The gains and losses of the daily support of the US index are key, while the EURUSD daily line is fluctuating

Recently, both geopolitical and economic situations have shown tension and complexity. In the Middle East, Israel has increased the population of the Golan Heights and bombed Gaza, exacerbating regional unrest; The Russia-Ukraine conflict has not eased, and the two sides continue to fight. In terms of economy, the contraction of manufacturing activity in the United States and the decline in PMI index have caused market concerns; But the service sector PMI hit a 38 month high, and the composite PMI output index also rose. In terms of trade policy, Trump has announced that he will impose tariffs on goods from Mexico, Canada, and major Asian countries, which will have a significant impact on the global trade landscape. In terms of financial markets, the US dollar index rose and fell, while US bond yields slightly declined. The Federal Reserve is about to hold a meeting, and the market expects a high possibility of interest rate cuts. The European Central Bank and others have also shown an intention to cut interest rates, challenging the strong position of the US dollar. Investors need to pay attention to the linkage reaction triggered by Trump's policies, as the Canadian government has allocated funds to respond to Trump's threat. At the same time, US retail sales and industrial output data will be released, and market expectations are optimistic, which may suppress gold prices. Investors need to pay close attention in order to adjust their strategies and respond to risks and opportunities in the complex global situation.

The US Dollar Index

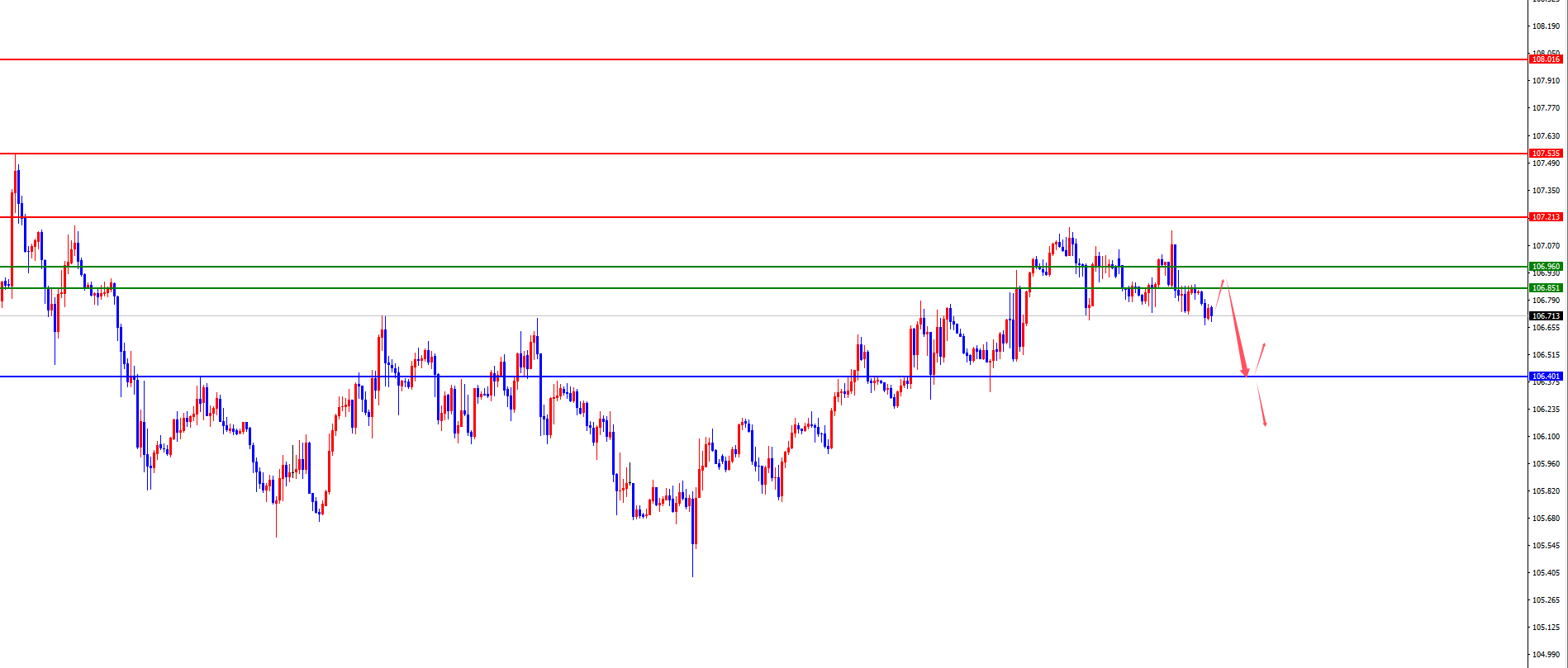

In terms of the US dollar index, the overall price of the US dollar index showed a downward trend on Monday. The highest price of the day rose to 107.145, the lowest was 106.719, and closed at 106.827. Looking back at the performance of the US dollar index on Monday, the price fell directly under pressure after the morning opening, and then stopped at four hours of support during the European session. At the same time, the price continued to fluctuate after the US session, but ultimately closed at a low level. At present, the US Composite Index is expected to further explore the daily support area of 106.40. The focus will be on the gains and losses of the daily support, which will determine the key trend of the band.

Short selling in the 106.85-95 range of the US Composite Index, defending 40 points, targeting 106.40

【EUR/USD】

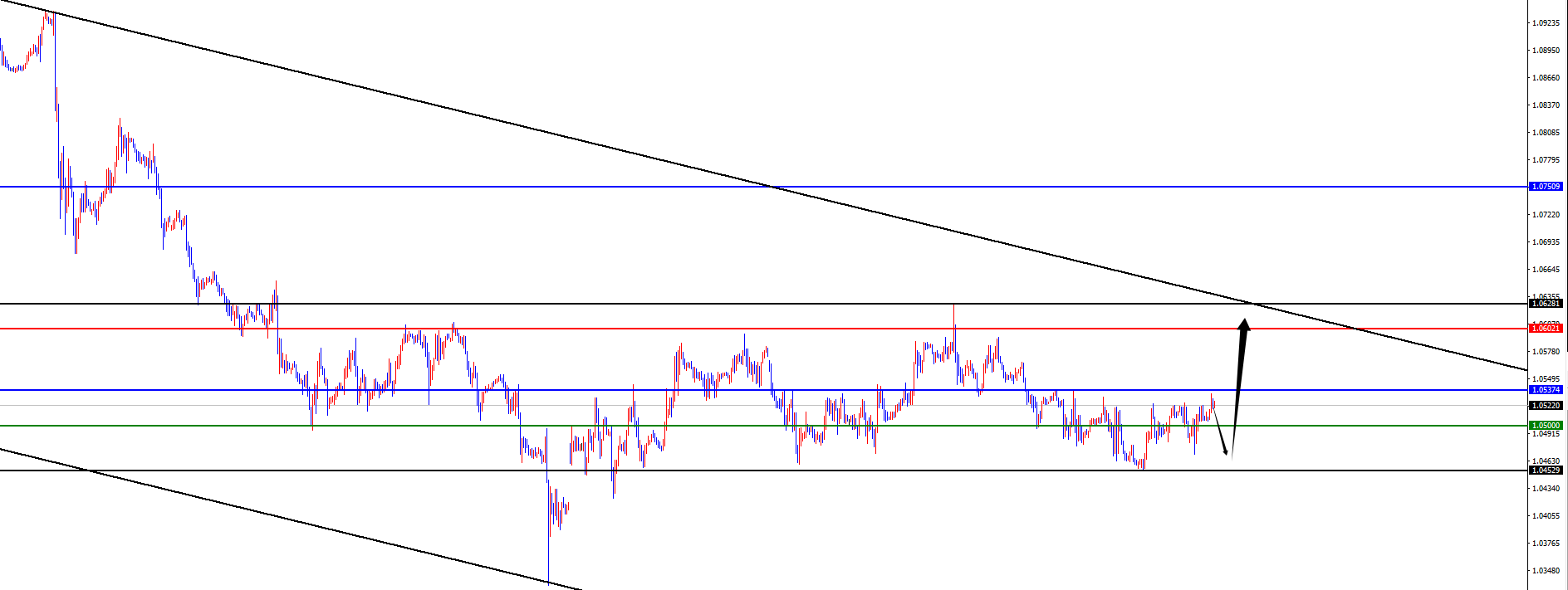

In terms of EURUSD, the overall price of EURUSD showed an upward trend on Monday. The lowest price of the day fell to 1.0474, the highest rose to 1.0524, and closed at 1.0508. Looking back at the EURUSD market performance on Monday, the price continued to rise in the short term during the morning session, then fell under pressure during the European session and broke through the low point of the morning session. However, it rose again after the US session, indicating that the EURUSD price is currently in a volatile pattern in the short term. From a weekly perspective, the 1.0750 area is the watershed for the medium-term trend. According to the daily chart level, the price is currently trending towards a stop after volatility. The short-term volatility range is temporarily focused on the 1.0450-1.0540 range, and will follow the layout after breaking through later levels.

Buy long in the EURUSD 1.0470-80 range, defend 40 points, target 1.0540-1.0600

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights