Crude oil analysis: US SPR replenishment plan eases decline, but Middle East risks remain unresolved

On Tuesday (October 29th), the international oil market remained volatile, following a 6% drop last week due to geopolitical conflicts, and the market remained weak in the short term. After falling below the level of $72.06 per barrel, Brent crude oil futures are currently trading at $71.30, a decrease of $0.72 from yesterday. WTI crude oil slightly rebounded to $67.70 per barrel, with a intraday increase of $0.32. The tense situation between Israel and Iran stirred up the market last week, and although it did not affect Iran's major oil facilities afterwards, regional risks still brought fluctuations to oil prices. At the same time, the announcement of a 3 million barrel Strategic Petroleum Reserve (SPR) replenishment plan by the United States has provided some support to the market, but considering weak demand growth, oil prices will face multiple pressures in the future.

Fundamental and News Analysis

The US Department of Energy recently revealed that it will complete the replenishment of strategic reserves by the end of May next year, which will have a certain short-term support effect on the market. The SPR replenishment action, represented by the United States, usually symbolizes the government's expectations and reserve planning for future energy supply, and has a significant impact on the recovery of market confidence. However, the current market focus is still on the prospect of overall demand growth. The slowdown in global economic growth has led to weak crude oil consumption, coupled with the fact that the winter kerosene demand peak season in the northern hemisphere has not yet begun, the demand side has not significantly boosted crude oil prices.

Hiroyuki Kikukawa of Nissan Securities analyzed that "the SPR replenishment in the United States has to some extent eased the downward trend of oil prices, but from the demand side, especially the risk of sluggish demand and global economic slowdown, oil prices are difficult to escape the bear market pattern." He emphasized that the market expects the local conflict between Israel and Iran to temporarily subside in the short term, but regional risks still exist. Once the situation escalates, it will reignite supply chain concerns.

At the same time, the upcoming inventory data released by the American Petroleum Institute (API) and the Energy Information Administration (EIA) will be an important catalyst in the short term. According to market expectations, crude oil and gasoline inventories in the United States will increase last week, while distillate inventories may decrease. API data is expected to be released on Tuesday, while EIA's weekly report is scheduled for Wednesday. These data may further reflect the supply and demand situation in the US market and affect oil prices in the short term.

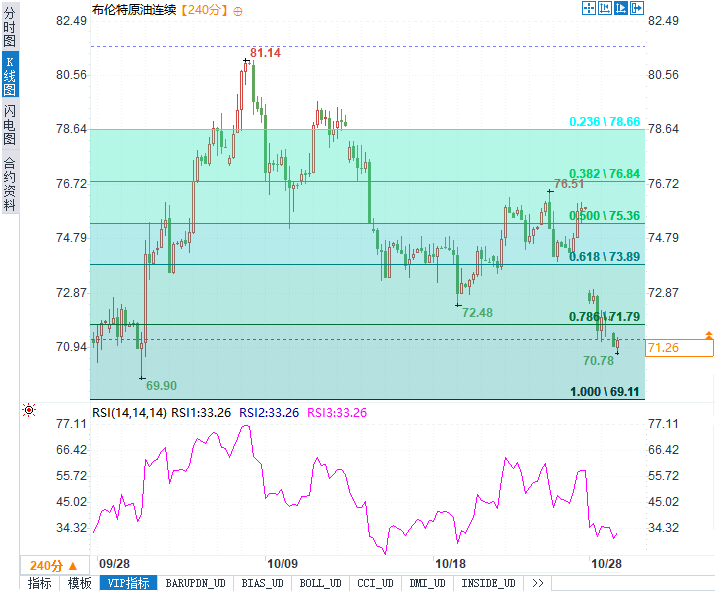

Technical analysis: Short term decline continues, WTI may test the $67 level

From a technical perspective, both Brent and WTI are showing short-term downward pressure. Brent futures have fallen below the key support level of $72.06, which reinforces bearish expectations in the short term and is expected to further drop to $70.90 or even $70.00. In terms of trading strategy, maintaining Brent below $72.06 is the key to sustained decline. Once the price rebounds and breaks through this level, there may be a brief bullish trend, testing the resistance area of $73.90.

In terms of WTI, yesterday's closing below the level of $68.65 confirmed the formation of a double top pattern, which poses a significant downside risk to the short-term market. Combined with the negative pressure brought by the EMA50 daily moving average, WTI targets $67.00. If it breaks through the $67 support, it may further decline to around $65.50 in the future. It should be noted that once WTI rebounds and breaks through $68.65, a reversal signal will be formed, and the market may try to rise again, but currently bearish pressure still dominates the trend. The trading range for WTI today is expected to be between $66.00 and $69.00.

Long position fatigue is difficult to change, short-term wait-and-see is advisable

The rebound space of the current crude oil market is constrained by multiple factors. The SPR replenishment in the United States provides temporary support for oil prices, but the pressure on prices from weak global demand is difficult to eliminate. Both Brent and WTI have shown sustained bear market signals on a technical level, especially with the medium - to long-term demand uncertainty brought about by the global economic slowdown, putting pressure on oil prices.

Overall, although the situation in the Middle East has not significantly escalated, regional risks still exist. Market traders should continue to monitor changes on the demand side in the short term, while closely monitoring the results of API and EIA inventory reports, in order to make flexible adjustments at key support levels.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights