Can ADP data create a storm? Gold, crude oil, foreign exchange, and bond markets are poised to take off!

On Wednesday (December 4th), the market focused on multiple key events, including the vote of no confidence in the French parliament, the release of US employment data, and the latest changes in policy expectations from major central banks. In this context, market sentiment is cautiously optimistic, with major asset classes showing a trend of differentiation.

Crude Oil: The Game between Supply Concerns and Demand Expectations

Brent crude oil recently traded at $74.12 per barrel, up 0.68% for the day; WTI crude oil rose 0.63% to $70.38 per barrel.

Yesterday, oil prices surged by over 2%, mainly due to the escalation of the geopolitical situation in the Middle East and market expectations that OPEC+may extend production cuts. The statement by the Israeli Defense Minister has raised concerns about the worsening situation between Lebanon and Israel, while the market is waiting for OPEC+to announce further extensions of existing production restrictions this week.

Meanwhile, the latest report from the Organization for Economic Cooperation and Development (OECD) shows that despite multiple challenges, global economic growth remains resilient, with an expected global GDP growth rate of around 3.3% from 2024 to 2026. This stable growth expectation provides support for oil demand.

Looking ahead, if geopolitical tensions escalate and OPEC+may continue to cut production, oil prices are expected to maintain an upward trend. However, the US non farm payroll data and Federal Reserve Chairman Powell's speech may affect short-term market expectations and create potential pressure on oil price fluctuations.

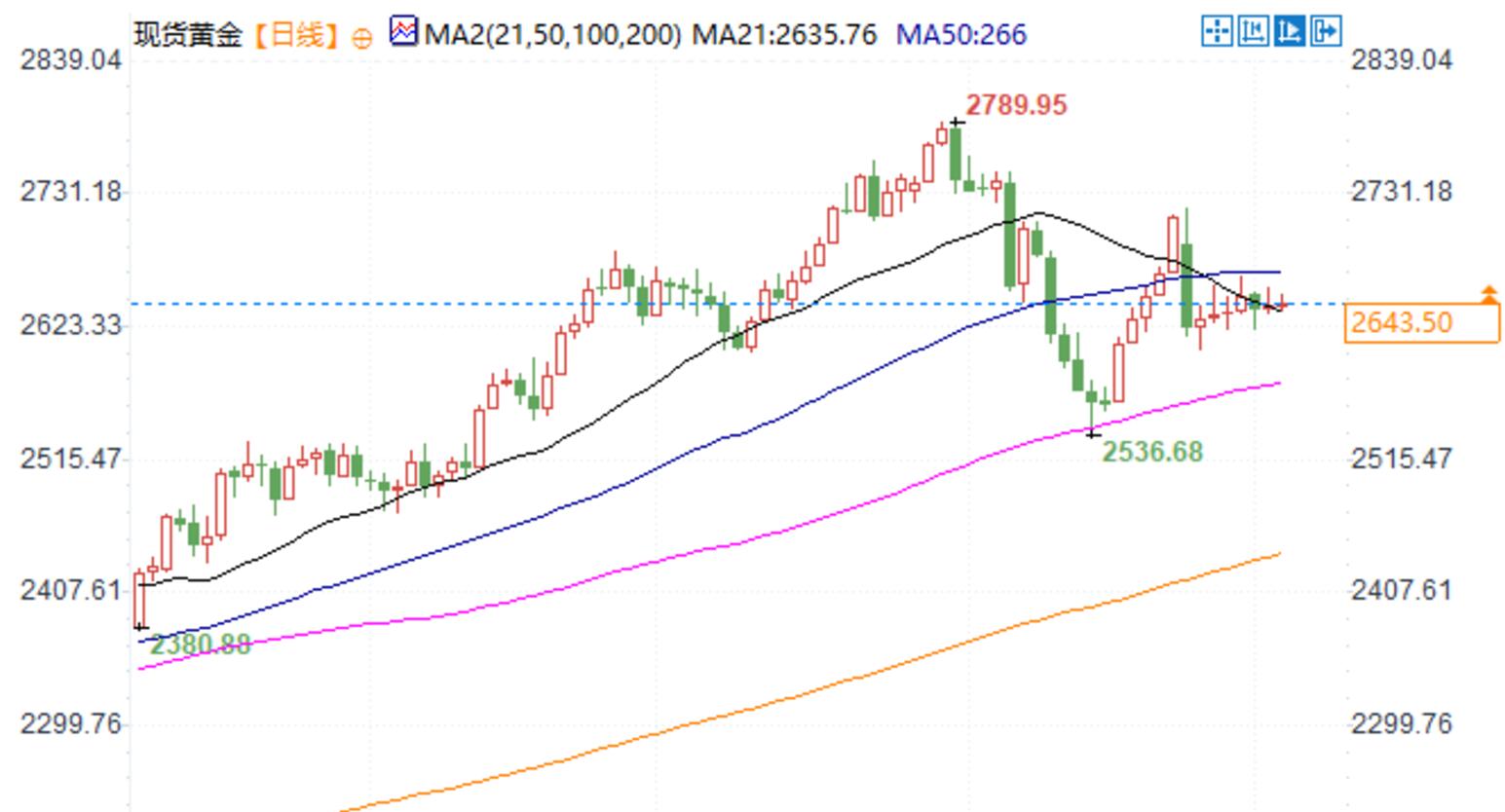

Precious Metals: Gold under Pressure from Strong US Dollar

The latest price of spot gold is 2641.36 US dollars per ounce, with a slight decrease of 0.08% during the day. The US dollar index is currently trading at 106.5011, with a 0.15% increase during the day, continuing the upward trend since the beginning of this week. The strengthening of the US dollar puts pressure on gold, while the market focuses on US employment data and Powell's evening speech. Investors are looking forward to more guidance on the future path of interest rates.

Federal Reserve Chairman Powell released a more cautious signal after the November policy meeting, reducing the market's expectation of a 25 basis point rate cut in December to around 75%. In the short term, the performance of US employment data will determine the next trend of the US dollar and gold. If ADP and non farm employment data are strong, it may further suppress gold prices; On the contrary, if the job market is significantly weak, gold is expected to have a rebound opportunity.

The US dollar and major currency pairs: exchange rate fluctuations intertwined with political risks

The latest increase of USD/JPY is 0.77% to 150.437, indicating the continued strength of the US dollar. The EUR/USD fell slightly by 0.08% to 1.0499; GBP/USD remained relatively stable at 1.2670.

The change in policy expectations of the Bank of Japan has put pressure on the yen. Recent media reports suggest that market expectations for the Bank of Japan to raise interest rates in December have cooled, dropping from 60% to 42%, leading to a decline in Japanese government bond yields and suppressing demand for the yen. Meanwhile, the relatively stable economic data in the United States further enhances the attractiveness of the US dollar.

In terms of the euro, political uncertainty in France remains a focus of attention. French lawmakers will vote on a motion of no confidence tonight, which could lead to the downfall of the current government and exacerbate the political crisis in the eurozone's second-largest economy. Although the market has sufficient expectations that the European Central Bank will soon cut interest rates by 25 basis points, the political turmoil in France may further weaken the trend of the euro.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights