Oil prices closed lower on Friday, but strengthened for the fourth consecutive week as the latest US sanctions on Russian energy trade intensified concerns about oil supply disruptions.

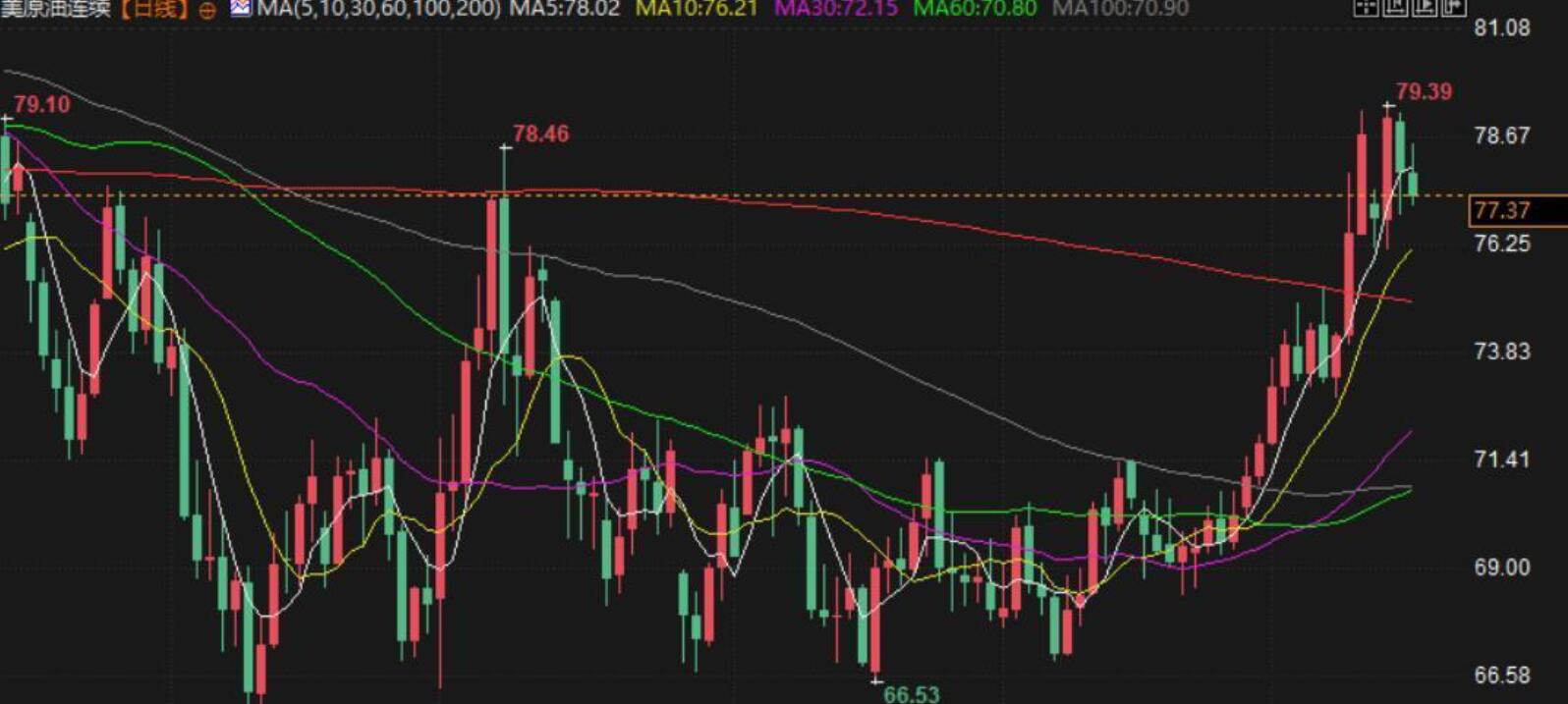

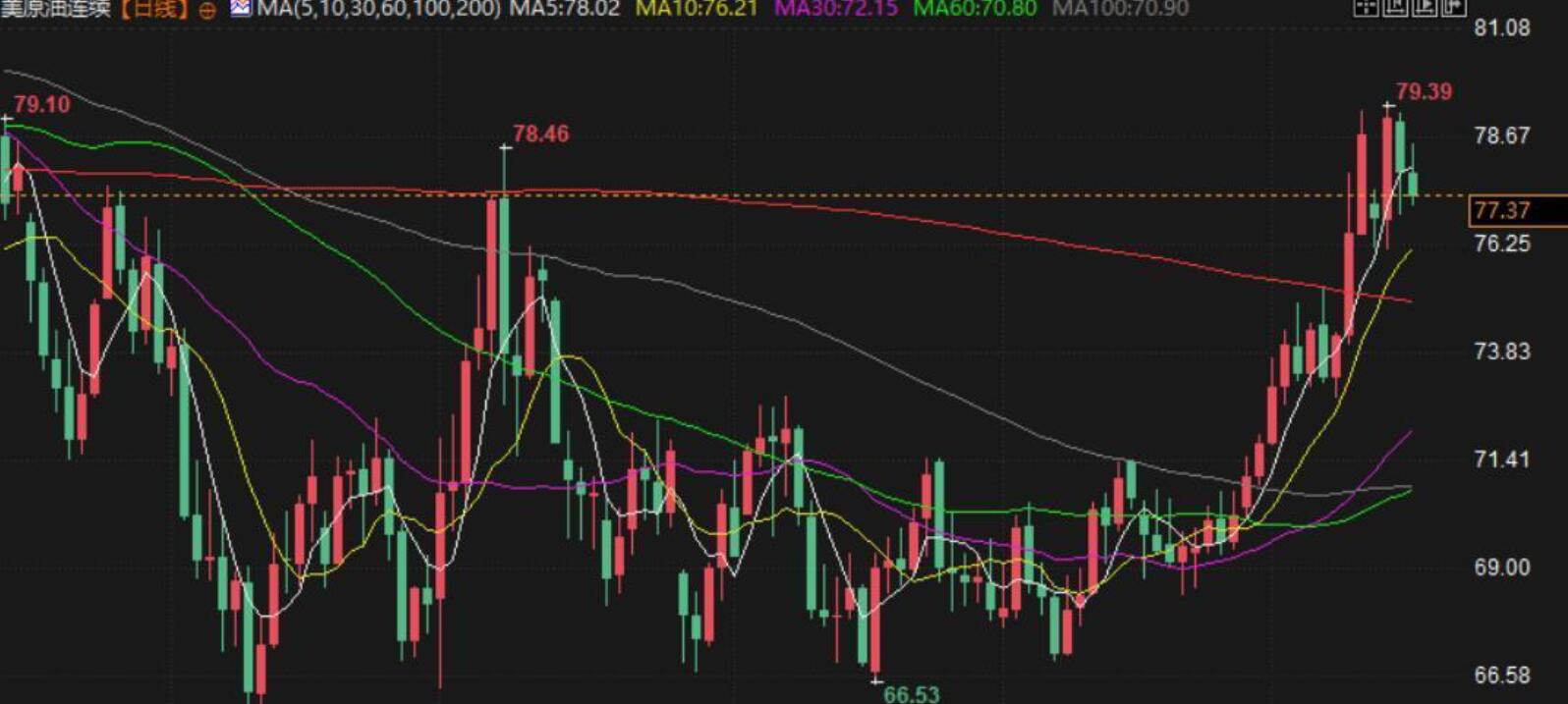

Brent crude oil futures fell 0.6% to $80.79 per barrel, but rose 1.3% this week. US crude oil futures fell $0.80, or 1%, to $77.88 per barrel, and rose 1.7% this week.

The sanctions against Russia are causing supply shortages in countries such as Europe and India, "said Phil Flynn, senior analyst at Price Futures Group

Investors are still evaluating the potential impact of President elect Trump's return to the White House on Monday. Trump's nominee for Treasury Secretary has stated that he is prepared to impose stricter sanctions on Russian oil.

After the Gaza ceasefire agreement was reached, it is expected that the Houthi armed forces in Yemen will cease their attacks on ships in the Red Sea, which has also put pressure on oil prices.

Earlier on Friday, expectations of increased demand provided some support for the oil market. This week's data shows that inflation in the world's largest economy, the United States, has eased, increasing expectations for the Federal Reserve to cut interest rates.

This week's report from HSBC pointed out that the bank has raised its 2025 Brent crude oil price forecast from the previous $70 per barrel to $73, with the first quarter forecast also rising from $70 to $77, mainly reflecting the impact of the latest US sanctions on Russia.

The bank stated that due to the sanctions measures announced by the United States last week, the number of oil tankers on the sanctions list has nearly doubled, and oil prices have risen to over $80 per barrel in recent days. These measures will have a significant impact on Russian

crude oil and its product exports, although the impact is short-lived.

The bank believes that the oil market is still in a tug of war between

OPEC+overcapacity and persistent geopolitical risks, and expects Brent

crude oil prices to trade between $70 and $80-85 per barrel this year, slightly lower than the past two years.

The bank also stated that sufficient

OPEC+surplus capacity should be able to limit price spikes, with an estimated current

OPEC+surplus capacity of 6.5 million barrels per day. The bank also stated that, on the contrary, due to the downward risks brought by geopolitics to supply and the determination of

OPEC+to support the market, caution should be exercised this year to avoid excessive pessimism.

The spot premium of Asian 380 cST high sulfur fuel oil closed at its highest level in over a month on Friday, boosted by supply uncertainty caused by recent sanctions.

The spot price of 380 cST high sulfur fuel oil has risen above $9 per ton compared to Singapore's quotation, and the cracking price difference has also remained strong. According to data from the London Stock Exchange Group (LSEG), the price difference between 380 cst high sulfur fuel oil and Brent

crude oil cracking has risen to a discount of about $4 per barrel.

The spot premium of ultra-low sulfur fuel oil closed at nearly $6 per ton, and the cracking price difference was reported at about $11 per barrel of premium. With the strengthening of the high sulfur fuel oil market, the premium (Hi-5 price difference) of ultra-low sulfur fuel oil compared to 380 cst high sulfur fuel oil narrowed by more than 6% compared to last week, and was reported at around $96 per ton on Friday.

According to reports, the Singapore trading window has completed a transaction for 380-cst high sulfur fuel oil, but has not reached a transaction for 180-cst high sulfur fuel oil or ultra-low sulfur fuel oil.

The price difference of gasoline cracking has declined for the third consecutive trading day, and the weekly chart has also fallen. The stable inventory level and lukewarm demand outlook have put pressure on the market.

According to data from the Commodity Futures Trading Commission (CFTC) and the Intercontinental Exchange (ICE), speculators' net long positions in NYMEX decreased by 15670 contracts to 230692 contracts during the week of January 14th. The net long position of ICE Brent

crude oil increased by 27473 contracts to 254332 contracts, reaching a new high in over eight months.

The net long position in Brent and WTI

crude oil increased by 27304 contracts to 464730 contracts, reaching a new high in approximately nine months. The net long position in NYMEX gasoline increased to 57223 contracts, reaching a four week high.