Silver will outperform gold next year!

TD Securities' commodity strategist stated that silver is the most exciting commodity in the entire commodity sector this year and is expected to outperform gold again in 2025. Strategists predict that as the Chinese and American economies rebound and absorb inventory in the second half of next year, silver prices will challenge $36.

Analysts from TD Securities stated in their 2025 commodity outlook that the strengthening of the US and Chinese economies in the second half of 2025 will stimulate demand and tighten the silver market with insufficient supply, and excess inventory will be absorbed in the coming year.

They wrote, "As Asian demand recovers and absorbs recent inventory increases, as well as increased processing capacity for base metal concentrates, silver may be squeezed

We expect the average price of silver to reach $36 per ounce in the last few months of next year, and as the gold/silver ratio challenges the annual low, silver will become an excellent commodity. How the new Trump administration manages the promises of the Inflation Reduction Act, climate issues, and tariff policies will be key to determining silver's performance

Analysts added that 'Silver Squeeze' is the most exciting trade in the entire commodity complex in 2024, but they still believe that this precious metal has enormous growth potential in the coming year.

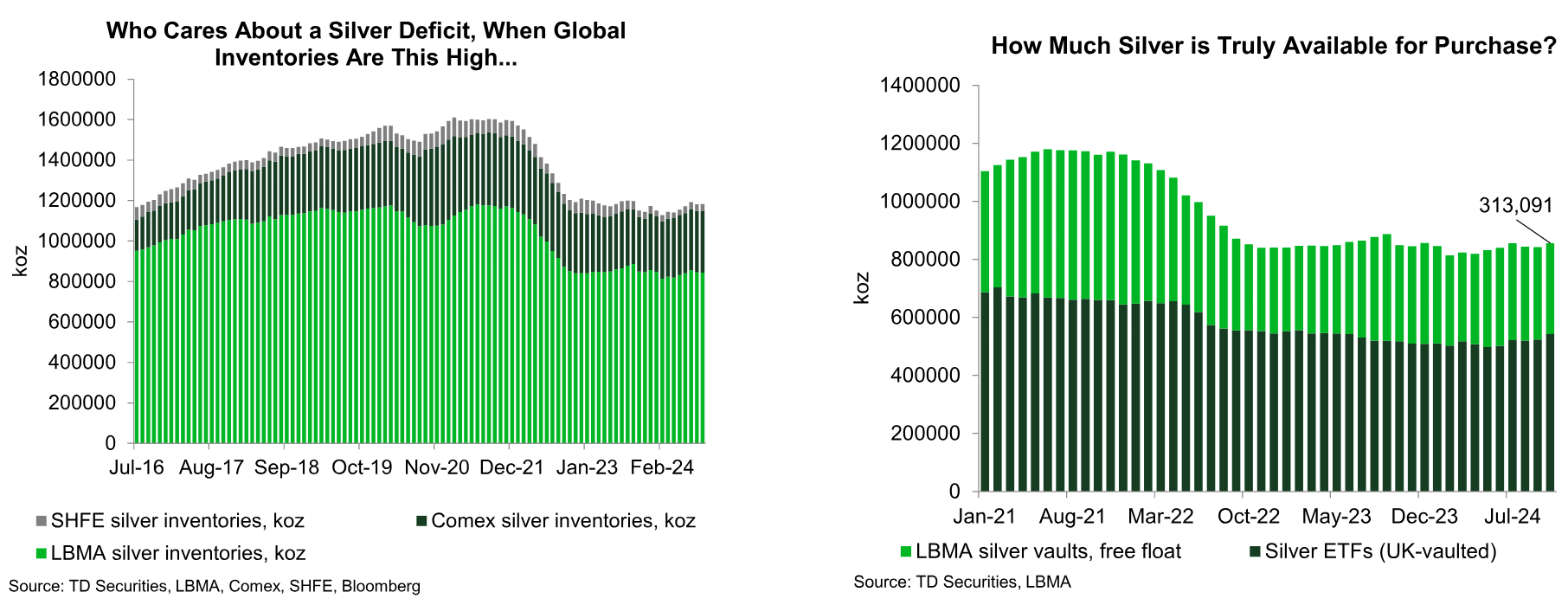

They said, "There is no doubt that the rise in silver prices over the past year has been mainly linked to the price of gold, but we have noticed that this setting exhibits explosive convexity, indicating that floating inventory is about to decrease and eventually deplete

(Source: TD Securities)

TD Securities believes that the increase in ETF buying activity brought about by the typical interest rate cut cycle of the Federal Reserve "may greatly shorten the consumption time of existing silver inventory".

They said, "This is far from an atypical cycle, and the potential threat to the independence of the Federal Reserve could bring additional upside potential, which could further enhance the investment attractiveness of precious metals. ETF buying activity is a key catalyst for the possible reduction of LBMA inventories, as they would erode the supply of metals that can be 'freely purchased' in the world's largest treasury system

They warned that if ETF buying volumes develop along the average path of the Federal Reserve's typical loose cycle, the entire 'free circulation' of LBMA will be almost eroded. In fact, the current amount of gold available for purchase is not sufficient to meet the ETF purchase volume, which is similar to the path of the special reduction cycle during the pandemic

(Source: TD Securities)

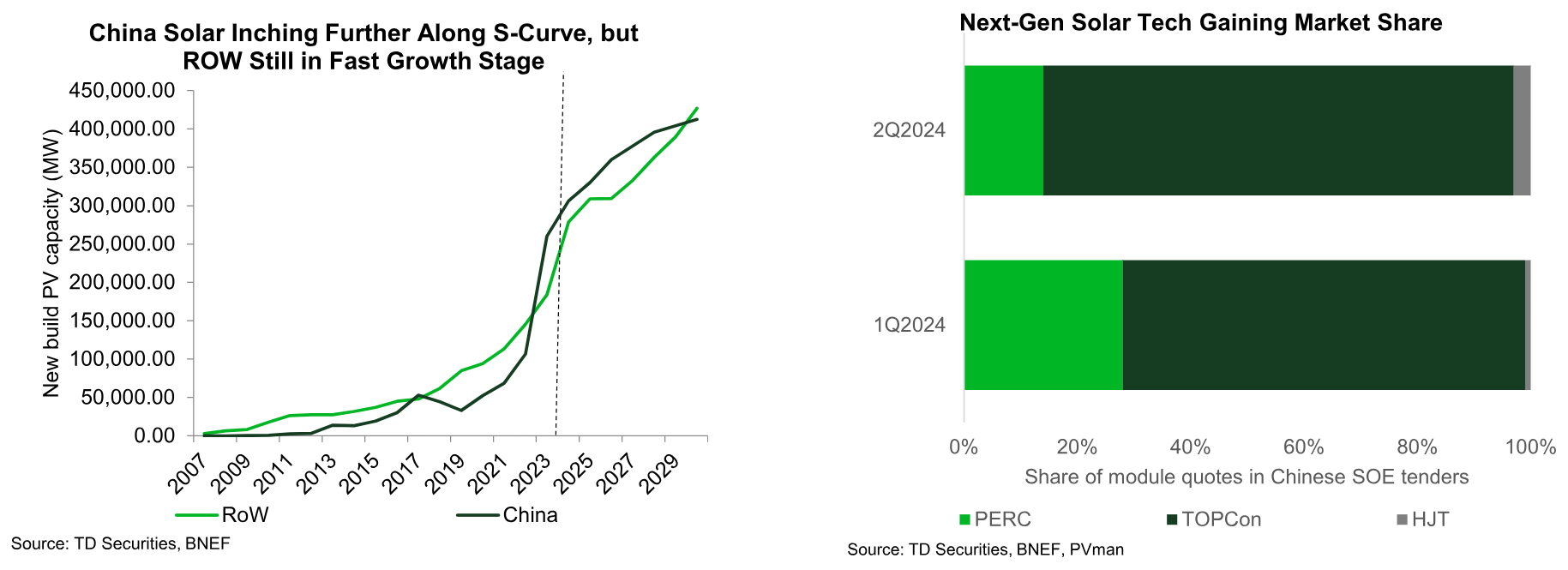

While investment demand continues to increase, the booming demand for solar energy also provides fundamental support, and its performance continues to exceed expectations.

TD Securities said, "The weak demand in traditional industries has led to the loss of freely tradable stocks, but the resilience of the US economy can prevent these industries from further weakening. At the same time, it is unreasonable to worry that the S-shaped curve adopted by China's solar technology is about to end, as global solar installations are still in a healthy stage of technology adoption, ensuring a significant increase in future production capacity

They pointed out, "Although the Trump administration may have a negative impact on the growth of domestic solar energy production capacity, production capacity in other parts of the world will still significantly increase

(Source: TD Securities)

The most important thing is that the price has remained high for some time, but we haven't seen any signs of the 'devil' rising, "the analyst said. Customs data shows that exports have not increased, which may be related to global private vault holdings, indicating that we have not yet reached the execution price that could incentivize private vault holdings to flood into the market

TD Securities believes that even though silver prices have reached their highest levels in years, market prices have not yet reached the level where "any pressure relief valves we have found flood the market".

They concluded, "This setup requires higher prices to release inventory from unconventional sources, which is the most prominent transaction in the complex, and the fund positioning in the silver market seems much clearer than in the gold market. Therefore, we expect silver to perform significantly better than the gold market

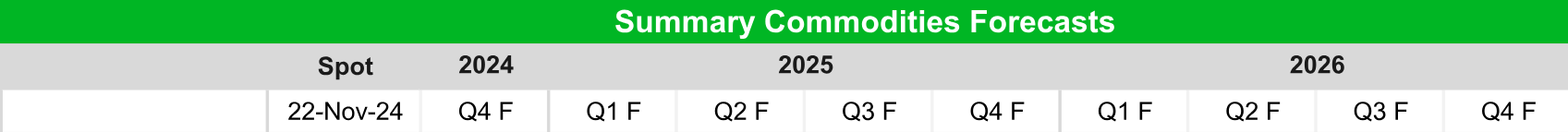

According to detailed forecasts from TD Securities, the spot silver trading price in the first quarter of 2025 will be $33.25 per ounce, $33 in the second quarter, $34 in the third quarter, and reach a peak of $36 per ounce in the fourth quarter. They are more optimistic about the outlook for 2026, expecting silver prices to fluctuate between $38 and $39 per ounce.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights