Faced with the BRICS countries and the increasingly popular gold, the US dollar is facing severe challenges

The depreciation of the US dollar is a hot topic, especially after the Kazan BRICS Summit. But according to analysts at The Kobeissi Letter, the claim that the US dollar is about to die has been exaggerated as its share in global payments has just reached its highest level in 12 years.

There have been many discussions about the US dollar losing its global currency dominance, but the data so far still suggests that this is not the case, "Kobeissi Letter wrote in an article on X

They stated in a subsequent post, "According to SWIFT data, the share of the US dollar in global payments has reached 49%, the highest level in 12 years

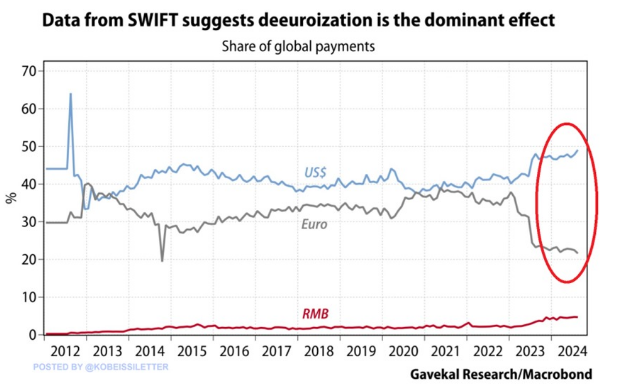

Figure: SWIFT data indicates that de euroization is the main impact (the left vertical axis represents global payment share) (blue line represents US dollars, black line represents euros)

They added, "In the past two years, the use of the US dollar in international payment transactions has increased by 9 percentage points. At the same time, the share of the euro has plummeted from 39% to 21%, the lowest level in a decade. The use of the Chinese yuan has increased from 2% in 2023 to 5% currently. What's wrong with the euro

Analysts say, "The US dollar remains the primary global currency, but it is still far from reaching that level. Can the BRICS countries really overthrow the dominance of the US dollar

Many users quickly pointed out that the data used was flawed as it only tracked transactions on SWIFT, while Russia and its trading partners are increasingly using other channels for trade and fund transfers.

X's user Stay Curious wrote, "This is not a true reflection of the current state of the US dollar, as it only shows what is happening within Swift, not the recent volume of transactions leaving Swift. What is missing is the significant growth in all trade between Russia and various countries, as well as direct currency exchange between governments

They added, "Although no other government wants a global reserve currency, according to French economist Jacques Sapir, BRICS countries may see 19.5% to 25.5% of global trade no longer using the US dollar/euro in the next five years

Another commentator reiterated, "This chart only measures SWIFT transactions and reflects the decline in global trade share, as any bilateral trade involving Russia or BRICS countries is not included. The bigger question is: when will Europe tire of being a vassal state of the United States

Robert Avery emphasized, "The eurozone mainly uses the SEPA IBAN payment system, and these payments are not registered in SWIFT

Another user emphasized a point that has not received much attention in the dialogue on de dollarization among BRICS countries.

They said, "The BRICS countries themselves are also struggling. Safety is key. When traveling to South America, all they want is the US dollar

Finance Insights stated that the decrease in the use of the euro "may reflect economic stagnation, political instability, and the complexity of managing multiple currencies in some parts of Europe, while balancing economic relations with the United States and major Asian countries

From a macro perspective, Spencer Hakimian, founder of Tolou Capital Management, emphasized that in an era where central banks around the world continue to print money, all fiat currencies are constantly depreciating.

He wrote on Twitter, "The US dollar is the least dirty shirt in the basket, and America is very lucky

Although the US dollar is still the king of legal tender, it is undeniable that the position of the US dollar is not stable in the face of the increasingly severe US debt situation and rising US debt yields.

Kobeissi Letter emphasizes, "The 10-year Treasury yield after the Fed's shift is currently at its highest level since July 5th, up 70 basis points since the Fed cut interest rates." "Mortgage rates have surged above 7.0%, and it is expected that mortgage demand will hit a new low in over 30 years. How could this be a 'Fed shift'

Figure: Yield of 10-year US Treasury bonds

Global market investors responded, "The United States has just announced its third largest budget deficit in history. For the fiscal year 2024 ending September 30, the federal deficit reached an astonishing $1.83 trillion, accounting for 6.4% of GDP. In other words, the US government borrows an astonishing $5 billion every day

Perhaps this is why gold continues to reach historic highs in this context.

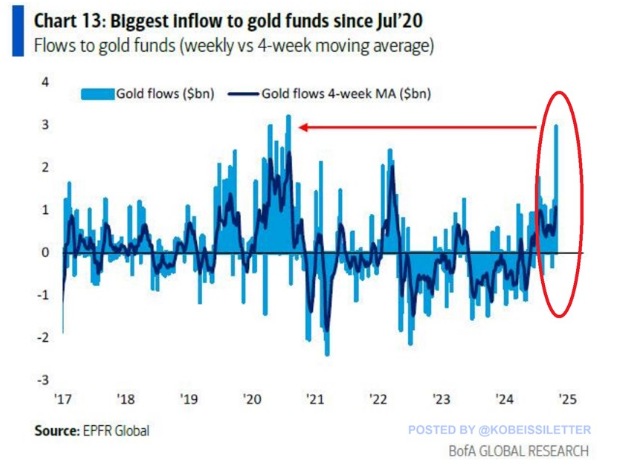

Kobeissi Letter said, "Last week, gold funds flowed in about $3 billion, the second highest on record, which is more than three times the average amount of the past few weeks

Figure: The maximum capital inflow of gold funds since July 2020 (light blue refers to weekly capital flow, deep blue refers to 4-week moving average capital flow)

They added, "A large influx of funds has pushed up the gold price, which has risen 33% so far this year and is expected to reach its best year since 1979. Therefore, the current trading market value of gold has reached a new high of $18.4 trillion. The proportion of central bank gold reserves to total monetary reserves has reached 12.1%, the highest level in more than 30 years. Everyone is hoarding gold

The stock market also shows that in the current environment, traders are doing their best to avoid holding US dollars.

Analysts at Kobeissi Letter said, "This is the most resilient stock market in history: the S&P 500 index has been above its 200 day moving average for 247 consecutive trading days, the third longest in 8 years. The previous two records were in 2016-2018 and 2020-2021, lasting 430 and 400 trading days respectively

They added, "In the past 12 months, the S&P 500 index has risen by over 40%, making it the fourth best performing 12 months of this century. Since 2000, the index has only risen at least 39% year-on-year three times: in 2004, 2010, and 2021. From this perspective, the average annual return rate of the S&P 500 index since 1957 is about 10%. We are witnessing history

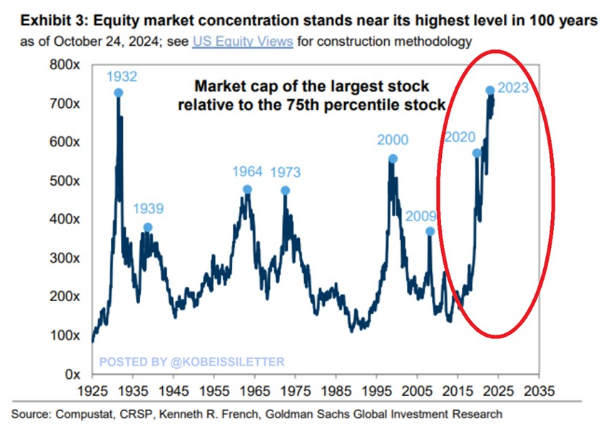

Another worrying sign is that while the stock market has repeatedly reached new highs, the concentration level is also constantly increasing, and the current situation is close to the market conditions during the Great Depression.

Kobeissi Letter wrote, "The market has become more concentrated: the market value of the largest stock in the United States is now 750 times that of the 75th percentile stock, approaching the highest level since 1932

They added: "In the past eight years, this difference has tripled. In addition, the current market concentration is even higher than that during the Internet foam in 2000. The largest stock peak in the United States in 2000 was 600 times that of the 75th percentile stock."

Figure: The concentration of the stock market is approaching its highest level in 100 years (relative to the maximum market value of the 75th percentile stock)

They emphasized, "The current level of market concentration only occurred during the Great Depression, it's ridiculous

Therefore, although the US dollar remains the king of legal tender, beneath the surface, the legal tender mechanism seems to be collapsing. Although the US dollar may be the last currency, there is evidence to suggest that de dollarization is on the rise, with investors increasingly favoring gold, the world's oldest store of value.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights