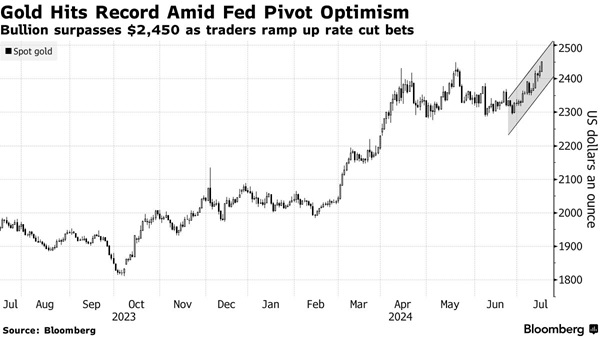

The 'Trump Deal' is surging, traders are increasing their bets, helping gold prices break historical highs

On Tuesday (July 16th), although the US dollar remained relatively stable, the gold market experienced an "astonishing trend", with spot gold skyrocketing nearly $47 in a single day, reaching a high of $2469.55 per ounce. On Monday, Sanya City broke its historical high to $2472.94 per ounce.

According to Bloomberg analysis, the hope of the Federal Reserve cutting interest rates is heating up, coupled with some traders increasing their bets on Donald Trump winning the US presidential election, causing gold prices to reach a historic high.

In addition, the recent increase in holdings of exchange traded funds (ETFs) has also contributed to the upward trend of gold.

Spot gold closed up $46.55, or 1.92%, at $2468.70 per ounce on Tuesday.

Spot gold prices rose to a high of $2469.71 per ounce on Tuesday, surpassing the historical record set in May.

As gold prices rise, signs of slowing inflation in the United States intensify speculation that the Federal Reserve will soon begin cutting interest rates. Since gold does not yield interest, interest rate cuts can reduce the opportunity cost of holding gold and increase its attractiveness to investors.

The US Department of Labor reported last Thursday that the US Consumer Price Index (CPI) fell 0.1% month on month in June, marking the first decline since May 2020, after market expectations for a 0.1% increase. The non seasonally adjusted CPI in the United States rose by 3.0% year-on-year in June, lower than the market expectation of 3.1%, reaching the lowest level since June last year.

In addition, the seasonally adjusted core CPI monthly rate in the United States recorded 0.1% in June, lower than the market expectation of 0.2% and the lowest level since August 2021. The seasonally adjusted core CPI for June recorded an annual rate of 3.3%, lower than the market expectation of 3.4%, and the lowest level since April 2021.

Supported by massive purchases by central banks around the world, strong demand from Chinese consumers, and the need for safe haven assets amid geopolitical tensions, gold prices have surged nearly 20% this year.

Ewa Manthey, commodity strategist at ING Bank NV, said on Tuesday: "With increasing economic data supporting the Fed's shift, optimism about US interest rate cuts is supporting gold. In the current global geopolitical and macroeconomic situation, gold is expected to maintain its positive momentum, while central bank demand is expected to grow

On Monday, Federal Reserve Chairman Jerome Powell said that recent data has given policymakers more confidence that the inflation rate is falling towards the Fed's 2% target. Traders now expect two 25 basis point interest rate cuts this year.

Powell stated that the second quarter economic data has given policymakers more confidence that inflation is falling towards the Federal Reserve's 2% target. This statement may pave the way for recent interest rate cuts.

Powell stated that he will not wait until inflation reaches the 2% target before cutting interest rates, as the impact of monetary policy is lagged. If interest rates are maintained for too long and too high, it will excessively suppress economic growth. He further explained that if we wait until inflation reaches the 2% target and cut interest rates, it may take too long because we are currently adopting a tight monetary policy or the existing tightening policy will still have an impact, which can lower the inflation rate below 2%.

Goldman Sachs Group Inc. stated that loose conditions are ripe and officials have "solid reasons" to cut interest rates as early as July.

The recent rise in gold prices may not be unexpected. In June of this year, consulting firm Metals Focus predicted that gold prices would set a new record this year. Earlier this month, Citigroup Inc. stated that its basic expectation for gold prices in 2025 is $2700-3000 per ounce.

The Trump factor brings momentum

Bloomberg reported that investors in the entire market are also weighing the possibility of Trump's return to the White House, as his campaign momentum has increased after a failed assassination attempt over the weekend and the dismissal of a criminal case against him.

Former US President and Republican Trump was "attempted assassinated" at a campaign rally on the evening of July 13th. According to data from prediction website Polymarket, the probability of Trump winning the 2024 presidential election has significantly increased from 60% to 71% after the attack.

A federal judge in Florida on Monday dismissed a criminal case accusing former President Trump of "mishandling classified documents," marking a major legal victory for Trump, who is seeking re-election.

Kyle Rodda, Senior Financial Market Analyst at Capital, stated that this news marks a turning point in the political normalcy of the United States. For the market, this means safe haven trading, as he saw customers flocking to gold after the shooting.

David Higgins, the head of trading at Merrion Gold, stated that gold may gain some support from Trump's election as president.

Higgins said, "When he is elected, he will attract a lot of people to buy because retail customers - mainly small buyers - associate him with instability

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights