After the Lantern Festival, we will welcome the wedding season, and the demand for gold in India may explode again!

Kavita Chacko, Head of India Research at the World Gold Council, stated that during Diwali, despite the record high gold prices, India's gold demand remained strong, and investment attractiveness supported strong gold sales.

India's gold demand is strong: Diwali drives up gold prices, investment enthusiasm is high

Chacko mentioned that the trend of Indian gold prices in October was consistent with international gold prices, but due to the 0.2% depreciation of the Indian rupee and the push of holiday buying, the increase was slightly higher, and Indian gold prices closed up 5.5% in October.

Chacko pointed out that after the US election, as the US dollar strengthened and US bond yields rose, the rise in gold prices came to a halt. In fact, since the end of October, both international and Indian gold prices have fallen by 8%. Despite recent declines, gold remains one of the best performing assets of the year, with a year to date return rate of 17% denominated in Indian rupees.

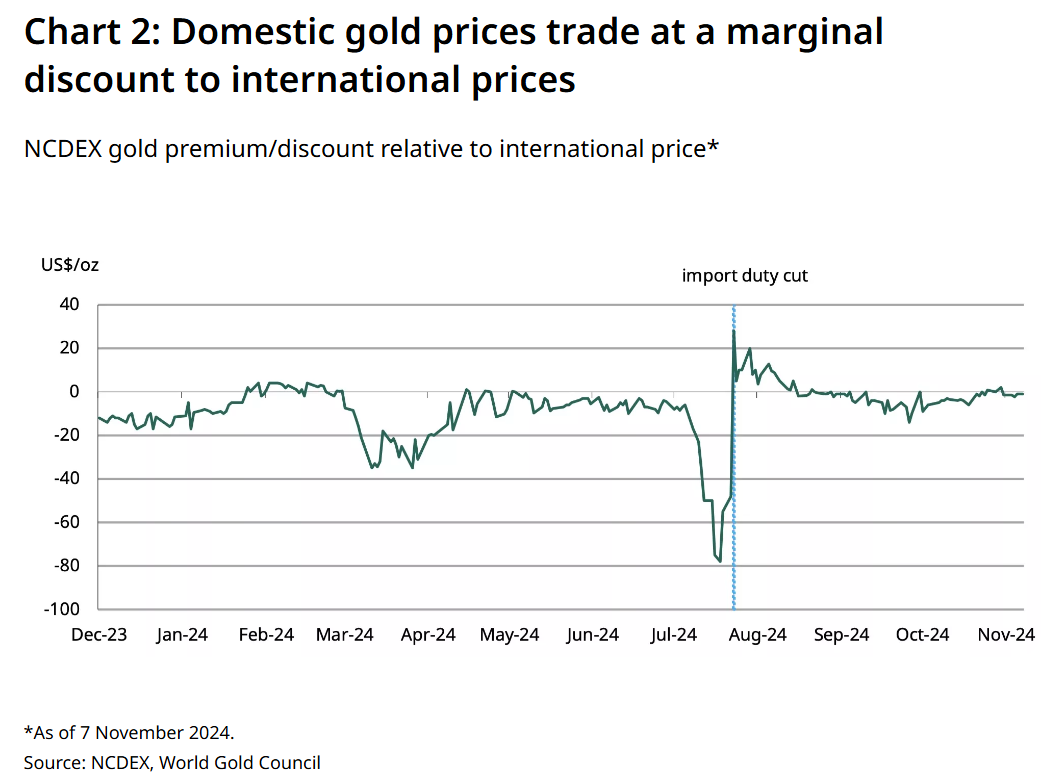

The World Gold Council believes that since mid August, the Indian gold price has slightly discounted compared to international benchmark prices, reflecting the dynamics of supply and demand balance. Chacko stated that India's significant reduction in import taxes in July almost stopped smuggling gold, while official imports of gold increased significantly.

Chacko also added that during the peak period of Diwali at the end of October, Indian gold prices were basically on par with international gold prices, and even showed a slight premium, reflecting higher demand levels. The average monthly price difference narrowed from $5 per ounce in September to $2.8 per ounce in October, and further narrowed to $1 per ounce in the first week of November.

(Trend of slight price difference between Indian gold prices and international prices)

Despite the record high in gold prices, Chacko stated that Indian consumers' purchases of gold jewelry, bars, and coins remained strong during Diwali. According to media reports, there has been an increase in foot traffic in Indian jewelry stores, and there is also a high level of activity in purchasing gold coins through both online and offline platforms. The rise in gold prices since Diwali in 2023 has strengthened consumer sentiment, viewing gold as a long-term investment. The volatility of the Indian stock market, coupled with the rise in international gold prices, further enhances the investment attractiveness of gold.

Chacko stated that although gold sales have decreased year-on-year, higher prices have driven sales growth.

Driven by ETF and central bank, India's gold reserves hit a new high

In October, the demand for Indian gold ETFs also remained stable. Chacko pointed out that driven by the rise in gold prices and increased volatility in the Indian stock market, the Indian gold ETF continued to attract a large influx of funds in October. Due to the implementation of the long-term capital gains tax policy on gold announced in July, there has been a significant increase in capital inflows.

In the first 10 months of 2024, the net inflow of Indian gold ETFs reached $1.11 billion, a significant increase from $301 million in the same period last year. These funds have added a total of 12.2 tons of gold so far this year, with a total gold holdings of 54.5 tons, a year-on-year increase of 32%.

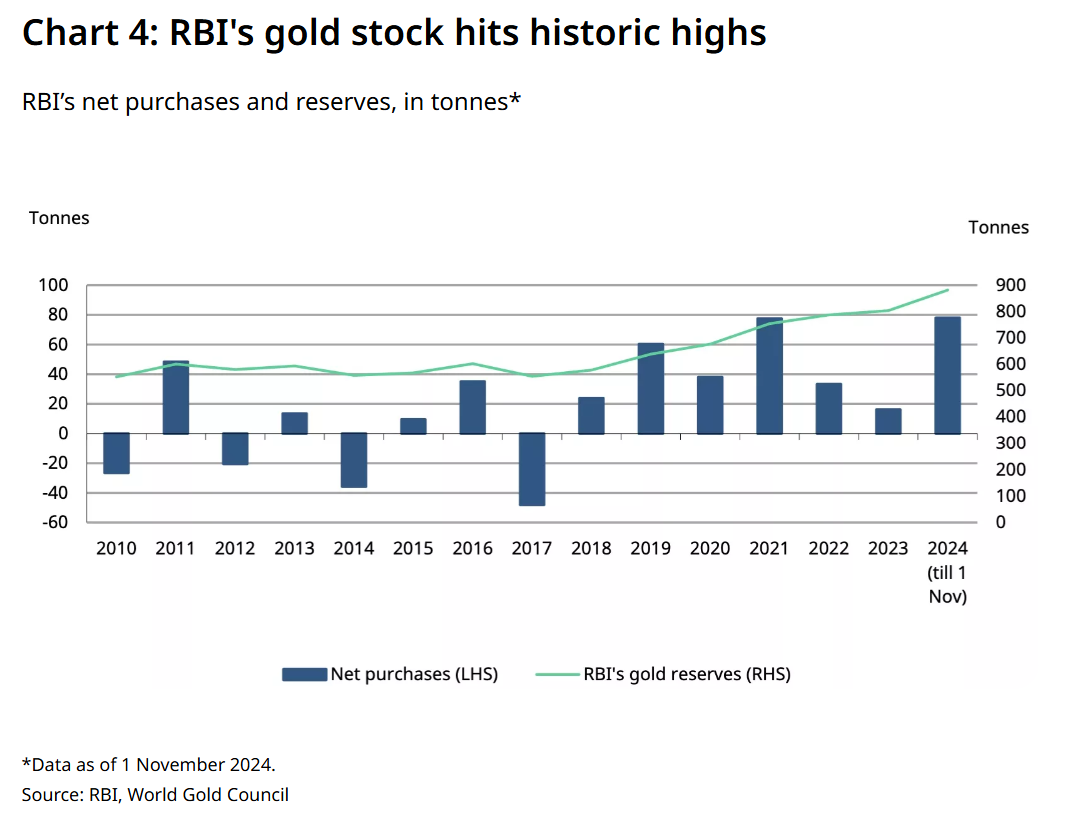

The Reserve Bank of India also significantly increased its gold reserves in October, with its total gold reserves increasing by 10% so far this year, reaching 882 tons.

Chacko pointed out, "According to data from the Reserve Bank of India and our estimates, the Reserve Bank of India added about 28 tons of gold to its foreign exchange reserves in October, bringing the total gold purchases so far this year to 78 tons. This is the second highest annual net purchase volume for the Reserve Bank of India since its net purchase of 257 tons of gold in 2009. In terms of value, gold currently accounts for 10% of total foreign exchange reserves, the highest proportion since 1999

India's central bank's gold reserves hit a historic high

Chacko wrote that at the same time, the Reserve Bank of India is focusing on holding its gold reserves in India and reducing the amount of gold stored in the Bank of England and the Bank for International Settlements. As of the end of September 2024, 60% (approximately 510 tons) of the total gold reserves of the Reserve Bank of India are held in India, an increase of 102 tons since March 2024. This proportion has significantly increased from 38% in March 2023.

Seasonal demand also drove the growth of India's gold imports last month, showing a dual increase in both monthly and annual levels.

The World Gold Council stated that India's gold imports in October increased from $4.39 billion in September to $7.13 billion, reflecting seasonal growth in demand for festivals and weddings. According to the World Gold Council's estimation, the import volume in October was about 90 to 92 tons, higher than the 59 tons in September. Since the reduction of import taxes in July, the monthly import average has been about 95 tons, higher than the 50 tons at the beginning of the year. So far this year, India's total gold imports have increased by 21%, reaching 44 billion US dollars, and the import volume has remained stable at around 635 tons.

Looking ahead, Chacko stated that after the peak of Indian holidays and the upcoming wedding season from November to March, the correction or stabilization of gold prices may further stimulate demand, while bullish sentiment may continue to support investment interest in gold amid sustained stock market volatility.

Daily chart of spot gold

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights