New changes have occurred in the foreign exchange market! Singapore dollar is gradually becoming the preferred currency for US election trading among option investors

The US presidential election on November 5th is approaching, and there are new changes in the foreign exchange market. The Singapore dollar is gradually becoming the preferred trading currency for option investors in the US election. Bloomberg reported that hedge funds have turned to betting on the Singapore dollar, and traders are laying out that the US dollar/Singapore dollar will rise, leading to a significant increase in the cost of speculating on the Singapore currency.

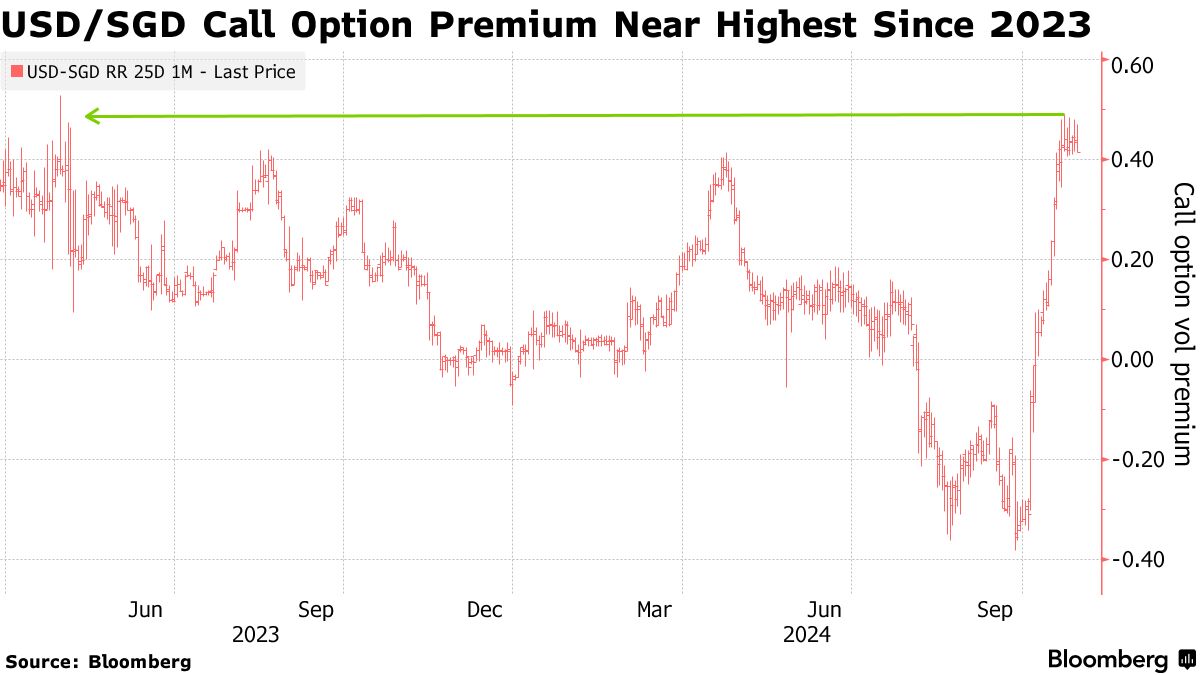

Compared to put options, the premium for purchasing one month call options is close to the highest level since May 2023, and if the US dollar/Singapore dollar rises, the value of call options will increase.

As of this week, at the Depository Trust and Clearing Corporation in the United States, all nominal trades of this currency pair approaching or exceeding $100 million are call options with a maturity date of no later than January 22nd.

Most central banks manage the economy by setting interest rates, but the Monetary Authority of Singapore achieves this by influencing the nominal effective exchange rate of the Singapore dollar, which is based on a basket of currencies of Singapore's major trading partners. This makes the Singapore dollar an effective indicator for macro investors betting on Donald Trump winning the US presidential election.

The general view is that if Trump wins, the US dollar will benefit against other major currencies, especially against Asian currencies, "said Mukund Daga, head of Asian foreign exchange options at Barclays in Singapore

He stated that hedge funds have shown interest in purchasing US dollar/Singapore dollar call options that will expire in the next three months.

Traders say that if former US President Donald Trump wins the US presidential election, investors will also bet on currencies such as the EUR/USD that may be affected by tariff measures to strengthen.

Alvin Tan, Head of Asian Foreign Exchange Strategy at Royal Bank of Canada Capital Markets in Singapore, said, "There is a lot of interest in USD/SGD parity options in the market

For the Singapore dollar, the implied volatility seems to be very high in the market.

This week, US data includes the September Core Personal Consumption Expenditure (PCE) Price Index released on Thursday, which is the Federal Reserve's preferred indicator for measuring inflation, as well as Friday's key Non Farm payroll report (NFP).

Despite this, the US dollar index is still expected to record its largest monthly increase in two and a half years and remain near a three-month high before the release of data that may determine the direction of the Federal Reserve's policy.

The Job Openings and Labor Mobility Survey (JOLTS) by the US Department of Labor shows that the number of job vacancies in September fell to the lowest level in three and a half years, and last month's data was also revised down, indicating a continued cooling of the labor market.

Meanwhile, as labor market awareness improves, US consumer confidence rose to a nine month high in October.

Helen Given, Deputy Director of Trading at Monex USA, said, "Even though the non farm payroll numbers in September were much higher than expected, we still see a pattern of slowing employment, which has been the overall theme of the past few months

However, she stated that considering the inherent risks of the November 5th election and next week's Federal Reserve meeting, she believes that the downside space for the US dollar is still limited.

Recent data highlight the resilience of the US economy, and the market's increasing bet that Trump will defeat Vice President Kamala Harris in the general election, which together support the US dollar and push up the yield of US treasury bond bonds.

The US dollar index has risen 3.6% so far in October, marking its best monthly performance since April 2022. The latest report of the index is 104.34, and it has risen against all major currencies except the pound this year.

Marvin Loh, Senior Global Market Strategist at State Street Bank in Boston, said, "We are influenced by the election, and we still expect that, as everyone has long said, the election results will be quite intense.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights