Why hasn't oil prices risen but fallen as the situation in the Middle East escalates? How much longer can global demand remain weak!

After experiencing a few months of turbulence, the crude oil market has now entered a new equilibrium phase, mainly driven by the tension between weak global demand and tight supply. The market performance on October 1st was relatively stable, but there is still uncertainty behind it, especially the situation in the Middle East and the policy trends of OPEC+.

Market Review: Oil Price Fluctuations under the Game of Supply and Demand

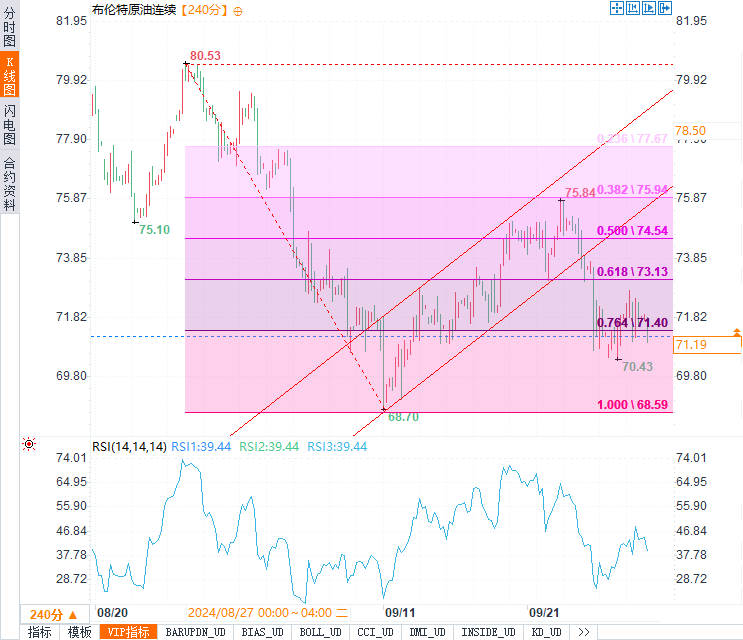

On Tuesday (October 1st) at 15:37, Brent crude oil futures prices fell slightly by $0.68 per barrel to $71.15 per barrel; Meanwhile, WTI crude oil prices in the United States fell by $0.57 per barrel to $67.59 per barrel. Overall, the downward trend of oil prices is still quite evident, especially the overall performance in September which has dealt a certain blow to market confidence. Brent crude oil futures closed down 9% in September, marking the largest monthly decline since November 2022; And WTI fell by 7%. In terms of quarterly performance, Brent crude oil plummeted 17% in the third quarter, while WTI also recorded a 16% decline. These numbers undoubtedly reflect the market's ongoing concerns about weak demand.

IG market strategist pointed out that "OPEC+plans to increase supply before the end of this year, while the global economic growth momentum is insufficient, which limits the upward space of oil prices. However, the market's response to weak data is not intense, as global investors still have expectations for the effectiveness of economic stimulus policies." This also explains why oil prices have not risen significantly despite the escalating situation in the Middle East.

Middle East situation: Geopolitical risks fail to effectively boost oil prices

The current tense situation in the Middle East is undoubtedly one of the focuses of market attention. The Israeli military announced earlier today that it has launched a "limited" attack on Hezbollah targets along the Lebanese border. This series of military actions indicates that further escalation of regional conflicts is inevitable and may involve Iran and the United States as well. Last Friday, Israel killed Hezbollah leader Nasrallah, and the situation quickly deteriorated thereafter. However, it is worth noting that the market does not seem to have fully priced this risk.

IG analysts say that although the escalation of the Middle East situation does pose potential risks to future supply, the main focus of the current market is still on the reality of weak global demand growth. On the supply side, OPEC+plans to increase daily production by 180000 barrels in December, further reinforcing market concerns about oversupply. Therefore, although geopolitical risks are gradually increasing, their driving effect on oil prices has not yet become apparent.

The existence of this supply pressure, in parallel with the tense situation in the Middle East, has plunged the market into a complex game: on the one hand, the expectation of increased supply has suppressed the rebound of oil prices; On the other hand, geopolitical risks provide support. However, overall, weak demand still dominates market sentiment.

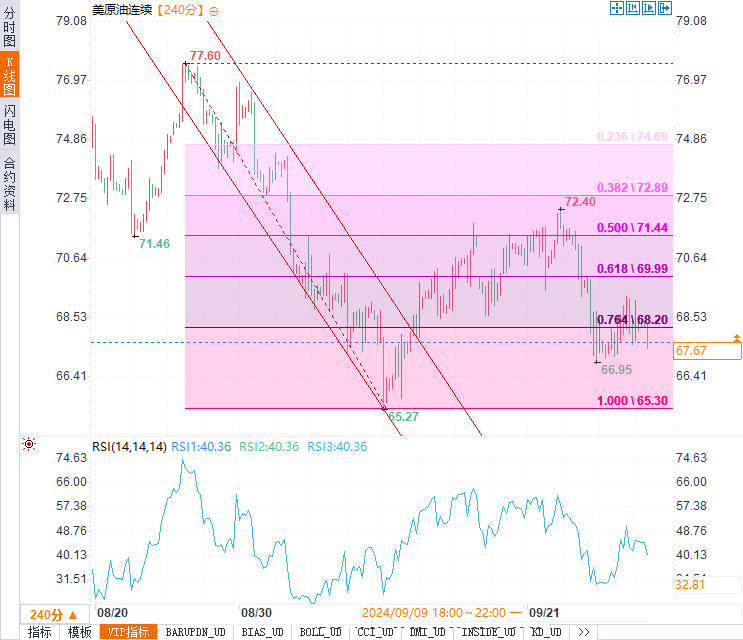

Technical aspect: The key support level of WTI is stable, and the bullish trend is awaiting verification of momentum

From a technical perspective, WTI crude oil futures are currently above the key support level of $68.55 per barrel and have maintained a relatively stable volatile market around this level. Technical analysis shows that if WTI can gain sufficient upward momentum, it is expected to initiate a new round of rebound, with a primary target of $70.44 per barrel and a further upward target of $71.95 per barrel. It is worth noting that if the price falls below the support level of $68.55 per barrel, the market will re-enter a bearish trend, and the target levels will be lowered to $67.55 per barrel and $66.65 per barrel, respectively.

Overall, the trading range for WTI today is expected to be between the support level of $67.80 per barrel and the resistance level of $70.80 per barrel. Although technical indicators currently show bullish signals, whether the target price can be successfully reached still depends on whether the market can provide sufficient momentum, especially in the face of an unfavorable global demand outlook.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights