolitical instability and economic turbulence. If these geopolitical tensions remain unresolved, this "safe haven" behavior may continue, providing a solid foundation for the upward momentum of gold.

The decline of the US dollar is also a key factor supporting the rise of gold prices. Since the end of June, the US dollar has been weakening, as the dovish outlook of the Federal Reserve has weakened its attractiveness, causing the US dollar to fall for several consecutive weeks. The weakening of the US dollar has made gold priced in US dollars more affordable for buyers using other currencies, thereby stimulating demand. As long as the Federal Reserve continues to lean towards interest rate cuts and the US dollar continues to be under pressure, the current bullish trend in gold may continue. However, given the recent surge in gold, a short-term correction may be necessary to avoid an overbought situation.

In addition, if the expectation of continued policy easing by the Federal Reserve is maintained, gold prices are expected to reach the price target of $3000. Continued geopolitical instability and dovish signals from the Federal Reserve have prolonged interest rate cuts, but fundamental drivers of gold remain strong. Investors should be aware of potential volatility, but the overall trend still indicates that gold has a promising outlook for the foreseeable future.

In summary, Umair believes that the bullish momentum in the gold market is driven by strong technical patterns and favorable macroeconomic factors. This indicates that prices may continue to rise in the short term, with the goal of reaching a level between $2700 and $3000 in the fourth quarter of 2024. Although there may be seasonal adjustments in October or November, this pullback will provide buying opportunities for long-term investors. The key catalysts include the Federal Reserve's expectation of further interest rate cuts, geopolitical tensions, and the weakening of the US dollar, which continue to support the rise of gold. Therefore, although there may be short-term fluctuations, the outlook is still bullish, and if the current situation continues, it is expected to reach the price target of $3000.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights