The Federal Reserve will cut interest rates for the third consecutive time, and the wording of the resolution statement may be changed

At 3:00 am Beijing time on Thursday, the Federal Reserve announced its interest rate decision, and at 3:30 pm, Federal Reserve Chairman Powell held a monetary policy press conference.

The Federal Reserve may lower borrowing costs this week, while also stating that next year's rate cuts will be lower than previously expected.

It has been proven that the US economy is more resilient than officials had anticipated a few months ago. Recent data shows that the rate of inflation decline is slower than officials expected, and the labor market is not as weak as people had feared.

The revised outlook may prompt officials to adjust the wording of the policy statement after Thursday's meeting and increase the expected path of borrowing costs. The stronger than expected data has also raised questions about whether the neutral interest rate (the level at which the Federal Reserve neither boosts nor slows down the economy) is now higher.

Tim Duy, Chief US Economist at SGH Macro Advisors, said that this uncertainty may give officials more reason to slowly cut interest rates. When you approach the upper limits of these estimates, from the perspective of the Federal Reserve, it makes sense to slow down when assessing the position in the policy cycle.

Interest rate determination

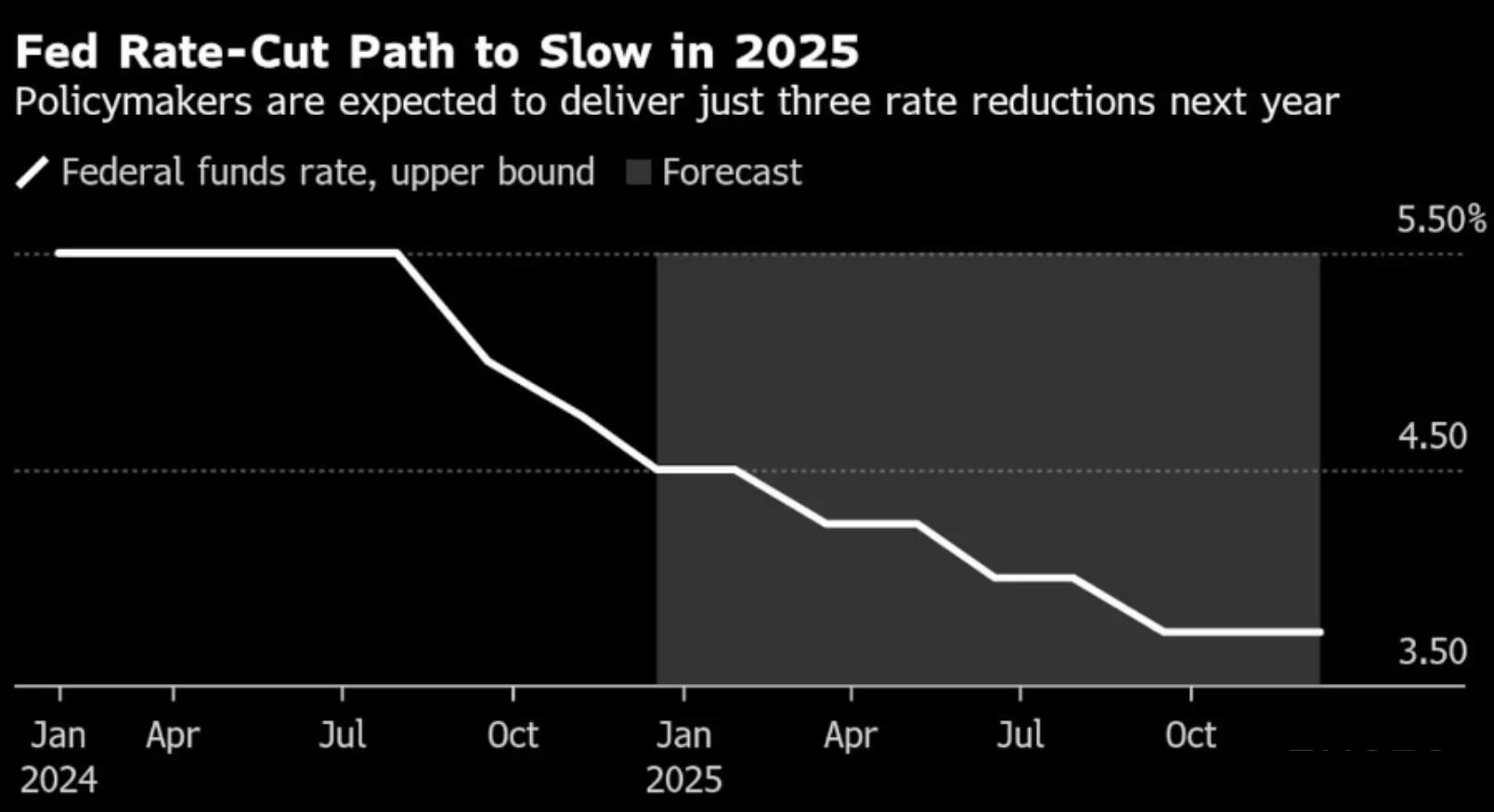

According to futures contracts, it is widely expected that the Federal Reserve will lower the benchmark interest rate by 25 basis points this week. This move will bring the federal funds rate to the target range of 4.25% to 4.5%, which is a full percentage point lower than the level when officials began cutting interest rates in September.

This will make the benchmark interest rate much higher than the median estimate of 2.9% written by officials in September, who expect the rate to stabilize in the long term. Recent comments indicate that policymakers' estimates of this rate (seen as a representative of neutral rates) will continue to climb in the new forecast, which is partly why some policymakers prefer to reduce interest rate cuts.

Economic forecast

The economic data released in recent months shows that the economic situation is better than officials expected when they released their forecasts in September. This means that policy makers may raise their outlook in the updated 2024 forecast, indicating rising inflation, declining unemployment, and strong economic growth.

The most scrutinized part of the updated estimate will be the central bank's "dot matrix", which displays the expected path of interest rates. Most economists surveyed by Bloomberg News said they expect officials to implement three interest rate cuts next year, one less than policymakers' predictions in September.

Anna Wong, Chief Economist of the United States, stated that it is expected that the core PCE inflation data for November will be weak (to be released on December 20th), but Federal Reserve staff can already make high-precision estimates based on CPI and PPI data, which may even make a few Federal Reserve officials who believe there is an upward risk of inflation reluctantly believe this data. Agree to further interest rate cuts

However, these predictions are unlikely to fully reflect the policies proposed by President elect Trump. Several Federal Reserve officials have stated that they are waiting for more details on Trump's tariffs and expulsion plans before incorporating these policies into growth and inflation forecasts.

Declaration wording

Federal Reserve officials may choose to retain wording similar to November, which states that the risks of achieving the Fed's employment and inflation targets are "roughly balanced".

But Barclays economists suggest that policy makers can also add language stating that they expect to "gradually" lower interest rates.

Du Yi stated that another option is to update the statement, indicating an open attitude towards suspending interest rate cuts in the near future. He expects the Federal Reserve to maintain interest rate stability in January after cutting interest rates this week, and said officials can convey this message by introducing language about the timing of further interest rate adjustments.

Powell's press conference

Powell can use the press conference after the meeting to elaborate on how officials interpret economic data and the significance of these data for policies. He may be asked what conditions officials need to pause interest rate cuts and whether such a pause could come as early as January. Investors will listen to any insights on how officials will formulate future steps.

The Federal Reserve Chairman may also face the question of whether progress towards the central bank's 2% inflation target has stalled, and whether officials are now more optimistic about the employment situation than in September.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights