COT Report: Net Short Exposure to EUR/USD Reaches 4-Year High

The Weekly Trader's Promise (COT) report displays the holdings of asset management companies and large speculators in the Chicago Mercantile Exchange futures market. The following is partial position data disclosed in the COT report released by the US Commodity Exchange Commission as of Tuesday, December 10, 2024. There is a 3-day lag between the release date of the report and the actual positions held by the recorded traders. The report was released on Friday, but only the data from Tuesday was included.

The COT report data shows that traders are not only increasingly long on the US dollar, but they are also heavily short on the EUR/USD. This may pave the way for the euro to fall below parity next year. Traders went long by $24.6 billion last week, the highest level in seven months. The net short exposure of large speculators to euro/dollar futures has risen to a four-year, eight month high. Large speculators and managed funds were net bullish on Japanese treasury bond bonds for the second week in a row. Large speculators have lowered their net long exposure to AUD/USD futures to an 11 week low. The asset management company increased its net short exposure to a 16 week high. The net long exposure of two types of traders to gold futures has increased for the third consecutive week, reaching a seven week high.

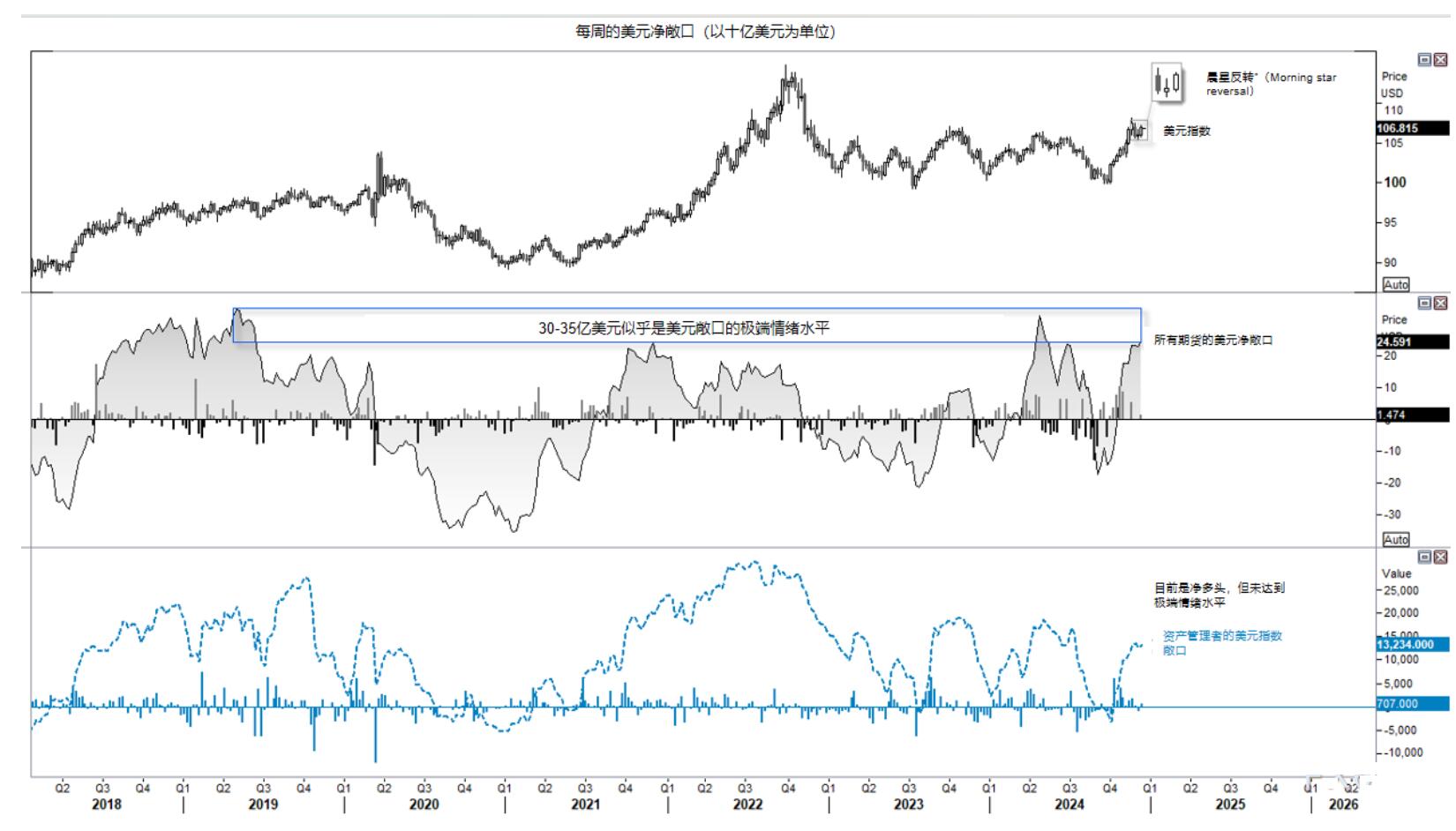

USD Position (IMM Data) - COT Report:

The US dollar index formed a three week bullish reversal pattern last week, known as the Morning Star reversal. The market seems to be hoping to push the US dollar above the 14 month high set three weeks ago. According to data from the International Monetary Market (IMM), traders went long by $24.6 billion last week, reaching the highest level in seven months. The asset management company has slightly increased its net long exposure to the US dollar index, adding 707 contracts - all of which are new long positions with no change in short positions. It is worth noting that the net long exposure of asset management companies has not reached extreme sentiment.

EUR/USD (Euro Futures) Position - COT Report:

Last week, large speculators increased their net short exposure to the highest level in 4 years and 8 months. They also increased their total short positions for the fourth consecutive week, reaching the highest level in two years and three months. Nevertheless, it seems that they have not yet reached an extreme emotion that will open the door for further decline as we enter 2025 and may potentially fall below parity. If they continue to flood into the Japanese yen, perhaps next year's trading will be short selling the euro/yen.

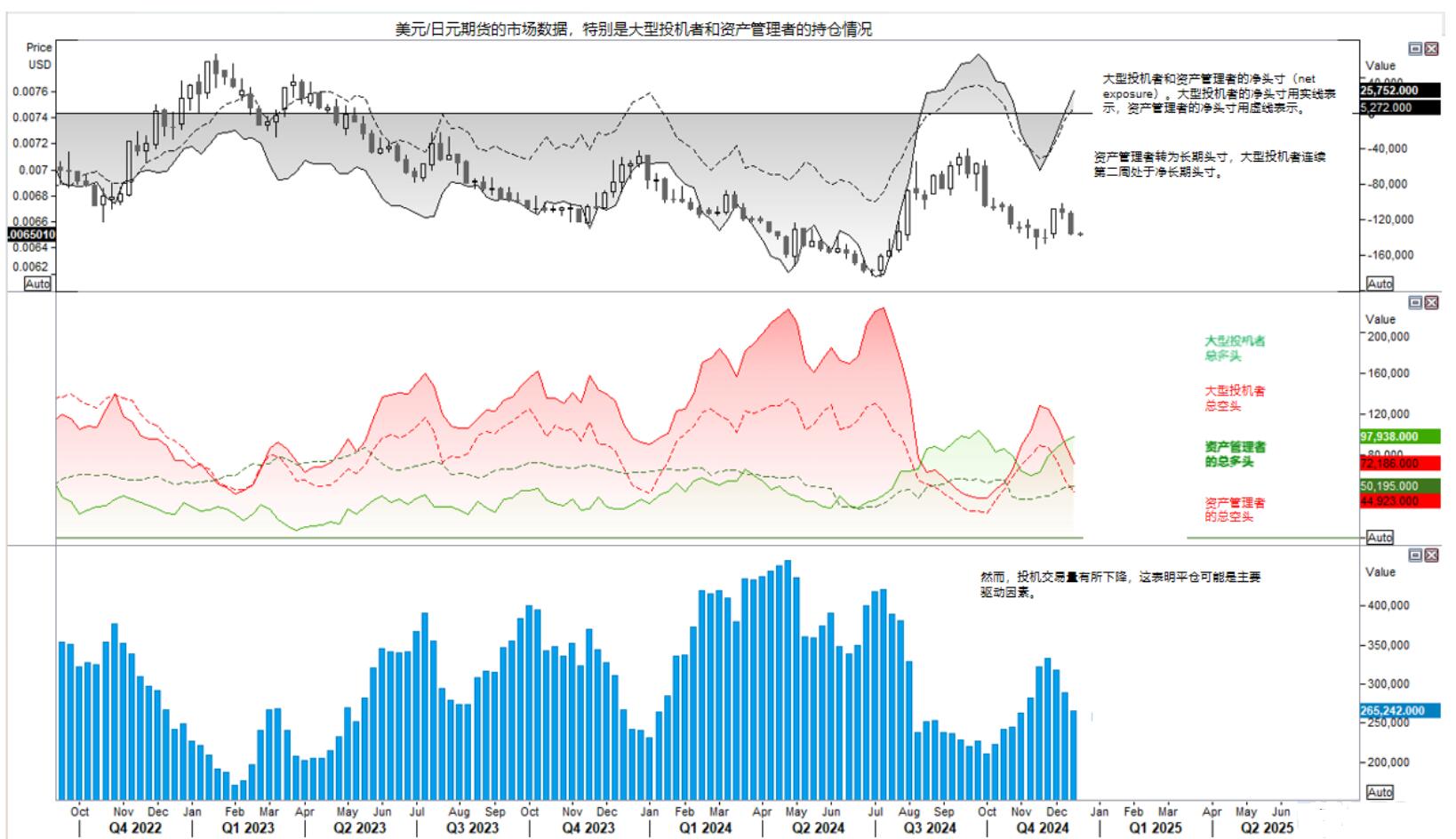

JPY/USD (JPY Futures) Position - COT Report

Asset management companies have converted to net long positions, and large speculators have net long positions for the second consecutive week. However, the speculative trading volume (the sum of specifications and asset management companies) has decreased for the third consecutive week, which tells us that short covering is the reason behind the net long position. As the Japanese yen price weakens for the second consecutive week, I cannot confidently say that traders will continue to go long. Of course, unless the Bank of Japan unexpectedly adopts a hawkish stance this week, or even raises interest rates.

Commodity Forex (AUD, CAD, NZD) Futures - COT Report:

Traders had a more pessimistic view on commodity forex futures last week, with both groups of traders increasing their net short exposure on New Zealand dollar and Canadian dollar futures, while reducing their net long exposure on Australian dollar futures.

Large speculators and managed funds are the most bearish on New York dollar/US dollar futures in the past five years. Although this may be seen as an extreme emotion by recent standards, their net worth actually increased by about 30% in 2019.

The open interest contracts of Canadian dollar futures have reached record highs, and the net short exposure of two types of traders is approaching record highs. This may be an extreme emotion.

And the Australian dollar seems to want to fall below 0.6300, with many investors lowering their net long exposure to an 11 week low, while asset management companies have increased their net short exposure to a 16 week high. Obviously, this is not an extreme emotion for either party and raises the question of whether the Australian dollar will fall to 0.5000 next year.

Metal Futures (Gold, Silver, Copper) Positions - COT Report:

The managed fund has increased its net long exposure to gold, silver, and copper futures. And large speculators have only increased their net bullish exposure to gold. I insist on my previous viewpoint that the gold price will not simply break through from the current price to a new historical high, and we are still in a pullback from the historical high, which may lead to another decline.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights