Non agricultural sector triggers a surge in gold prices, with a detailed explanation of non agricultural "sub items" and various averages in one chart

The non farm sector in the United States has become the trigger for the explosion of non US assets such as gold and silver. Gold has experienced a dramatic fluctuation of over 40 US dollars after the non farm sector, falling from 2368 to 2348 and then soaring to the front line of 2380 US dollars per ounce. Silver has rapidly surged and expanded its rise to 30.91 US dollars per ounce after falling from 30.61 to 30.12, with the US dollar index fluctuating by nearly 40 points. Why did non-agricultural sectors trigger such a big market trend? Looking at the "sub items" of non-agricultural research, a picture provides a detailed explanation of non-agricultural and various industry sub items.

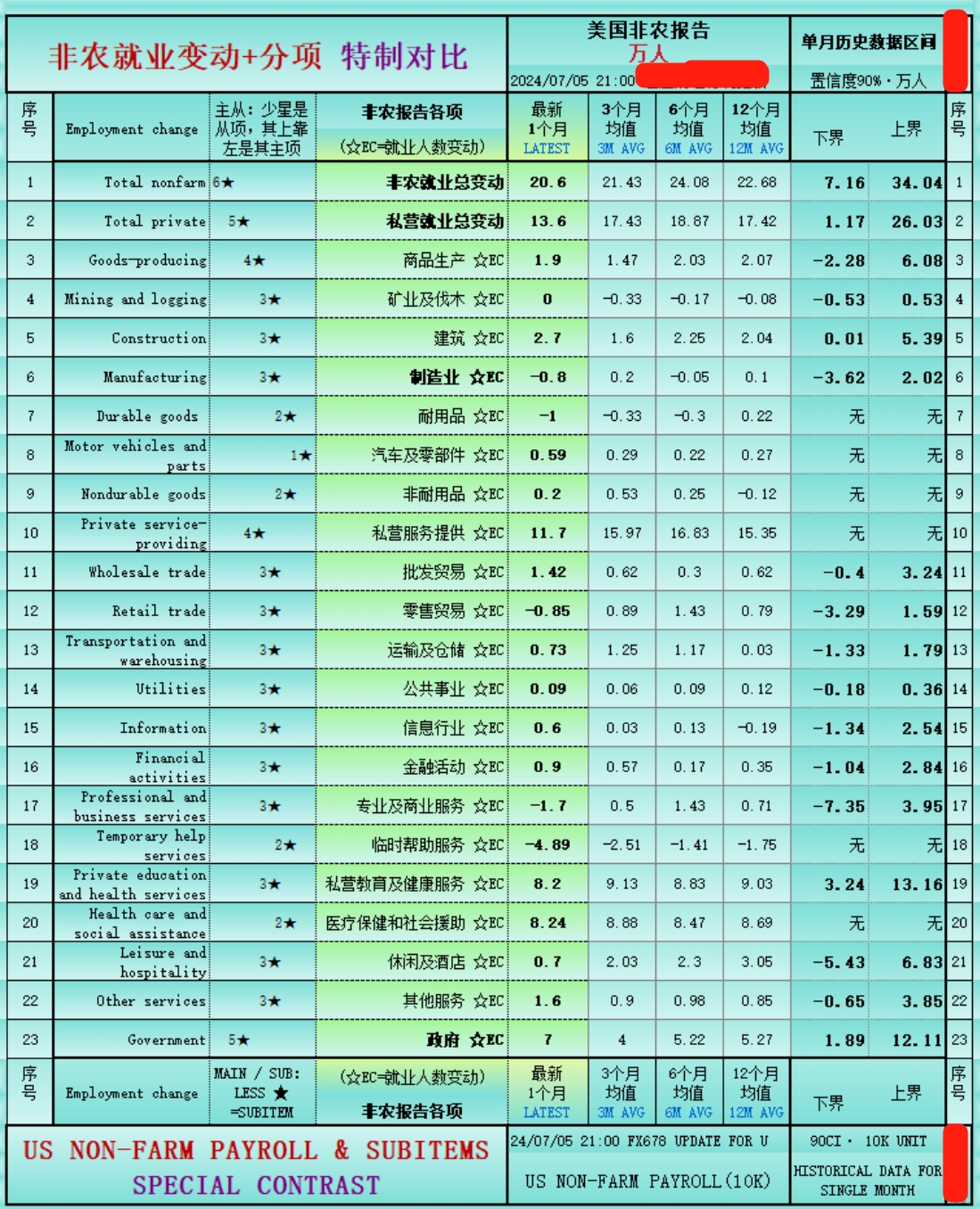

A chart: A summary of changes in non farm employment in the United States and various industries, including the latest value, 3-month mean, 6-month mean, 12-month mean, and a 90% confidence interval for historical data of various employment indicators (referring to 90% of historical data falling within this interval).

(Figure: Overview of Non farm Employment in the United States+Changes in Sub sector Employment by Industry)

As we mentioned earlier in our review of non farm payroll: Comparing the data, it can be seen that non farm payroll showed signs of "false strength": the United States added 206000 new non farm payroll in June, slightly stronger than the expected 190000 increase, but the unemployment rate rose to 4.1% worse than expected, and the 3.9% increase in annual salary rate confirmed a slowdown in the growth rate. The private sector's non farm payroll growth rate only increased by 136000, which is far from expectations, and the manufacturing sector unexpectedly decreased by 8000 people.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights